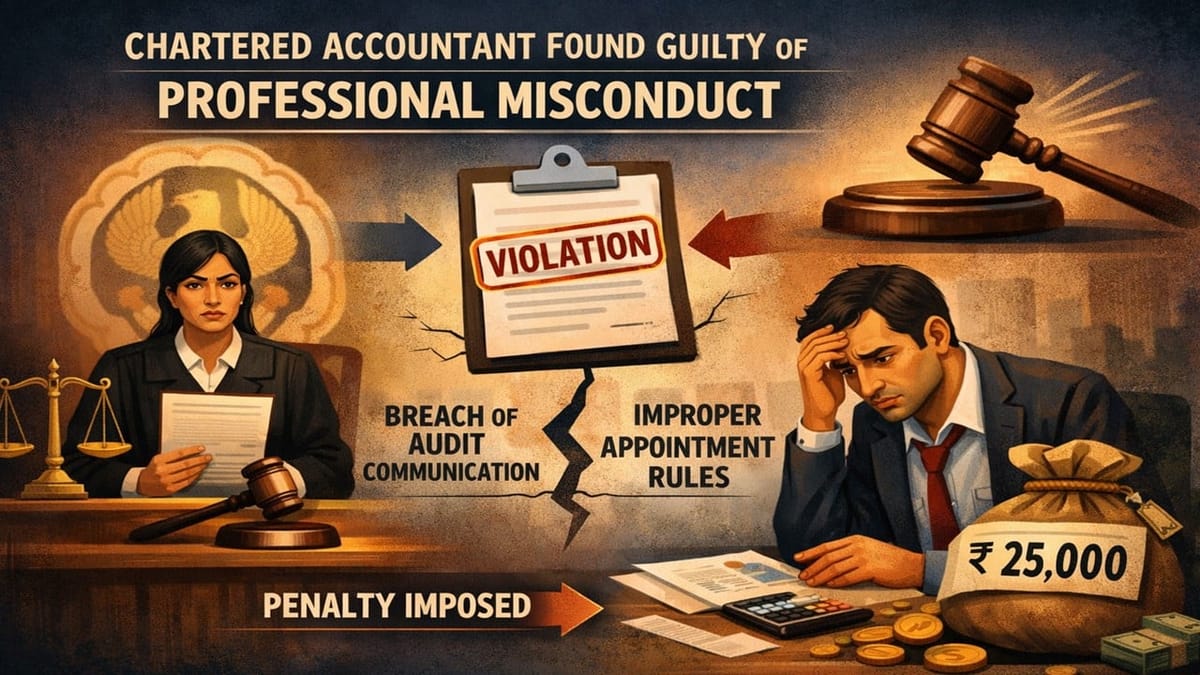

The ICAI found Chartered Accountant guilty of professional misconduct for violating mandatory audit communication and appointment rules, and imposed a penalty of Rs. 25,000.

Saloni Kumari | Feb 20, 2026 |

CA Penalised for Accepting Audit Assignment Without Mandatory Communication with Existing Auditor

The Institute of Chartered Accountants of India (ICAI) Board of Discipline has held a Chartered Accountant (CA), Manmohan Jhawar, guilty of professional misconduct via an order dated February 05, 2026, passed under Section 21A(3) of the Chartered Accountants Act, 1949, and imposed a penalty amounting to Rs. 25,000.

A complaint was filed against the respondent CA by another CA. Bimal Chandra Bothra (Complainant), alleging him of not complying with ICAI auditing standards. The respondent CA was the statutory auditor for the companies K.B. Syndicate Pvt. Ltd. and Saksena Bros. Pvt. Ltd for the financial year 2022-23. The complainant, CA Bimal Chandra Bothra, was the existing auditor for both companies till the financial year 2023-24. He resigned from the post on October 14, 2023, claiming the companies failed to provide him with the required documents and explanations to conduct the audit for FY 2022-23. Prior to his resignation, the respondent had conducted the audit of the companies for FY 2022-23 on August 30 and 31, 2023.

In conclusion, CA Bimal Chandra Bothra filed a complaint against CA Manmohan Jhawar, alleging that he accepted an audit assignment without first communicating with the existing auditor in writing, which is an obligatory requirement under Item (8) of Part I of the First Schedule to the Chartered Accountants Act, 1949. The complainant further highlighted violations of the provisions of Sections 139 and 140 of the Companies Act, 2013, regarding the proper appointment and resignation process of auditors.

When the board examined all the allegations deeply, it found them all genuine. As a result, the ICAI Board of Discipline held CA Manmohan Jhawar guilty of professional misconduct under Items (8) and (9) of Part I of the First Schedule to the Chartered Accountants Act, 1949. Additionally, a fine of Rs. 25,000 was levied on him.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"