Section 68 addition deleted where temporary deposits by family were fully explained and promptly returned

Meetu Kumari | Feb 1, 2026 |

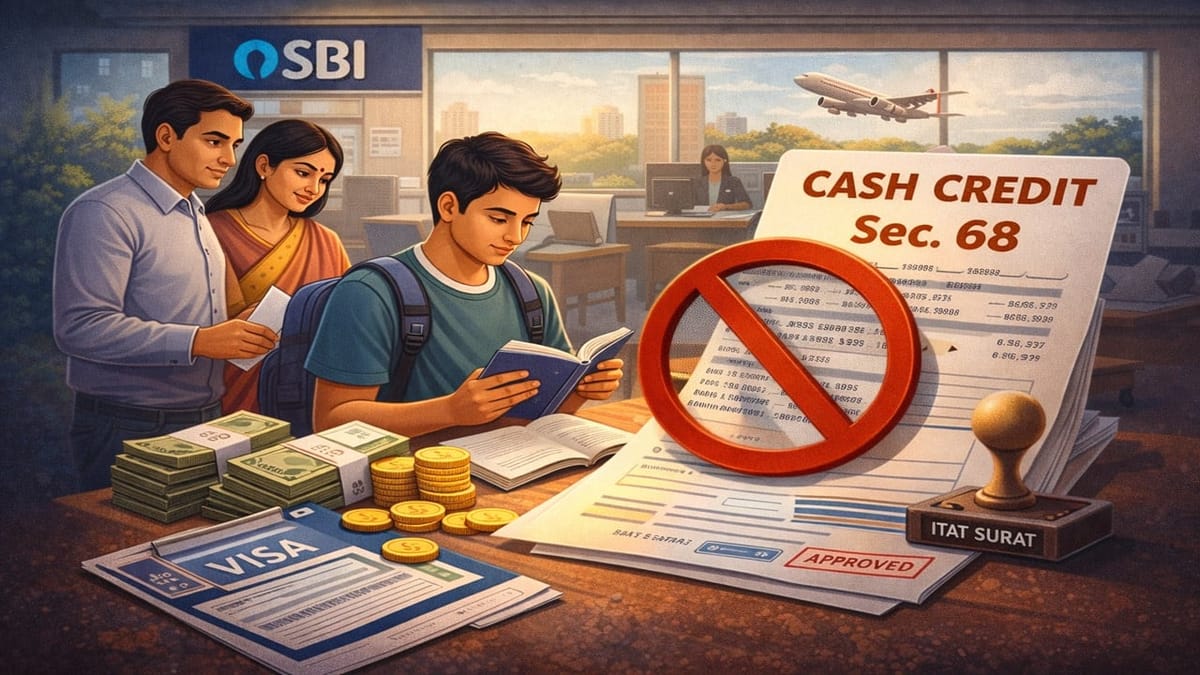

Student’s Visa-Related Bank Deposits Can’t Be Taxed as Unexplained Cash Credit: ITAT Surat

The assessee, a student during AY 2010-11, had not originally filed his return of income. Based on information that cash deposits aggregating to Rs. 11.40 lakh were made in his SBI savings account, reassessment proceedings were initiated under Section 148. In response, the assessee filed a return declaring modest income from tuition activity.

During reassessment, the Assessing Officer treated the entire cash deposits as unexplained under Section 68, solely on the basis of bank entries, and completed the assessment by making an addition of Rs. 11.40 lakh. The assessee explained that the deposits were temporary amounts placed by his parents and close relatives only to demonstrate financial capacity for obtaining a student visa, and that the amounts were withdrawn and returned within a short span. The CIT(A) still upheld the addition.

Main Issue: Whether cash deposits made in a student’s bank account, explained as temporary funds provided by family members for visa purposes and subsequently returned, can be treated as unexplained cash credits under Section 68 in the absence of books of account.

ITAT’s Order: The ITAT held that the addition under Section 68 was unsustainable on both facts and law. The Tribunal noted that the assessee was a student, maintained no books of account, and the addition was made only based on bank statements. The explanation offered, that the deposits were temporary funds from parents and close relatives for visa requirements, was found to be plausible and supported by details showing matching withdrawals and repayments within a short period.

As the Revenue failed to bring any material to disprove the genuineness of these transactions or to show that the deposits represented the assessee’s own income, the Tribunal deleted the entire addition of Rs. 11.40 lakh. The appeal was accordingly allowed.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"