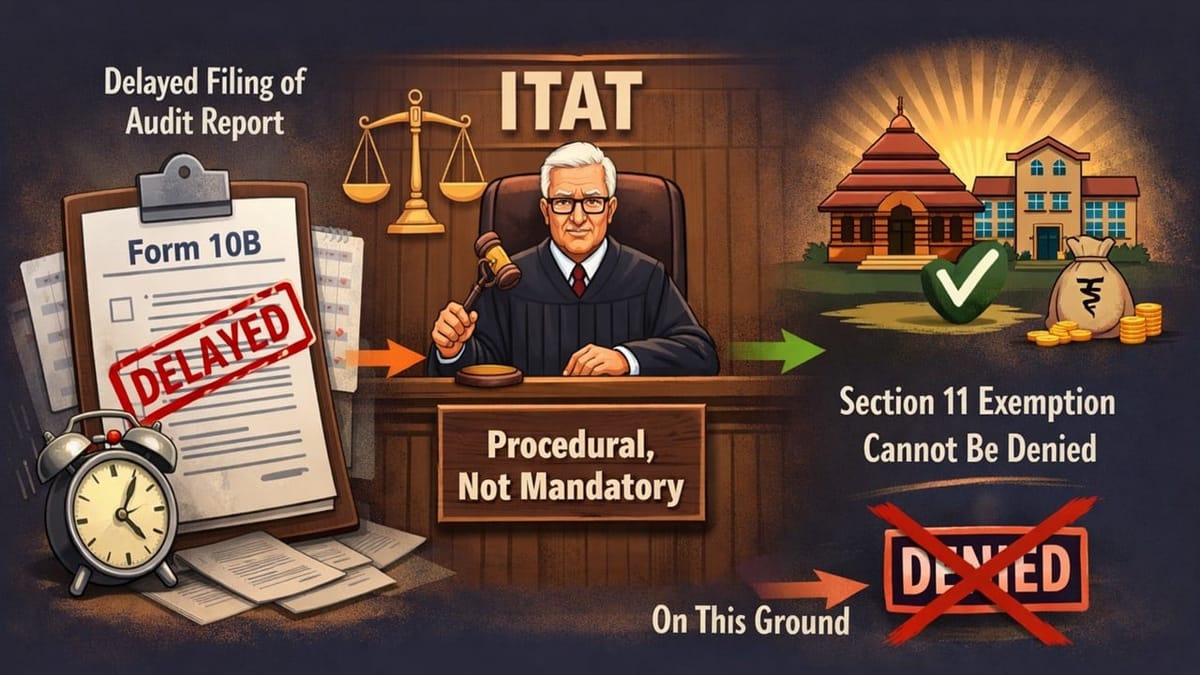

ITAT holds that the delayed filing of the audit report in Form 10B is procedural, not mandatory, and the Section 11 exemption cannot be denied on this ground.

Saloni Kumari | Dec 22, 2025 |

ITAT Rules Late Form 10B Filing Cannot Deny Section 11 Exemption; Tribunal Favours Assessee

Father Leblond Trust filed the present appeal before the ITAT Kolkata, challenging an order passed by the CIT(A)/NFAC Delhi on December 20, 2024, under Section 250 of the Income Tax Act, 1961. Through the impugned order, CIT(A) had denied the trust’s availed exemption under Section 11 of the Act.

The assessee is an approved trust under Section 12A of the Act. The trust filed its return of income under section 139(4A) exactly on the extended statutory due date, i.e., October 31, 2019, and also submitted an audit report in Form No. 10BB dated September 25, 2019. The tax authorities denied the assessee’s claim of exemption under section 11 of the Act vide rectification order dated October 30, 2020.

The main reason behind the denial was the late filing of the audit report in Form 10B, even though the return and Form 10BB were timely furnished. The aggrieved assessee filed an appeal before CIT(A). However, CIT(A) dismissed the appeal of the assessee through the impugned order dated December 20, 2024. Thereafter, the assessee filed an appeal before the ITAT Kolkata. The initial appeal was delayed by 140 days, but the Tribunal condoned it due to the trustee’s health issues.

The trust argued that the filing of Form 10B is only a procedural requirement, not a compulsion, and a delay should not be the mere reason to deny the exemption. The tribunal endorsed this argument of the assessee that filing Form 10B is procedural, and that the exemption under Section 11 cannot be denied just because it was filed late. It noted that the intimation under Section 143(1) was incorrect in denying the exemption.

As a result, the Tribunal set aside the impugned CIT(A) order and directed the AO/CPC to consider the audit report and grant the assessee exemption under Sections 11 and 12. The appeal was partly allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"