CA Pratibha Goyal | Apr 29, 2024 |

RBI releases fair practices code for interest on Loan charged by Bank: Huge Relief for Borrowers Paying EMIs

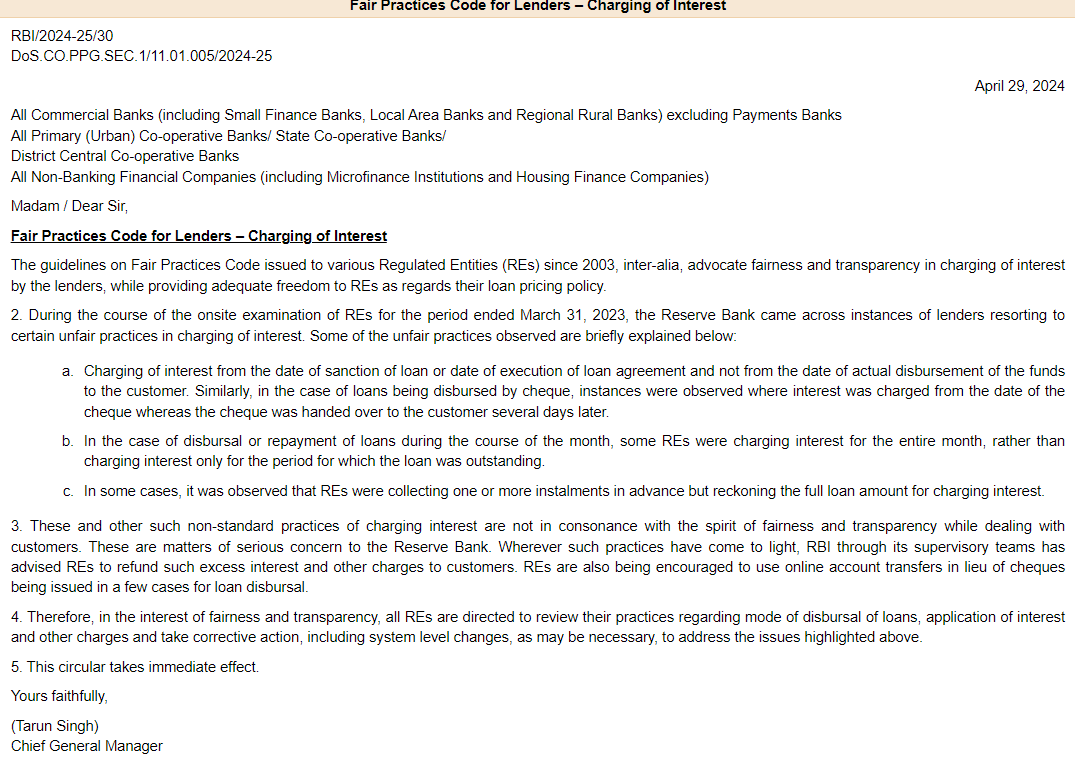

The Reserve Bank of India has released fair practices code for interest for Charging of Interest by the lenders while providing adequate freedom to Regulated Entities (REs) as regards their loan pricing policy.

First Relief: Suppose your loan sanction date is 17th May and your loan agreement date is 2nd June, Many banks used to take the date as 17th May, i.e., date of Loan Sanction for calculation of Bank Interest. But now as per new RBI guidelines, Disbusement date will be taken

Second Relief: Now suppose you Pay your EMI on 15th, Some banks were taking interest of full month, instead of remaining period of Loan Outstanding. Again new RBI guidelines have said that interest will be calculated on remaining period of Loan Outstanding.

And the last relief is, now banks cannot collect advance installments, but were charging interest on full loan amount. These non-standard practices, have to be stopped now, as per the RBIs instruction.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"