ITAT dismisses Revenue appeal, allowing assessee to invoke Rule 27 to support favourable CIT(A) order on limitation grounds

Meetu Kumari | Jan 23, 2026 |

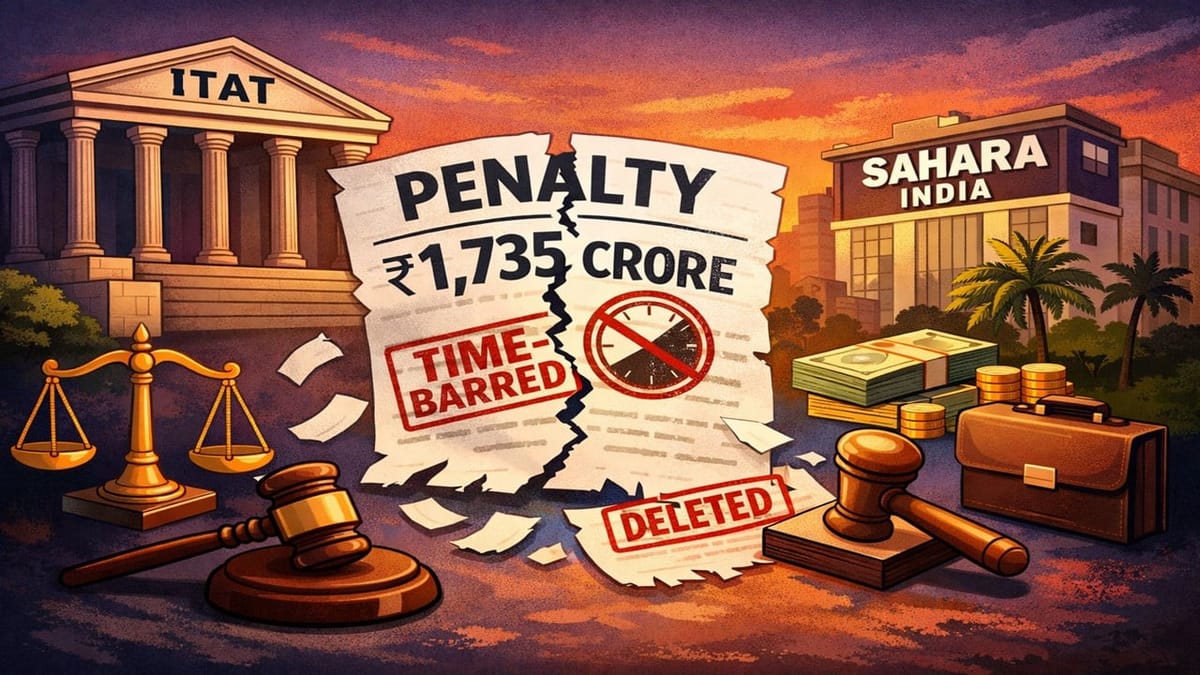

ITAT Upholds Deletion of Rs. 1,735 Crore Penalty on Sahara India; Penalty Held Time-Barred

For AY 2010-11, Sahara India Financial Corporation Ltd. was subjected to penalty proceedings under Section 271D for alleged violation of Section 269SS on account of acceptance of cash deposits. The Additional CIT levied a penalty of Rs. 1,735.27 crore, alleging that deposits were received otherwise than through prescribed banking channels. The assessee challenged the penalty before the CIT(A) on merits as well as on the ground of limitation.

The CIT(A) deleted the penalty on merits. The Revenue appealed to the ITAT.

Main Issue: Whether the assessee could invoke Rule 27 to support a favourable appellate order by raising limitation, and whether the penalty under Section 271D was time-barred under Section 275(1)(c).

Tribunal’s Order: The ITAT dismissed the Revenue’s appeal. It held that Rule 27 permits a respondent to support a favourable order on any ground decided against it or not examined earlier, so long as the appellant is not placed in a worse position. The assessee was therefore entitled to press the limitation ground.

The Tribunal followed PCIT v. Thapar Homes Ltd., holding that limitation under Section 275(1)(c) commences from the date of the assessment order recording satisfaction for initiation of penalty, and not from a later date chosen by the Revenue. Since the penalty order was passed beyond the prescribed period reckoned from the assessment order dated 12.05.2023, it was held to be time-barred.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"