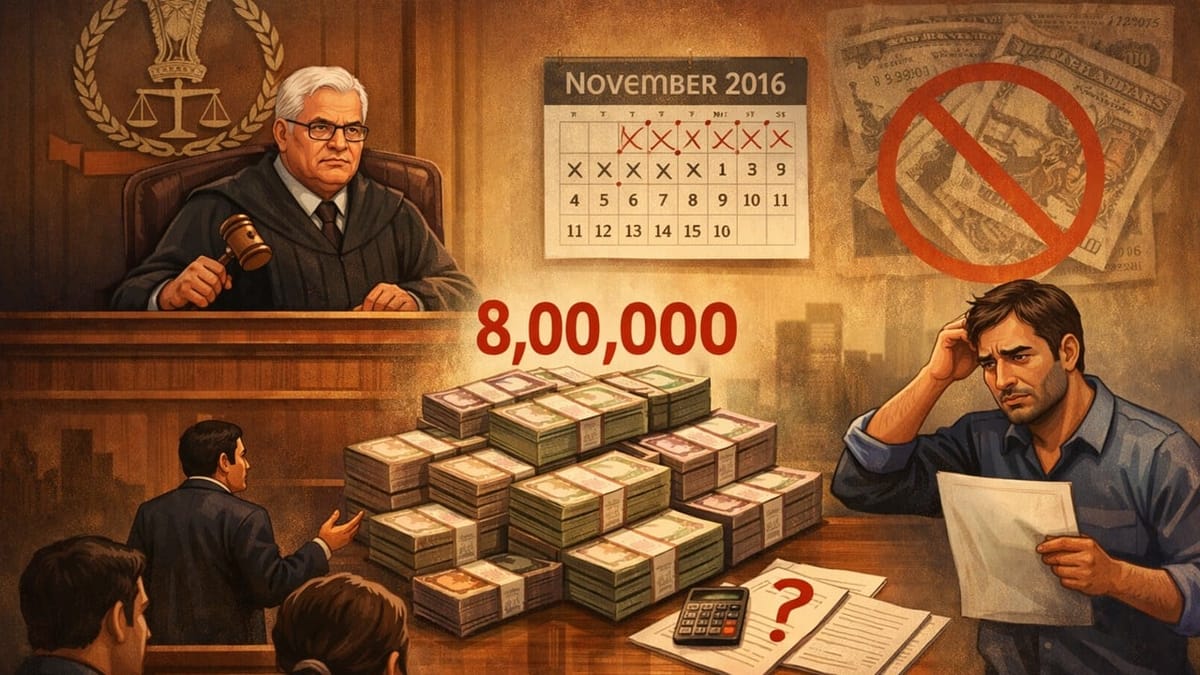

ITAT upheld the addition of Rs. 8 lakh as unexplained cash deposits made during the demonetisation period due to failure to prove the source.

Saloni Kumari | Dec 26, 2025 |

ITAT Upholds Rs. 8 Lakh Demonetisation Cash Deposit Addition for Failure to Explain Source

Bhikhabhai Ramanbhai Patel filed the present appeal before ITAT Ahmedabad, challenging an order dated December 09, 2024, by the CIT(A), ADDL/JCIT(A)-5, Kolkata, under section 250 of the Income Tax Act, 1961. The case is related to the assessment year 2017-18.

Through the challenged order, the CIT(A) had confirmed the addition of Rs. 8.00 lakhs made by the Assessing Officer (AO) on the assessee’s income as unexplained cash deposits made during the period of demonetization.

In November 2016, the assessee had deposited Rs. 8,16,500 in his bank accounts with the Kalupur Comm. Co-op. Bank Ltd. and Naroda Nagrik Cooperative Bank Ltd., Ahmedabad, which was a period of demonetization. When AO asked the assessee about the source of this deposit, the assessee explained that the deposit was made out of past withdrawals of Rs. lakhs from the bank. This withdrawal took place on March 19, 2016.

When AO further investigated the case, it discovered that the assessee in the past had taken a loan of Rs. 20 lakhs, and out of that amount, he had withdrawn Rs. 15 lakhs. It was further observed that some amount was also deposited by the assessee before the period of demonetization. Therefore, it was not confirmed if the deposit of Rs. 8 lakh was out of the cash withdrawals of Rs. 15 lakh made on March 19, 2016. In conclusion, AO made an addition of Rs. 8.00 lakhs to the assessee’s income, treating the cash deposit as an unexplained cash deposit.

The aggrieved assessee filed an appeal before the CIT(A). The CIT(A), after hearing the arguments of both sides, gave the assessee an extra opportunity to furnish some relevant documents explaining the source of the cash deposit. However, the assessee failed to furnish the documents and did not even answer the notice issued by CIT(A). In conclusion, CIT(A) confirmed the addition.

Thereafter, the assessee filed an appeal before the ITAT Ahmedabad. The tribunal, after listening to the arguments of both sides and the ruling of CIT(A), did not find any relevant reason to interfere with the order of the ld. CIT(A) upheld the same. Dismissed the appeal of the assessee.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"