Saloni Kumari | Feb 13, 2026 |

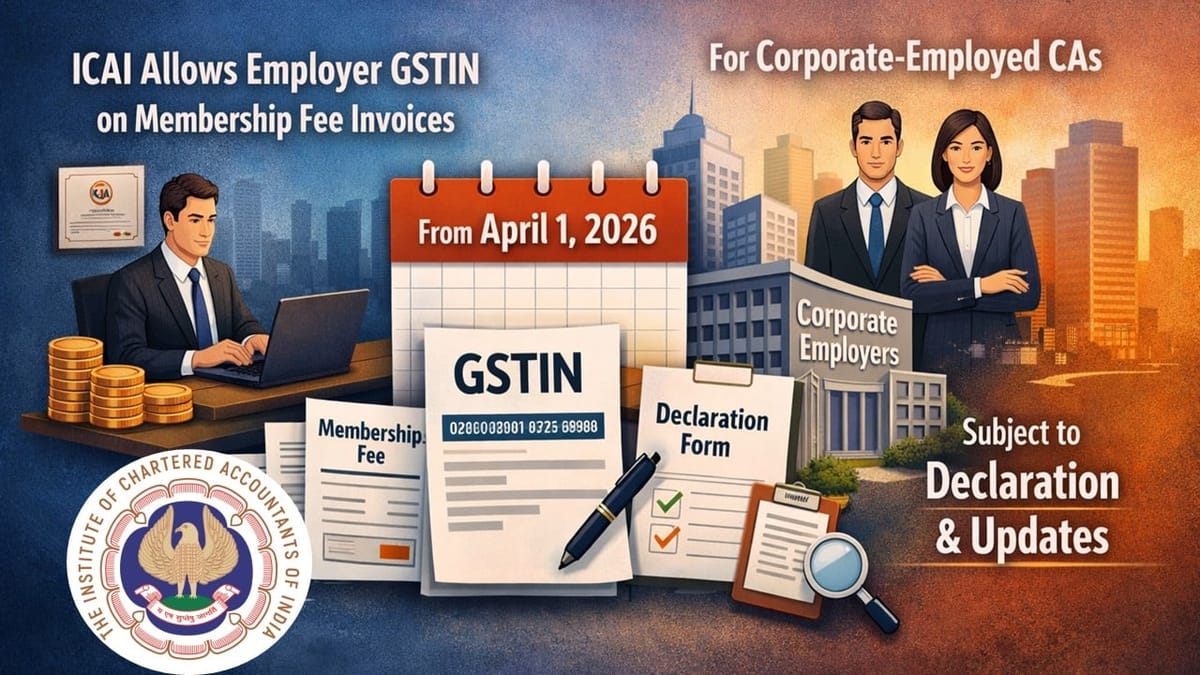

ICAI Introduces New Tax Invoice Rule for Corporate-Employed CAs from April 2026

The Institute of Chartered Accountants of India (ICAI) M&SS Directorate has announced a key update for all Chartered Accountants (CAs) working in corporate companies.

As per the update, the ICAI has decided that when a corporate entity pays the membership fee of a Chartered Accountant working with it, the tax invoice can be issued in the company’s GST number, based on a declaration from the member. This new rule has been scheduled to take effect from April 01, 2026, from the upcoming invoicing cycle.

In order to make sure the process is working smoothly, members working in the industry are requested to update or revise their employment details using the “Update Employment/ Engagement Form”. The form can be accessed under Member Functions on the Self Service Portal (SSP).

After updating the employment particulars, members are then requested to update their GST (Goods and Services Tax) Number using the “Update Your Profile” option available on the same portal.

ICAI has further requested all the concerned members to complete the aforesaid two steps on or before February 25, 2026. Doing this on time will help ensure that tax invoices for membership fees are issued correctly with the employer’s GSTIN wherever applicable. Members are encouraged to review their profiles early to avoid any last-minute issues during the new invoicing process.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"