The Central Board of Direct Taxes(CBDT) has notifies 3 new special courts for Black Money and Income Tax Provisions via issuing Notification.

Reetu | Jun 16, 2023 |

CBDT notifies 3 new special courts for Black Money and Income Tax Provisions

The Central Board of Direct Taxes(CBDT) has notifies 3 new special courts for Black Money and Income Tax Provisions via issuing Notification.

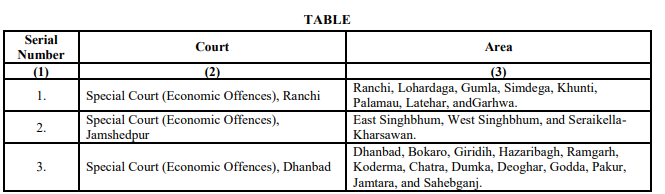

The Notification Stated as. “In exercise of the powers conferred by sub-section (1) of section 280A of the Income-tax Act, 1961 (43 of 1961) read with section 84 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (22 of 2015), the Central Government, in consultation with the Chief Justice of the High Court of Jharkhand, hereby designates the following Courts in the State of Jharkhand, as mentioned in column (2) of the Table below, as Special Courts for the areas mentioned in column (3) of the said Table, for the purposes of subsection (1) of section 280A of the Income-tax Act, 1961 and section 84 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.”

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"