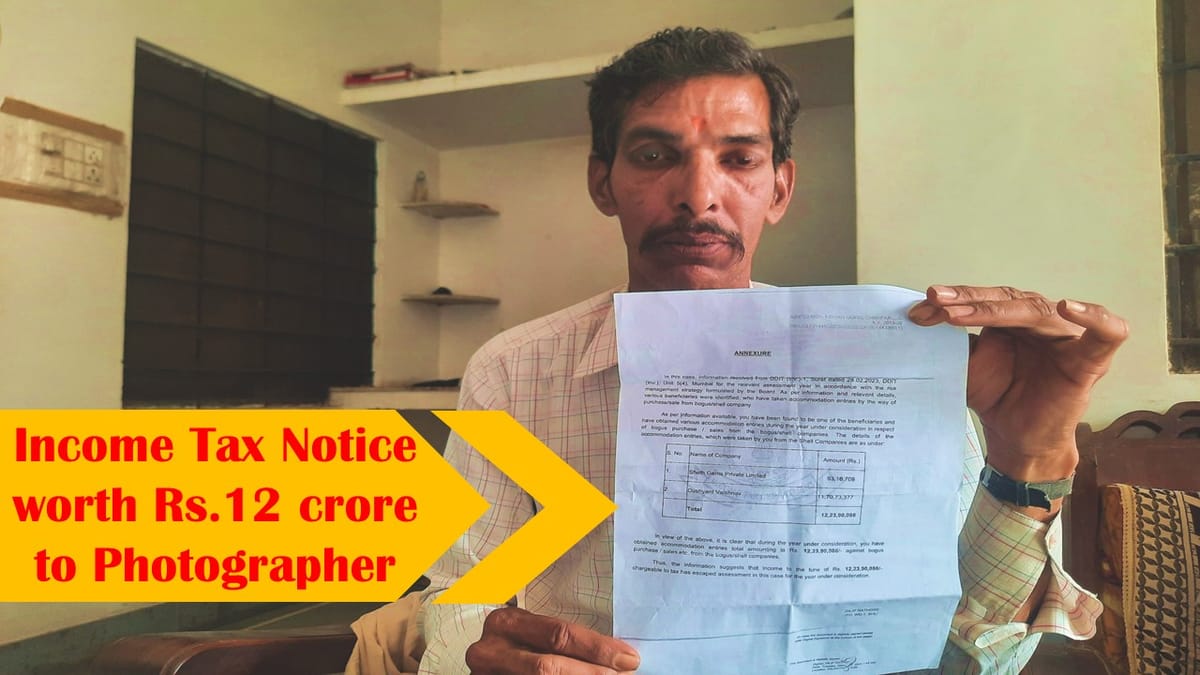

The Income Tax Department has handed over an income tax notice of Rs 12 crore 23 lakh to a photographer.

Reetu | Apr 4, 2023 |

IT Department issued Tax Notice worth Rs.12 crore to Photographer

The Income Tax Department has handed over an income tax notice of Rs 12 crore 23 lakh to a photographer. This notice is related to telling bogus purchases and sales in two shell (bogus companies) of Surat. Both of these Companies are said to be the diamond companies.

The notice’s response is required by the Income Tax Department by April 10. The photographer’s family experienced sleepless evenings after seeing this notice.

Kishangopal Chhaparwal, a resident of Sanjay Colony’s Mahesh Marg, who is a disabled person and by profession, he is a Photographer, reported that an Income Tax Department’s tax notice arrived at his residence by mail on March 29, 2023. Rameshwar Lal Chhaparwal who is the father of the photographer was at home at that point.

The victim Chhaparwal claimed, “He is a photographer by profession and has a rented shop in village Sanganer. I make between 7,000 and 8,000 rupees a month from all of this. However, I received a notification from the income tax department for 12 crore 23 lakh. My family and I were astounded to see this notification. Although I have never been to Surat in my life, the notice mentions two Surat-based businesses. In the Subhash Nagar police office, I have also filed a complaint about this. I believe the maker of these stressful jokes should face harsh punishment.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"