In this fraud, 28 chartered accountants allegedly reached out to clients who wanted to reduce their taxable income by claiming fake donations.

Nidhi | Feb 19, 2026 |

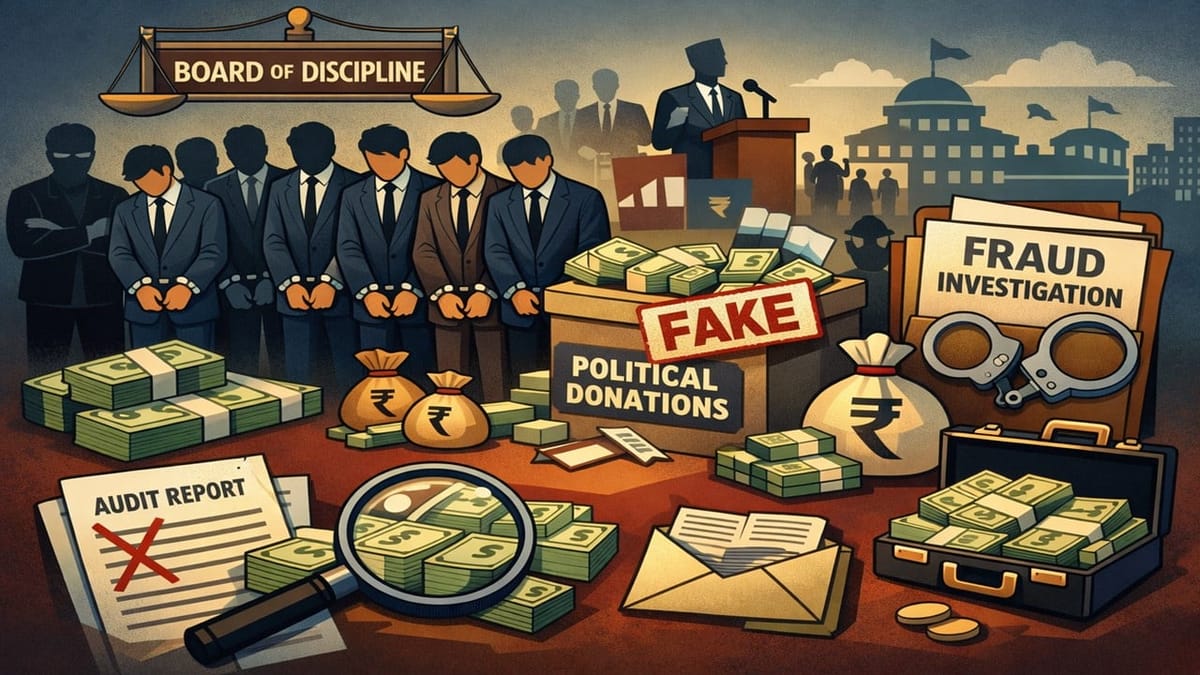

ICAI Board of Discipline Reprimands 11 Chartered Accountants for Role in Fake Political Donation Fraud

The Institute of Chartered Accountants of India (ICAI) Board of Discipline has held 11 chartered accountants guilty of professional misconduct for their alleged involvement in the fake political donation fraud.

The case started from a search and seizure operation conducted in February 2021 under the Income Tax Act, 1961. The operation targeted three political parties and two charitable institutions in Ahmedabad. Tax authorities alleged large-scale tax evasion through a bogus donation network.

As per the investigators, the CAs took help from the key individuals who were linked to the political parties. In this fraud, 28 chartered accountants allegedly reached out to clients who wanted to reduce their taxable income by claiming fake donations.

The clients were asked to route the donations to the specific political party. After the money was transferred, the donor’s details, including name, PAN, address, bank information and transaction references, were shared through WhatsApp with the party functionaries, who issued donation receipts. The donated amount was returned to the donor in cash after deducting the commission of the CAs and other intermediaries. Investigators claimed that the CAs admitted their role during questioning.

The Board observed that the CAs tried to withdraw their 2021 statement only in 2023 through affidavits, around two years ago. The board also noted that the Income Tax Department did not initiate any reassessment proceedings against the concerned political parties. The CAs requested a lenient view and assured the Board that they would not do such an act in the future.

In its recent disciplinary orders, the ICAI’s Board of Discipline held the CAs guilty of “Other Misconduct” under the First Schedule of the Chartered Accountants Act, 1949. The Board also considered action under Section 21A(3), but after considering the CAs’ written submissions and representations, the Board decided to issue only a reprimand.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"