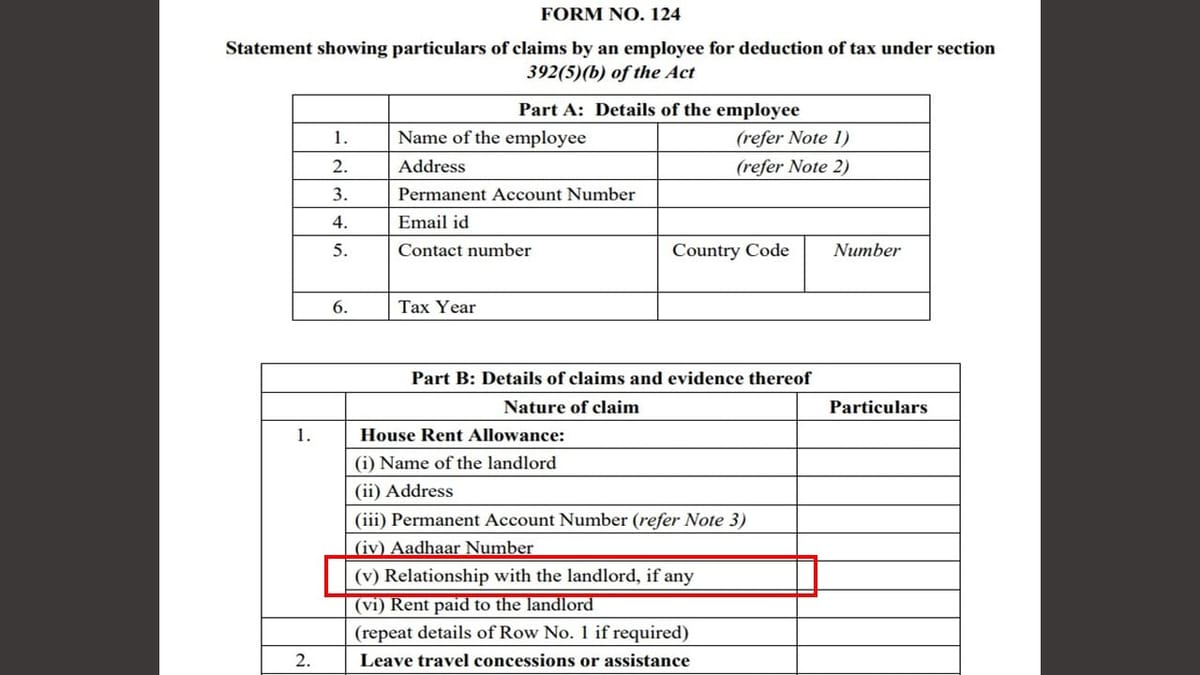

The draft rules, 2026, require employees to inform their relation with the landlord in Form No. 124 when claiming HRA.

Nidhi | Feb 21, 2026 |

New IT Rules 2026: Mandatory Disclosure of ‘Relationship with Landlord’ for HRA Claims

The draft income tax rules, 2026, released by the income tax department, introduce an important change for salaried employees claiming House Rent Allowance (HRA) for rent paid to their relatives.

The draft rules, 2026, require employees to inform their relation with the landlord in Form No. 124 when claiming HRA.

This new rule aims to target the taxpayers who are paying rent to their relatives (spouse, parents, etc.) and claiming fake HRA. The new rule allows the Income Tax Department to use data analytics to check the genuineness of the transaction and cross-verify it with the relative’s income declaration and property ownership.

Employees must ensure that their rent payments are supported by a valid rent agreement and are made through regular bank channels. Additionally, the landlord must report the rental income on their tax return.

As per the draft rules, failure to comply with this could lead to penalties of up to 200% of the tax under Section 270A. The disclosure removes the defense of “unawareness” for taxpayers.

Experts say that this new rule will not disallow the HRA benefit straight away if rent is paid to a relative, but the taxpayers must keep all the important documents ready, such as property papers, rent agreements, and ITR filed by the relative, as the chances of scrutiny are high in such cases.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"