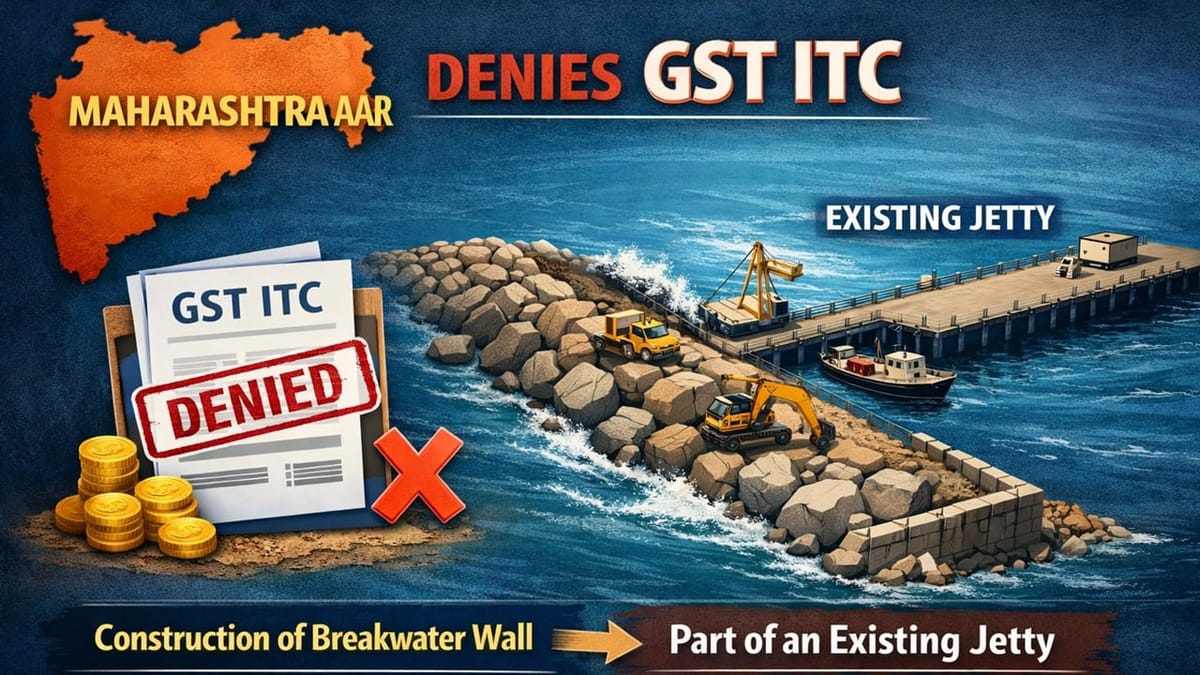

The Maharashtra AAR denies GST ITC on the construction of a breakwater wall forming part of an existing jetty, leading to litigation from the AAR and AAAR to the Bombay High Court.

Saloni Kumari | Feb 21, 2026 |

GST ITC on Breakwater Construction Denied Again; Matter Remanded but Ruling Stays Against Konkan LNG

M/s Konkan LNG Private Limited (KLPL) has been denied Input Tax Credit (ITC) on GST paid for construction of a breakwater wall, even after the matter was remanded by the Bombay High Court.

KLPL had initially approached the Maharashtra Authority for Advance Ruling (AAR) in February 2019 seeking clarity on whether it could claim ITC on GST paid for building a breakwater wall. The company argued that the breakwater was an integral and essential part of its jetty infrastructure, required to make it an all-weather operational facility.

KLPL sought rulings on two issues:

Whether ITC was available under Sections 16 and 17 of the CGST/MGST Acts for the GST paid on breakwater construction.

Whether the works contract services involved were not predominantly earthwork (exceeding 75% of value), thereby qualifying for a specific GST rate under Notification No. 11/2017.

The Maharashtra AAR ruled against KLPL on the first issue, holding that ITC was not admissible on the breakwater construction.

On the second issue, the AAR declined to give a ruling, stating that it could affect the rights of the contractor providing the works contract services.

KLPL appealed before the Appellate Authority for Advance Ruling (AAAR), but the AAAR upheld the AAR’s decision in November 2019.

KLPL then filed a writ petition before the Bombay High Court (Writ Petition No. 313 of 2021). The High Court remanded the matter back to the AAR for fresh examination of the ITC eligibility issue.

However, upon reconsideration, the AAR has once again ruled against the taxpayer, denying the ITC claim on the breakwater construction.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"