Income tax exemption has been given by the Central Government using its power given under section 10 of the Income-tax Act, 1961.

Vanshika verma | Jan 23, 2026 |

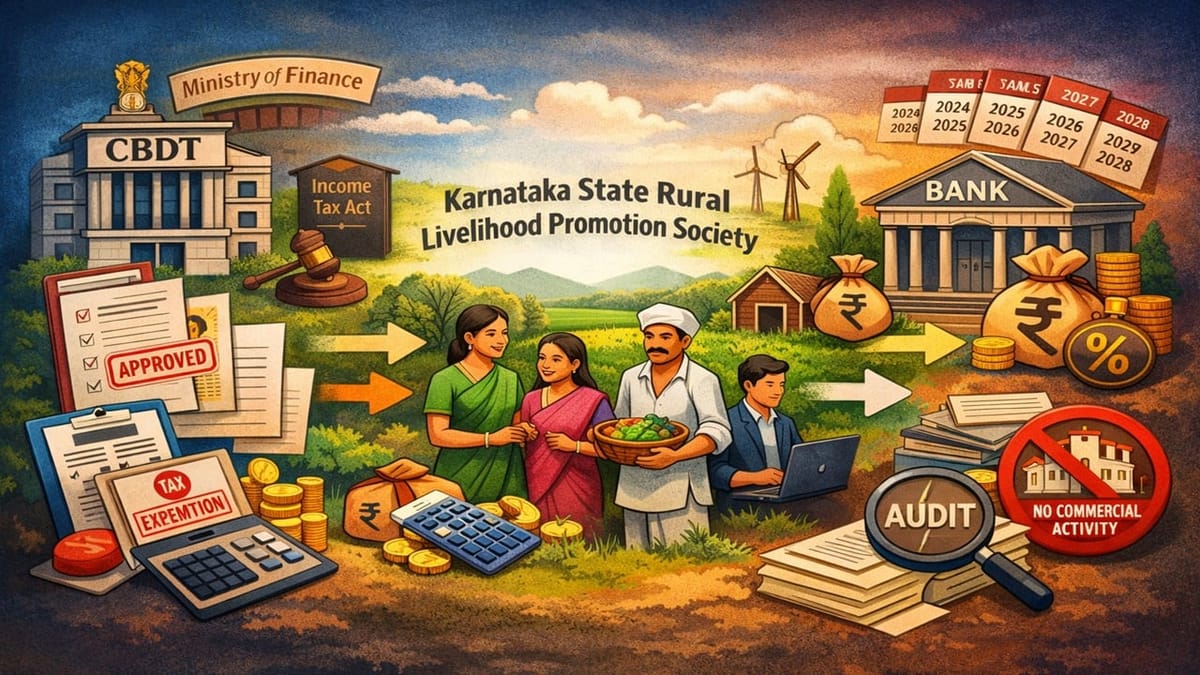

CBDT Grants Income Tax Exemption to Karnataka State Rural Livelihood Promotion Society

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance recently shared a notification (No. 11/2026) on January 21, 2026, regarding income tax exemption.

The Central Government, using its power given by clause (46) of section 10 of the Income-tax Act, 1961 (43), notifies Karnataka State Rural Livelihood Promotion Society (PAN AACAK0581H) for tax exemption. Karnataka State Rural Livelihood Promotion Society is a body established by the Government of Karnataka. The tax exemption is granted for the following income arising to the body:

(a) Grants received from the Central Government;

(b) Grants received from the State Government of Karnataka; and

(c) Interest earned on bank deposits.

This benefit will only be made effective if the Karnataka State Rural Livelihood Promotion Society:

If the Karnataka State Rural Promotion Society fails to comply with these rules, the tax authorities may take action against the board under the Income Tax Act, 1961, and the board may lose the tax benefits the board was given under section 10(46).

This notification applies across multiple years. It is considered to have already been applied for the assessment years 2024-25 and 2025-26, which relate to the financial years 2023-24 and 2024-25. It will also continue to apply to the assessment years 2026-27, 2027-28, and 2028-29, corresponding to the financial years 2025-26, 2026-27, and 2027-28.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"