The Tribunal held that Section 271B presupposes the existence of books of account which are required to be audited under Section 44AB.

Meetu Kumari | Jan 23, 2026 |

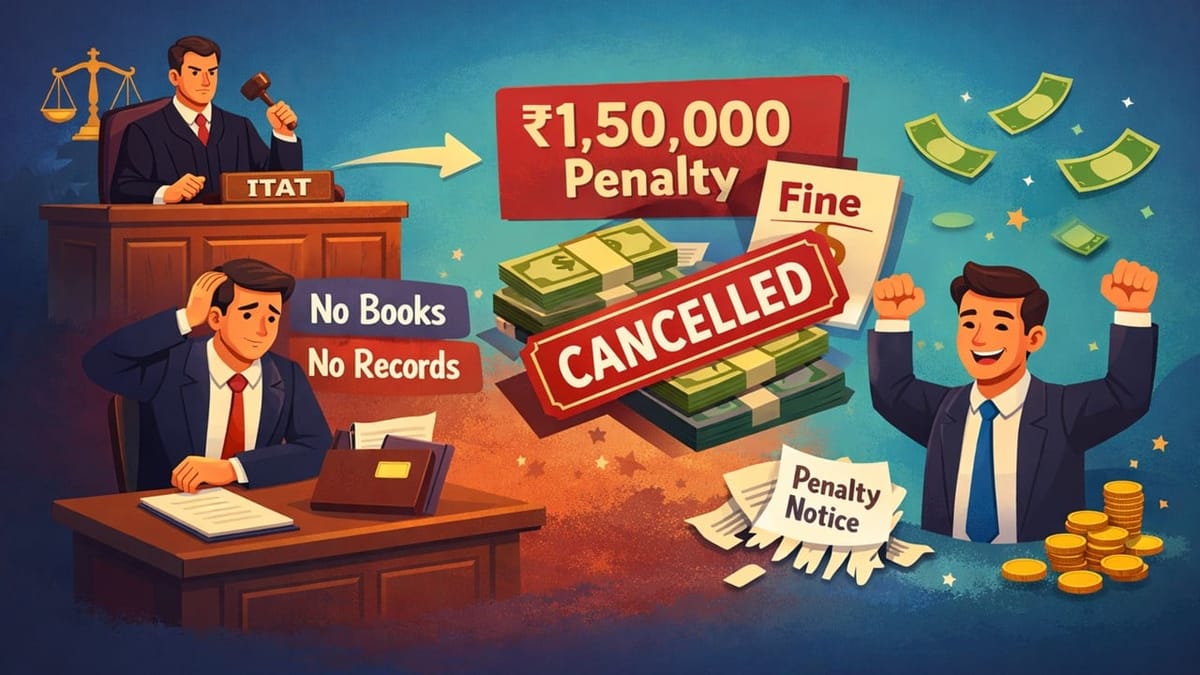

ITAT Quashes Rs. 1.50 Lakh Penalty Where No Books of Account Were Maintained

The assessee, engaged in contract business, filed his return of income for AY 2017-18, declaring a total income of Rs. 60.48 lakh. The return was accepted in scrutiny assessment under Section 143(3) without any addition. The Assessing Officer initiated penalty proceedings under Section 271B, alleging failure to furnish a tax audit report under Section 44AB and levied a penalty of Rs. 1.50 lakh.

The assessee contended that he had not maintained any books of account and, therefore, the question of audit did not arise. He also explained that the “audit yes” entry in the return was an inadvertent and erroneous tick. The CIT(A) dismissed the appeal and upheld the penalty, leading the assessee to approach the Tribunal.

Main Issue: Whether penalty under Section 271B can be levied for non-furnishing of a tax audit report when the assessee admittedly did not maintain books of account.

ITAT’s Order: The Tribunal allowed the assessee’s appeal and deleted the penalty. The Tribunal held that Section 271B presupposes the existence of books of account which are required to be audited under Section 44AB.

Relying on Surajmal Parsuram Todi, the Tribunal ruled that once the offence of non-maintenance of books is complete, there can be no further offence of failure to get such non-existent books audited. As the assessee had stated that no accounts were maintained, the penalty under Section 271B was held to be unsustainable.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"