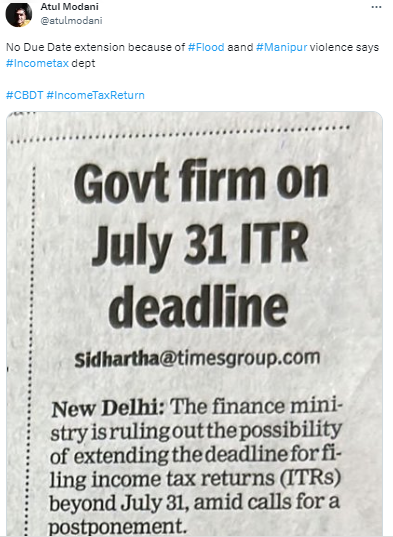

The Ministry of Finance has ruled out the prospect of extending the deadline for filing income tax returns (ITRs) beyond July 31, despite appeals for an extension.

Reetu | Jul 27, 2023 |

No Due Date Extension of Income Tax Return due to Flood and Manipur Violence; Says Income Tax Dept.

The Ministry of Finance has ruled out the prospect of extending the deadline for filing income tax returns (ITRs) beyond July 31, despite appeals for an extension.

According to officials, the government believes that the Income tax return deadline should not be extended unless there are severe issues with the income tax portal, which is not the situation at the moment.

Tax professionals, who make this request every year, believe that floods in various regions of the nation are making it impossible for many taxpayers to complete their Income tax returns. Furthermore, people’s lives in Manipur have been disturbed for several weeks as a result of ethnic conflict. While officials expressed sympathy for the situation in Manipur, they also stated that flooding was a yearly occurrence in many regions of the nation and that citizens should not always wait until the last minute to file their income tax returns.

Over 4 crore income tax returns have been filed thus far, with officials noting that the deadline was not extended even last year.

You May Also Like:

| CA writes to Finance Minister Secretary requesting due date extension | Click Here to Read |

| Extend Due Date for Submission of Income Tax Returns: Sales Tax Bar Association | Click Here to Read |

| Extend Income Tax Return Filing Deadline: Advocates Tax Bar Association | Click Here to Read |

| Chartered Accountants Association represents against e-proceedings tab of the IT portal | Click Here to Read |

| Extend Due Date of Filing Income Tax Return for AY 2023-24: Tax Advocates Association Gujarat | Click Here to Read |

| Extension of Due Date for Filing ITR for FY 2022-23 | AY 2023-24 | Click Here to Read |

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"