Payment of MCA fees through NEFT (National Electronic Fund Transfer) has been made simpler in order to eliminate inconveniences caused due to payment processing delays.

Reetu | Jan 3, 2023 |

MCA Fees payment method Simplified; Released User Guide on Paying MCA21 Fees Via NEFT

Ministry of Corporate Affairs (MCA) payments are currently accepted by physical challan, internet banking, and credit card. Now, the ministry has recognized five banks (Indian Bank, HDFC, ICICI, PNB and SBI) for collection of MCA 21 fees, which means that only the account holders of these banks can avail Internet banking facility. Also, payment through challan can only be made in the authorized branches of these above five banks. Though this was a major improvement compared to the earlier manual system, it caused delays in incorporation of companies and processing of other e-Forms.

The Ministry is initiating payment of MCA fees via NEFT (National Electronic Fund Transfer) mode, in addition to already exiting payment methods. Payment of MCA fees through NEFT (National Electronic Fund Transfer) has been made simpler in order to eliminate inconveniences caused due to payment processing delays. On June 11, 2012, the streamlined procedure was made public.

NEFT National Electronic Fund Transfer (NEFT) is an inter-bank/inter-branch online fund transfer within India.

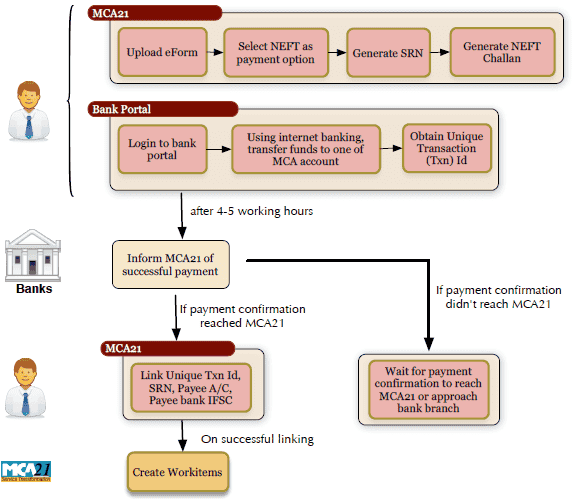

1. User uploads an electronic form, chooses “NEFT” as payment method, and generates an SRN and an e-Challan with instructions for making the NEFT transfer.

2. Through the internet banking service provided by their bank, users can transfer money to their MCA21 account. In the comment column, the user may quote SRN. Users should never pay in cash at branch counters; only use Internet banking. Linking payments made in cash at branch counters may not be possible.

3. User’s bank provides a unique transaction number (UTN) for the NEFT transfer.

4. Banks will inform MCA21 system in four to five working hours about the payment along with the UTN.

5. User logs in to MCA21 and connects SRN and UTN. The account number from which the transfer was made as well as the amount must be provided by the user for verification purposes. If the details match and the payment has been reported to the MCA21 system, the linking will be successful, and MCA21 will create a work item for further processing.

6. A message instructing the user to link the SRN and UTN later is displayed if the banks have not yet provided the SRN with payment information. A user-facing error message is displayed if the details don’t match.

7. There will be two SRNs (one for filing fee and another for stamp duty) for transactions involving stamp duty, and separate payments should be made. Both payments should be linked before the expiration date.

8. Amount will be returned to the account from which it originated if payment is not linked within the allotted time frame (currently, it is two days since banks report the transactions).

| HDFC | PNB |

| Account Number: 04990920001637 | Account Number: 1120002102318748 |

| IFSC Code: HDFC0000240 | IFSC Code: PUNBO112000 |

| Beneficiary Name: MCA21-NEFT | Beneficiary Name: MCA21-NEFT |

| Collection | Collection |

| Account Type: Current | Account Type: Current |

| Branch Name: HDFC bank, Sandoz House | Branch Name: ECE House, New Delhi |

NEFT is a nation-wide system that facilitates electronic transfer of funds from any bank branch to account holder of any other bank branch. The list of NEFT-enabled branches is available in the RBI website.

Presently, NEFT operates in hourly batches – there are eleven settlements from 9 am to 7 pm on weekdays and five settlements from 9 am to 1 pm on Saturdays. NEFT transaction charges are available in the RBI website and are in addition to MCA21 filing fee.

Further details on NEFT can be found in the RBI website.

1) SRN will expire if payment doesn’t reach MCA21 on time. Hence users should transfer funds well in advance taking into consideration of bank holidays and the settlement window mentioned as earlier.

2) Full amount has to be transferred in single transaction for a particular SRN. Amount can’t be dividend into multiple payments.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"