Pune ITAT remands Section 12A registration matter to CIT(E) for reconsideration due to wrong subsection selection.

Vanshika verma | Dec 24, 2025 |

ITAT Grants Fresh Opportunity to Charitable Trust for Section 12A Registration After Technical Error

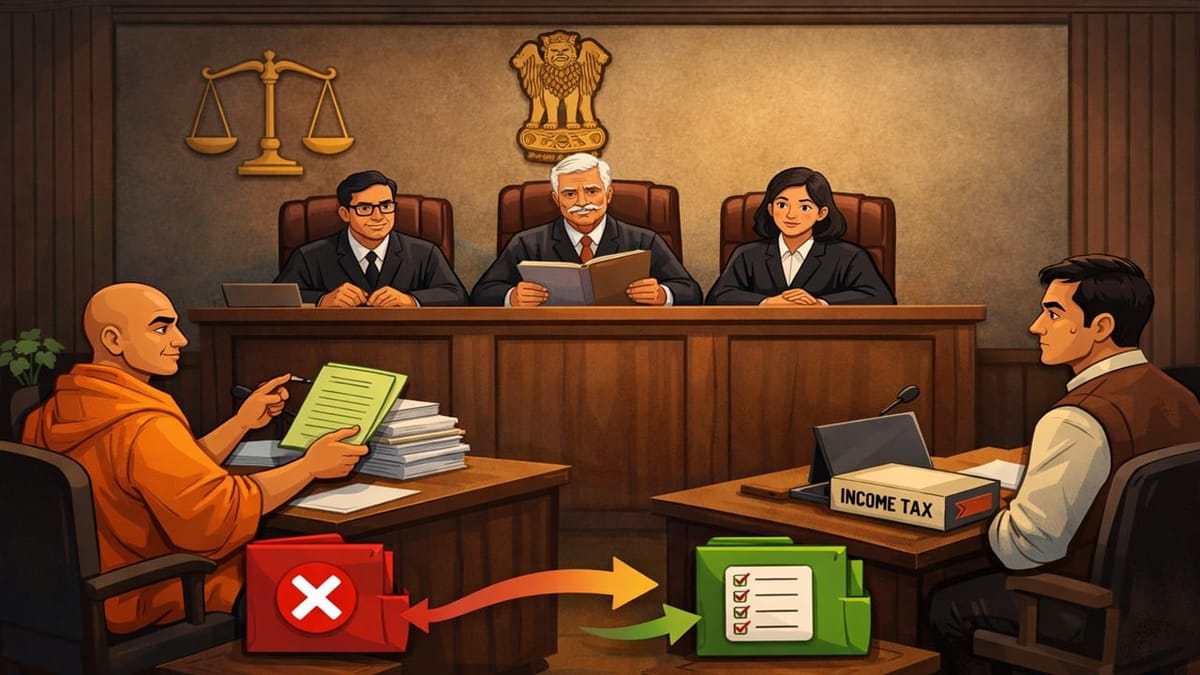

ITAT allowed the assessee another chance to seek Section 12A registration by remanding the matter to CIT(E) after finding the rejection was due to a technical error in Form 10AB selection.

Shri Ramkrushna Paramhansa has filed the present appeal against the ITO in the Income Tax Appellate Tribunal (ITAT) in Pune “B” Bench, challenging an order passed by the CIT(E), Delhi, dated September 9, 2025, in the proceeding under section 12A(1) of the Income Tax Act, 1961.

The assessee is a charitable trust that applied for regular registration under Section 12A of the Income-tax Act. While filing Form 10AB online, the trust mistakenly selected the wrong sub-section of the law due to a technical error. Due to this mistake, the CIT (E) rejected the application.

The assessee then approached ITAT. In the hearing, the assessee submitted that the error was unintentional and its activities are genuine and requested another opportunity to correct the mistake.

ITAT, observed that the trust had already done provisional registration and that the rejection was only due to a technical error. Considering all the facts, the Tribunal decided to give the trust one more opportunity and sent the matter back to the CIT (E) with instructions to allow the trust to file a corrected application under the correct sub-section and submit required details.

As the result, Tribunal allowed the appeal for statistical purposes, and directed the trust to be careful and cooperative in future proceedings.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"