The Kerala SGST Policy Division issued Sector Specific Trade Advisory on GST for the wood industry outlines key aspects like registration, tax rates, compliance, and invoicing.

Reetu | Jan 25, 2025 |

Kerala GST Department issued Sector Specific Trade Advisory on GST for Wood Industry

The Kerala SGST Policy Division issued Sector Specific Trade Advisory on GST for the wood industry outlines key aspects like registration, tax rates, compliance, and invoicing.

The Goods and Services Tax (GST) has transformed India’s taxation system, affecting all industries, including the wood industry. Understanding GST registration and compliance procedures is vital for wood industry merchants, including manufacturers, suppliers, and retailers.

Traders in the wood industry, including manufacturers, suppliers, and retailers, must register under GST if their total turnover in a financial year exceeds the GST threshold of INR 40 lakhs for goods and INR 20 lakhs for services/both goods and services. A registered person is required to collect and submit GST at the applicable rate. If the turnover exceeds the threshold limit, registration must be completed by submitting an online application through the common site within 30 days after the duty to register. Registration can be done as a regular taxpayer or under the composition scheme.

The Composition scheme is a streamlined tax compliance scheme under the GST system for registered small taxpayers that aims to minimise compliance burdens and make tax payment easier. The Composition Scheme is available to taxpayers who sell goods with an aggregate turnover of up to INR 1.5 crores and service providers with an aggregate turnover of up to INR 50 lakhs in a financial year, under which-

GST’s input tax credit (ITC) allows registered individuals to claim credit for previously paid GST on business inputs and services, preventing double taxation of goods and services.

Regular scheme taxpayers are required to file GSTR-1 and GSTR-3B returns within the timeframe specified by the Act and rules. Those using the Composition Scheme must file a quarterly statement in GST CMP-08 and an annual return in GSTR-4 within the specified time frame. GST returns should be filed through the the GST common portal.

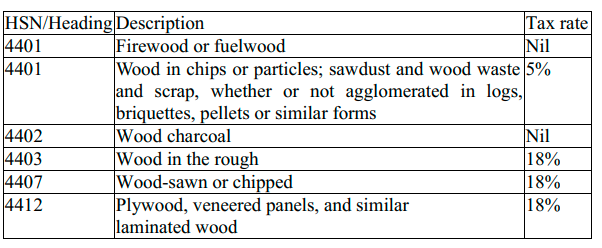

As a wood industry supplier, every registered taxpayer must provide a tax invoice or bill of supply (for composition taxpayers) for all supplies. These invoices should include information such as the taxable person’s name and address, GSTIN, invoice number and date, product description, Harmonized System of Nomenclature (HSN) code for wood products, applicable GST rate, taxable value, and tax charged for a supply, among others.

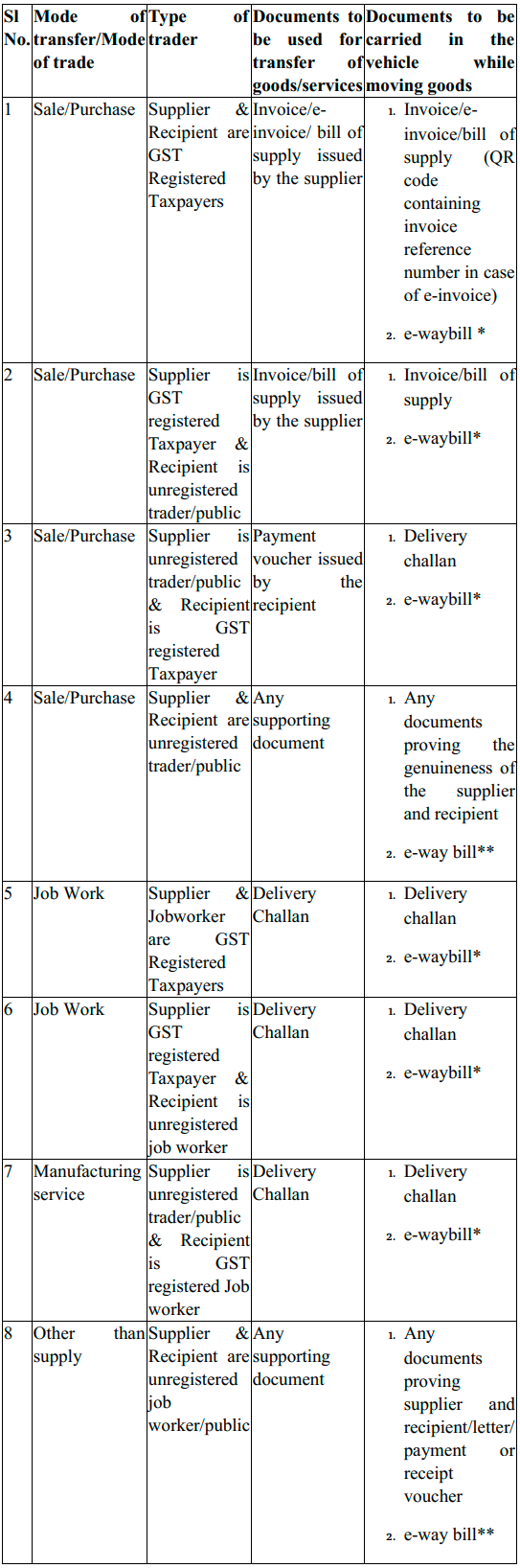

In addition to the invoice, each registered individual transporting timber/wood with a consignment value of Rs.50,000 or more must generate an E-Way Bill by logging into the E-Way Bill Portal.

When interstate movement of goods is made for job work by a registered person, an e-way bill shall be generated either by the registered trader/manufacturer or the registered job worker irrespective of the value of the consignment.

Non-filing of GST returns for a continuous period of six months may result in the suspension and cancellation of GST registration. In addition, non-compliance with GST regulations can result in hefty penalties, such as fines, interest on unpaid taxes, and rejection of Input Tax Credits. Persistent non-compliance may result in the seizure of items and records. Severe cases might result in significant fines and perhaps arrest. To prevent costly penalties and ensure efficient business operations, register when turnover exceeds the threshold limit, file proper returns, and pay taxes on time.

Note:

E-waybills are to be generated in the situations mentioned in Sl.No 7 above. A hard copy of e-waybill is not necessary. You may keep either a hard copy or an electronic form or the e-waybill number.

An unregistered person may generate an e-way bill from the e-way bill portal by giving his/her details and vehicle details for the movement of goods for own use or as part of the supply. This will enable the person for hassle-free movement of goods.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"