The Government of India is launching an ‘Invoice incentive Scheme’ by the name ‘Mera Bill Mera Adhikaar’ to encourage culture of customers asking for invoices/bills for all purchases.

Reetu | Aug 25, 2023 |

Launch of Invoice Incentive Scheme “Mera Bill Mera Adhikaar” from 1st September, 2023

The Government of India, in association with State Governments, is launching an ‘Invoice incentive Scheme’ by the name ‘Mera Bill Mera Adhikaar’ to encourage the culture of customers asking for invoices/bills for all purchases.

The scheme’s goal is to promote in the general population a cultural and behavioural shift that recognises ‘Ask for a Bill’ as a right and entitlement.

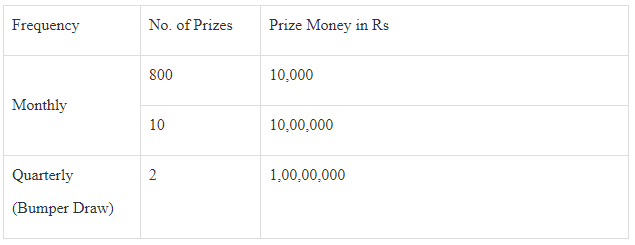

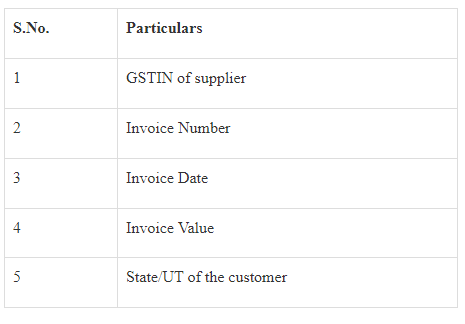

The details of the Scheme are as under:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"