Notice will be sent to Taxpayers against whom the Department is having Definitive Information of Income Tax Evasion.

CA Pratibha Goyal | Feb 21, 2024 |

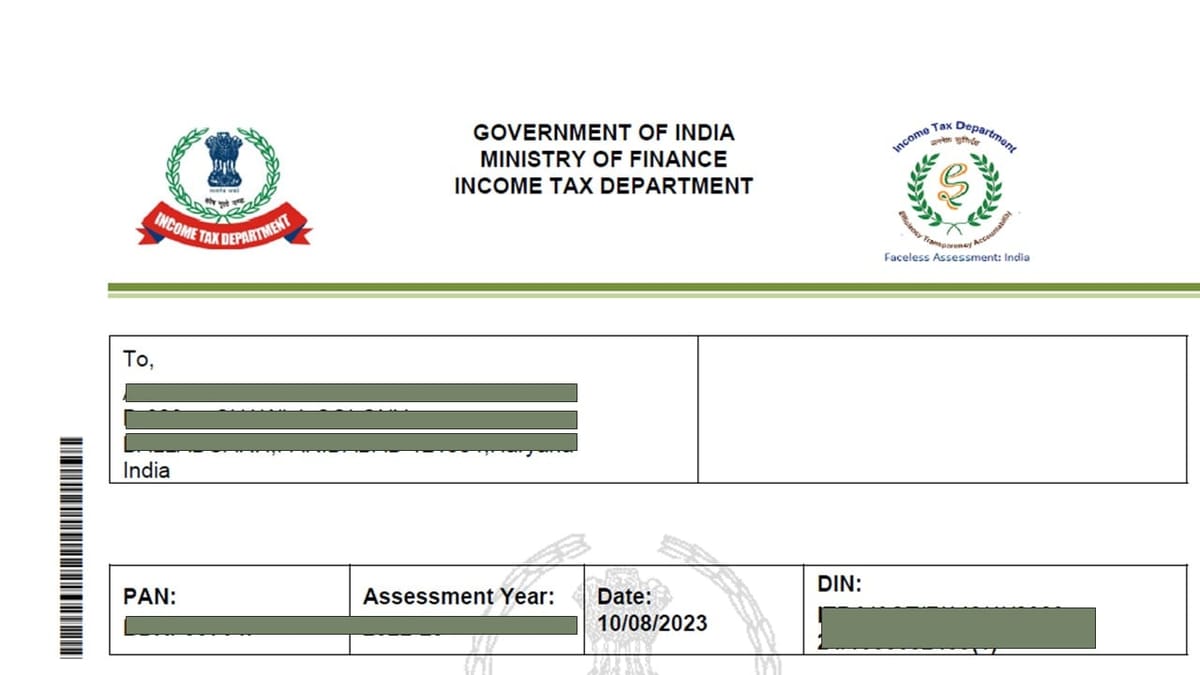

Income Tax Department to issue notices to Non-Fillers of ITRs and TDS Dedutees

The chairman of the Central Board of Direct Taxes (CBDT) has warned that the Income Tax Department will soon take strict action against those whose ITRs are not filed but whose TDS has been deducted.

Notice will be sent to Taxpayers against whom the Department is having Definitive Information. He also highlighted that the IT-Department has taken many measures to enhance the experience of Taxpayers like bringing down Income Tax Refund period and solving Large unresolded disputed.

In Interim Budget 2024, our Finance Minister also announced waiver of old outstanding Income Tax demands up to INR 25,000 for the period up to financial year 2009-10 and up to INR 10,000 for financial years 2010-11 to 2014-15.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"