Reetu | Sep 5, 2024 |

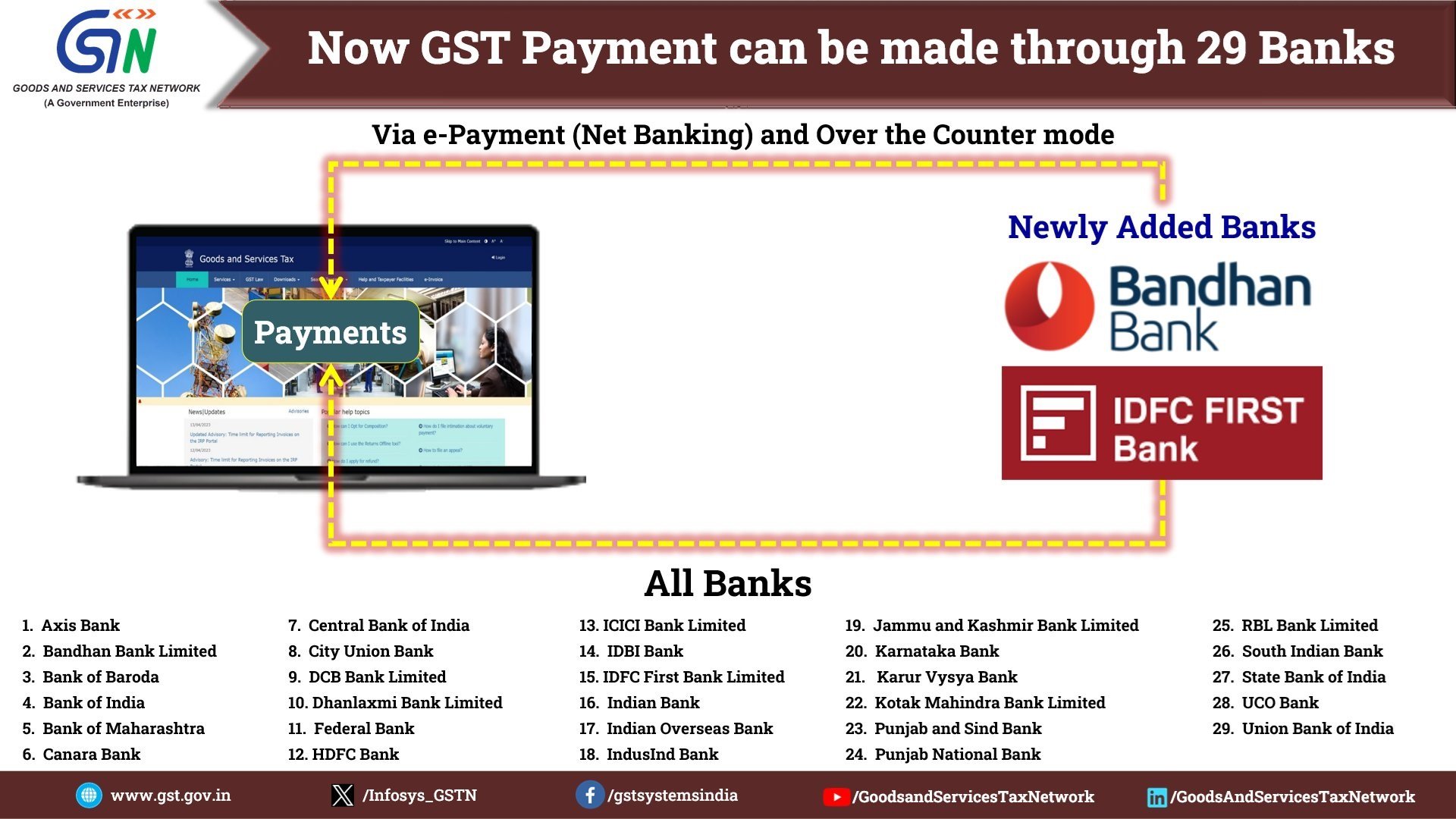

GST Portal Update: Now GST Payments can also be made through 29 Banks

The Goods and Services Tax Network (GSTN) has enabled Services of GST Payment for Bandhan Bank and IDFC First Bank with Net Banking (e-Payment) and Over the Counter options. Now GST Payments can also be made through Bandhan Bank and IDFC First Bank.

These Newly added banks bring a change in the total number of banks that accept GST Payments. Now payment of tax can be made through 29 banks.

1. Axis Bank

2. Bandhan Bank Limited

3. Bank of Baroda

4. Bank of India

5. Bank of Maharashtra

6. Canara Bank

7. Central Bank of India

8. City Union Bank

9. DCB Bank Limited

10. Dhanlaxmi Bank Limited

11. Federal Bank

12. HDFC Bank

13. ICICI Bank Limited

14. IDBI Bank

15. IDFC First Bank Limited

16. Indian Bank

17. Indian Overseas Bank

18. Induslnd Bank

19. Jammu and Kashmir Bank Limited

20. Karnataka Bank Limited

21. Karur Vysya Bank

22. Kotak Mahindra Bank Limited

23. Punjab and Sind Bank

24. Punjab National Bank

25. RBL Bank Limited

26. South India Bank

27. State Bank of India

28. UCO Bank

29. Union Bank of India

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"