CA Sudhir Halakhandi | Feb 22, 2022 |

GST Input Credit – Is There Any Solution to This Problem !!!

In India GST was introduced with Four main objectives and one of the topmost objectives was seamless flow of Input credit. The other three were Removing the cascading effect, increasing the tax base and enhancing the tax revenue. In budget speech out Hon. Finance Minister Madam has told the GST has achieved the highest tax collection in the Month of Jan.22 and further the number of tax payers are increasing day by day. The current number has crossed 1.30 Cr Limit. The cascading effect is now minimized but the problem of ITC is increasing day by day. The ITC is not seamless and further the artificial restrictions are increasing day by day to make it more complicated.

The input credit is not seamless and now through budget proposals it will be more difficult situation for the dealers to get the input. The are two parties to a transaction – one is seller and another one is purchaser. Both are independent entities and no one can control the other. Let us first see how GST is working. It is a very simple tax in Normal course of business. Let us see with the help of a very simple Example: –

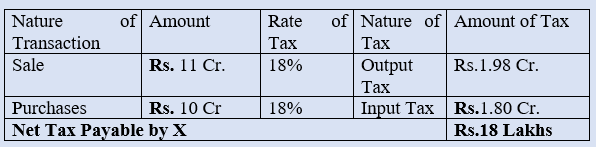

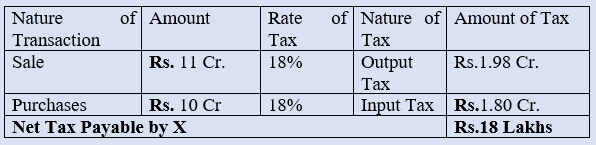

X has purchased goods from Y at Rs. 10 Crores Plus 18% GST and sold to Z at 11 Crore Plus GST. This is normal Business Transaction. Now see in this transaction how GST will work for X: –

This is very basic and simple format of the GST and most of the GST dealers are covered in this format. The name of Tax may IGST, SGST and CGST but the simple formula is the dealer has to pay the tax by deducting the ITC from his output tax and this will be his net tax Liability.

Suppose here the dealer has to pay the tax without deduction the ITC and now this Rs. 18 Lakhs will be converted into 1.98 Cr and here we see the importance of the ITC. ITC is the backbone and soul of the GST. Hence it was promised that there will be seamless flow of ITC in GST.

Let us see what is the problem with the ITC at present dealers are facing.

If the seller has not filed his GSTR-1 up to 11th day next following the month then the Purchaser will not get ITC in that month. Slight delay of one day by seller in filling his GSTR-1 will affect the purchaser very badly. Let us see the effect of previous Example: –

The seller Y has to file his GSTR-1 of the Month of Jan. 2022 up to 11th Day of Feb 2022 but due to unforeseen circumstances he filed his GSTR-1 on 12 Feb 2022. Now there will be no ITC for X in the month of Jan. 2022 hence his output tax has become his net tax liability and he have to pay Rs. 1.98 Crore as his tax in cash instead of his real GST liability of Rs. 18.00 Lakhs.

Now X will get the ITC in the Month of Feb 2022 since his right of ITC is not totally lost but it will certainly depend on the act of his seller on which he has No control.

The problem was the same in the VAT also but the time to settle the mismatch was sufficient in that regime so dealers were able to coordinate to settle the Mismatch of sale and purchases and resultant problem of ITC was not so severe but the GST was introduced to mitigate the problems of erstwhile indirect tax regime. GST ITC provisions it has made the situation more complicated.

Now see the seriousness of the situation. X will get this ITC in the month of Feb. 2022. In the month of Feb. 2022 his purchases are also there because how can he make a sale in Feb without purchase hence there will also be ITC from his new purchases so the tax paid by him in cash as mentioned above will take Months to settle down since the real tax liability is only on his Margin.

How GST is a Tax on Margin in Most of the Cases: –

Let us see the Example one again: –

Here the difference in sale and purchases is Rs. 1 Cr and this is the Margin of X and in statutory language one can say it is “value addition” and the net tax payable is Rs. 18.00 Lakhs and it is exactly the 18% of the value addition i.e., Rs. 1 cr.

Now due to restriction of ITC the dealers have to arrange more working capital hence there will be more interest burden on them.

What are the possible solutions? –

1. The dealers should be given 90 days’ time to settle the Mismatch and if the mismatch is still there then ITC should be restricted.

This may be a solution but here the Government has full details of the seller and can book him and compel him to pay the tax instead of punishing the Purchaser who has purchased the goods after paying the price of goods including GST. “Choose your vendor” is only an imaginary solution having no practical value at ground level.

2. The time of payment of Tax is 20th of the next month hence artificially blocking the credit on the basis of GSTR-1 filed on 11th is also a very harsh step. At least, if solution given in point No.1 is not acceptable to the law makers, then without any loss of revenue they can make the date 20 as a cutoff date or make it the date when the dealer his filing his GSTR-3B for the relevant month. If returns are late then dealers are already paying the Interest and penalty so there is no loss of revenue to the Government if this arrangement is accepted.

The whole GST taxation system is now based on activities of suppliers and in the whole exercise the Purchasers or recipients are helpless sufferers. The Suppliers are giving the details of Goods sold by them. Only Supplier has to file details of sale made by them with GST numbers of dealers purchasing the Goods from them.

