The Income Tax Department has started sending notices under Section 133(6) of the Income Tax Act for Assessment Year 2023-24 (AY 23-34) to salaried individuals asking for proof of deductions and exemptions claimed in the Income Tax Return (ITR) Form.

CA Pratibha Goyal | Feb 21, 2024 |

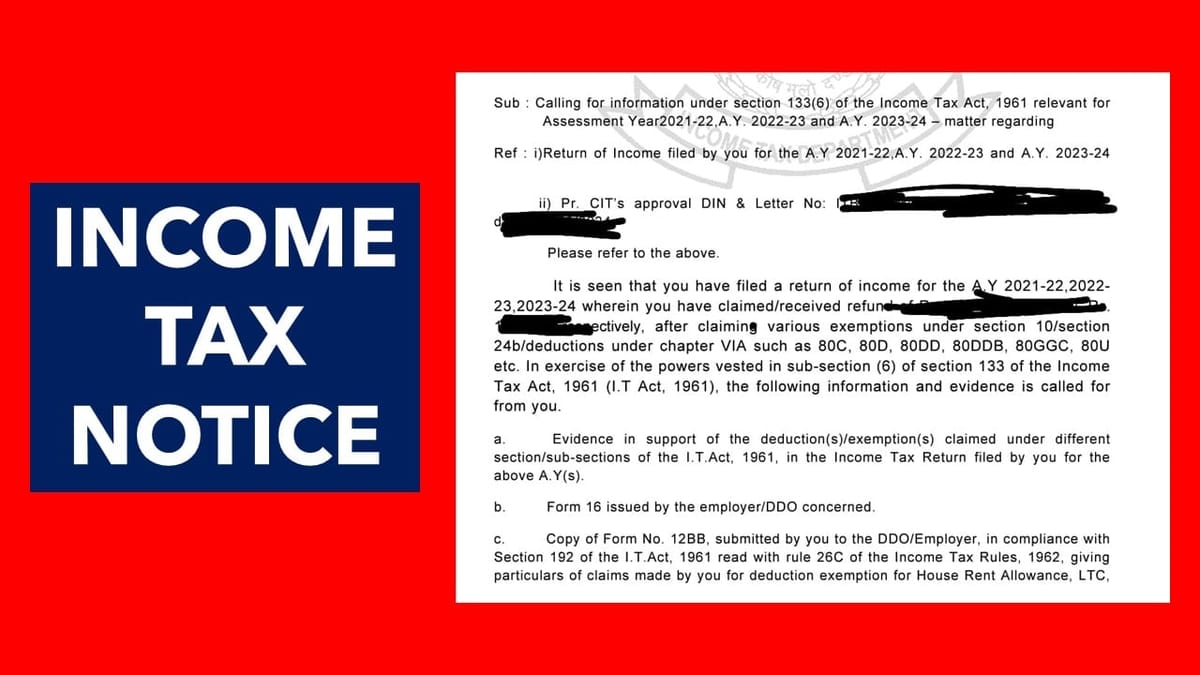

Income Tax Department sends notice to salaried Individuals asking proof of deductions claimed in ITR

The Income Tax Department has started sending notices under Section 133(6) of the Income Tax Act for Assessment Year 2023-24 (AY 23-34) to salaried individuals asking for proof of deductions and exemptions claimed in the Income Tax Return (ITR) Form.

The Old Tax Regime Allows salaried individuals to claim various exemptions and deductions linked House Rent Allowance (HRA), Leave Travel Allowance (LTA), Housing Loan Deduction, Insurance, ELSS, Medi-Claim etc. in order to save tax.

Taxpayers receive Income Tax Notice u/s 133(6): Know how to comply

However these provisions were misused by many individuals to claim fake tax exemptions for saving tax. This could lead to Income Tax Notice.

While filing ITR, Tax Professionals, Chartered Accountants should ensure that no fake Tax Claim is made. Also it is suggested that Opt for New Tax Regime, which is very Lucrative after Budget 2023 instead of claiming Incorrect Exemptions/Deductions.

Income Tax Department to issue notices to Non-Fillers of ITRs and TDS Dedutees

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"