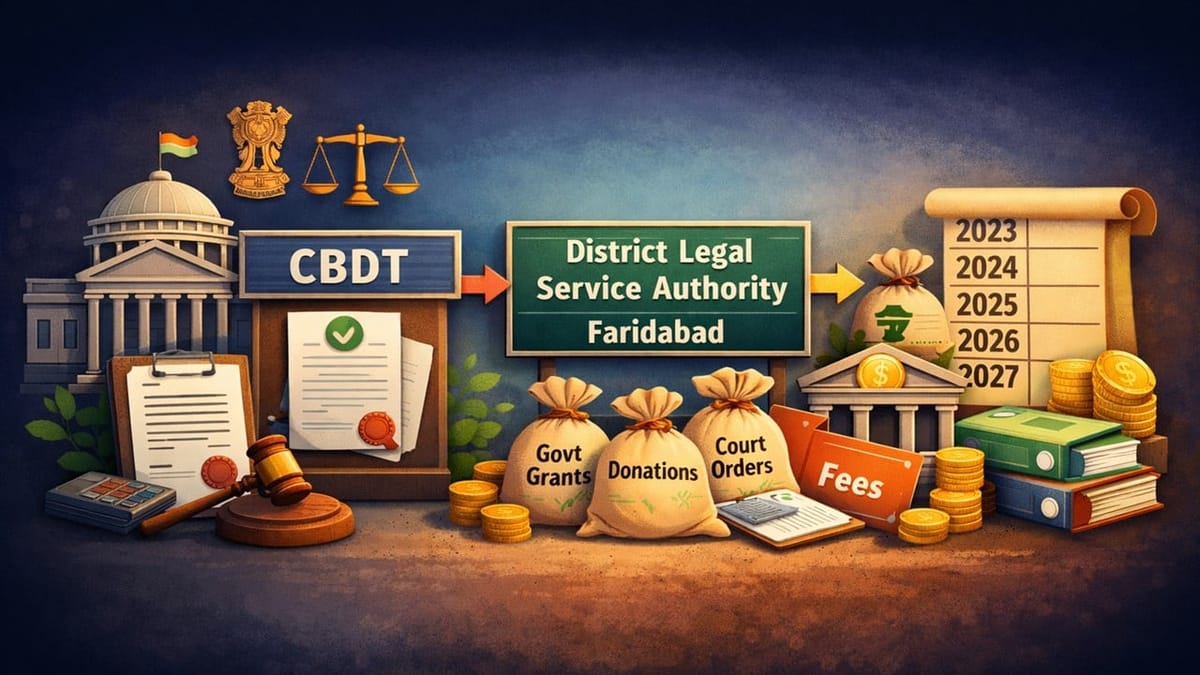

CBDT notifies income tax exemption under Section 10(46) for the District Legal Service Authority, Faridabad, subject to compliance with prescribed conditions.

Vanshika verma | Feb 6, 2026 |

CBDT Grants Income Tax Exemption to District Legal Service Authority, Faridabad

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance and Department of Revenue recently shared a notification (No. 17/2026) on February 5, 2026, regarding income tax exemption.

The Central Government, using its power given by section 10(46) of the Income-tax Act, 1961 (43), notifies ‘District Legal Service Authority’, Faridabad (PAN AAAJC0807B) for tax exemption. It is the body established by the Government of Haryana for District in the State of Haryana. The Central Government has granted tax exemption for the following specified income arising to District Legal Service Authority:

a) Grants received from the Punjab and Haryana High Court, the National Legal Services Authority, and the Haryana State Legal Services Authority to carry out work under the Legal Services Authorities Act, 1987.

b) Donations or grants received from the Central Government or the State Government of Haryana to carry out work under the Legal Services Authorities Act, 1987.

c) Amount received under the order of the Court

d) Fee received as recruitment application fee and

e) Interest earned on bank deposits.

This benefit will only be made available if the District Legal Service Authority fulfils the following conditions:

1. Will not be involved in any commercial activity

2. Activities and the nature of the specified income will remain unchanged throughout the financial years and

3. Will file a return of income in accordance with the provisions of clause (g) of sub-section (4C) of section 139 of the Income-tax Act, 1961.

If these conditions are not followed, action may be taken under the Income-tax Act, 1961, and the tax exemption given under Section 10(46) may be cancelled.

This notification will be treated as applicable for the assessment years 2023-24, 2024-25, and 2025-26, and it will also continue to apply for the assessment years 2026-27 and 2027-28.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"