The details of the purchases are not asked from the purchasers along with the GST Numbers of the sellers and tax paid to them. This is the main reason of problem.

Let us try to understand the problem: –

Suppose A seller has filed his return with 35 invoices only though he has sold the goods through 50 invoices. Now there is no system with the Tax authorities to find how many invoices are not reported by the seller since the system is not asking purchasers to file details of their purchases though ITC of all these 15 invoices will not be available to the purchasers.

This system is a faulty system and was not commensurate with the originally planned “Two-way communication system” in which purchasers were also entitled to show their purchases if the same is not reported by the seller. This two-way communication system which was never started and now it is finally dropped. How GST will work with this faulty system where there is no too to detect how much is tax is collected particular seller or supplier.

Now a concrete system should be developed in which the details of purchases should also be asked from the purchasers and both the details should be processed in the centralized computers and after that resultant mismatch should be posted in accounts of the seller and purchasers to give them opportunity settle the same in a reasonable time.

Government has its own version of this problem and it is determined to collect the tax by any means so instead of booking the defaulters, it has adopted a very easy and simple way to stop the ITC of innocent purchaser. The same modus operandi was there in VAT also with some relaxed provisions. The GST was introduced for simplification of indirect taxation system of India but ITC problems has made it more complicated. A mid-way should there to satisfy the needs of all the stakeholders including the Government and Tax Payers.

Let us now see what is proposed new budget regarding input credit in Budget-2022, but keep in mind that these provisions are not being implemented yet because for this the government will now announce the date of their implementation in future after getting assent to the Finance Bill . One more thing should be kept in mind that even declaration of this date is not in the hands of the central government alone because these provisions have to come in the GST law of all the states and for this it has to be passed by the state legislatures as well.

But it is important to read and understand these proposals because in future this provision will decide the direction of doing business in our country. Let’s see, there are provisions proposed in the budget, in which seller’s shortcomings or delay in filing return or payment of tax or any other notified “characteristic” of the seller will result in restricting the ITC of purchases although purchasers have no control over the activities of the seller :-

1. The input credit given by the Newly registered Dealers for a certain period of time. Let us try to understand how this restriction will work. For Example, X has taken a registration in Jan 2022 and suppose it is prescribed that ITC of new registration will not be able to give ITC to their seller for first 2 Months. It may be partly or fully but at present it is uncertain how this restriction will work and how will be prescribed. In my opinion it will be very difficult to prescribe such restrictions because it will hit the New Businesses so it should be introduced with certain exceptions to avoid any undue hardships.

2. If such seller is in default of payment of his tax and such default continues till such time as may be prescribed , the input issued by such seller shall not be passed on to his buyers. The duration of such default is also yet to be determined but the purpose of this provision is to make dealers to pay their taxes within time otherwise their buyers will suffer.

3. A seller whose Payment of Tax is less than a specified percentage of the tax shown in his statement of sale, as may be prescribed. This is in relation to the difference between the tax shown in GSTR -1 of a dealer and what is paid in GSTR -3B and if such a stipulated difference is there, then his buyers will not get input credit.

The purpose of this provision is that A dealer should pay the Tax as per the sales shown in his GSTR -1, but if there is a default in doing so then in certain prescribed circumstances the credit of his buyers will be restricted. Amazing!!!

4. A seller who is claiming more Input credit from the specified inputs received by him ELIGIBLEAS PER 2B during a stipulated period of time and the difference is greater than a prescribed limit .

See this provision is related to the input credit that is coming in your GSTR –2B and claimed in the GSTR – 3B by the dealers. If a dealer takes more of the credit than he gets and this difference remains beyond a specified prescribed limit and this difference remains for a specified period, then the input credit of the goods sold by such seller will not be available to his buyers. It may partly or fully.

5. A seller who is utilizing more ITC than what he can utilize from his credit ledger . The input credit given by him will be withheld for his buyer subject to certain conditions & restrictions. It means there will be a restriction on utilization of Input credit from the credit ledger and rest of the tax has to be paid in cash for a particular Tax period.

For this purpose a new Section 49(12) is being introduced. As per this provision the government, on the advice of the GST Council, will fix a limit on how much tax a dealer can pay from his credit ledger while paying his tax i.e., after the prescribed limit, that dealer will have to pay his tax in cash despite having money in the credit ledger. This is an unnatural restriction and does not match the spirit of GST.

A similar restriction is there through Rule 86B and now another section 49(12) has been proposed in the law which supports this rule.

Now see if some selling dealer violates this limit while paying his own tax, then there is also this unique provision of withholding the input credit of his buyer, which will again increase the troubles of the buyers.

6. Apart from this, the category of those suppliers will be prescribed , whose buyers will not get the input credit of the sales made. Under this, through the notification, those dealers or the type of dealers will be identified whose buyers will not get input credit.

The government has its own point of view regarding these provisions and it wants to protect it’s tax in any case, but right now the dealers are already facing the lot of problems while claiming ITC, then if these proposals are implemented, there will be more problems in doing business . It has to be seen that in the final Notifications that how will these provisions come about, what is the time period i.e., duration of default and extent of violation in them coupled with exceptions if any.

Any way whatever may the Final outcome, even at present we can say that the ITC is not seamless and this aspect of GST should also be looked into by the Law makers while making the provisions related to GST.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"