Govt has granted income tax exemption to Dadra and Nagar Haveli Building and other Construction Workers Welfare Board u/s 10 of Income-tax Act.

Vanshika verma | Jan 23, 2026 |

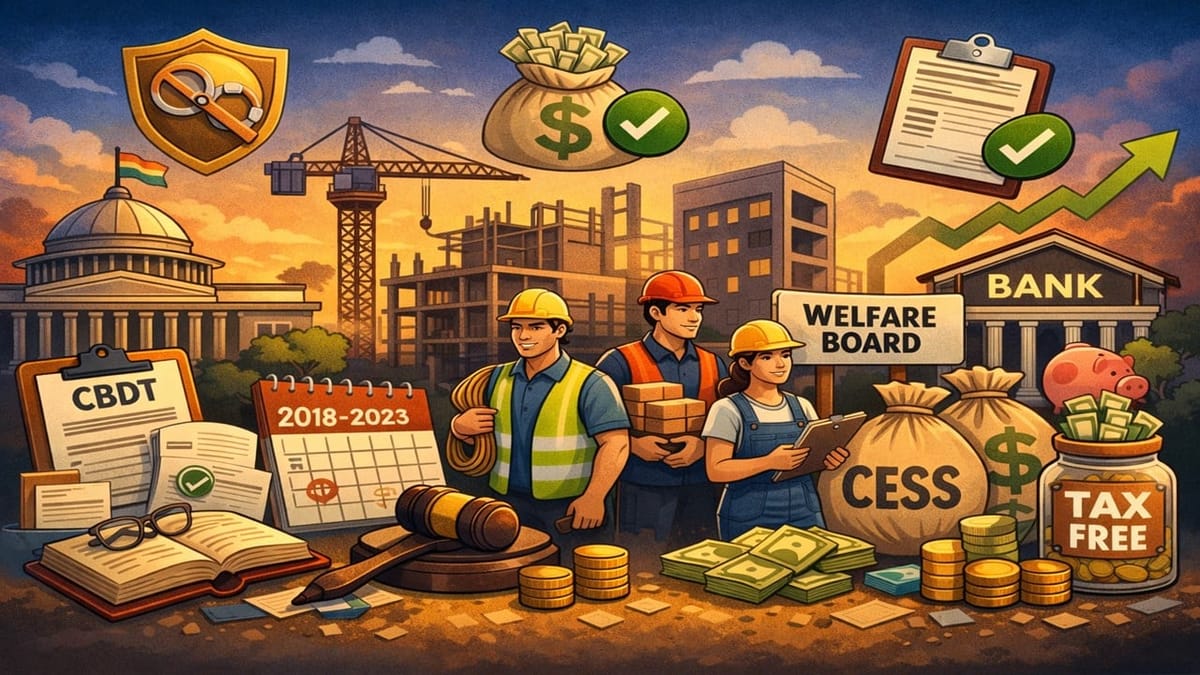

CBDT Notifies Tax Exemption for Dadra and Nagar Haveli Building and other Construction Workers Welfare Board

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance recently shared a notification (No. 12/2026) on January 21, 2026, regarding income tax exemption.

The Central Government, using its power given by clause (46) of section 10 of the Income-tax Act, 1961, notifies “Dadra and Nagar Haveli Building and Other Construction Workers Welfare Board” (PAN: AAALT2225N) for tax exemption. It is a board established by the UT Administration of Dadra and Nagar Haveli. The tax exemption is granted for the following specified income:

This benefit will only be made effective if the “Dadra and Nagar Haveli Building and Other Construction Workers Welfare Board”:

If the board fails to comply with these rules, the tax authorities may take action against the board under the Income Tax Act, 1961, and the board may lose the tax benefits the agency was given under section 10(46).

This notification is considered effective for the financial years 2018-19 to 2022-23, and it will also apply to the assessment years 2019-2020 to 2023-2024.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"