CA Pratibha Goyal | Feb 10, 2024 |

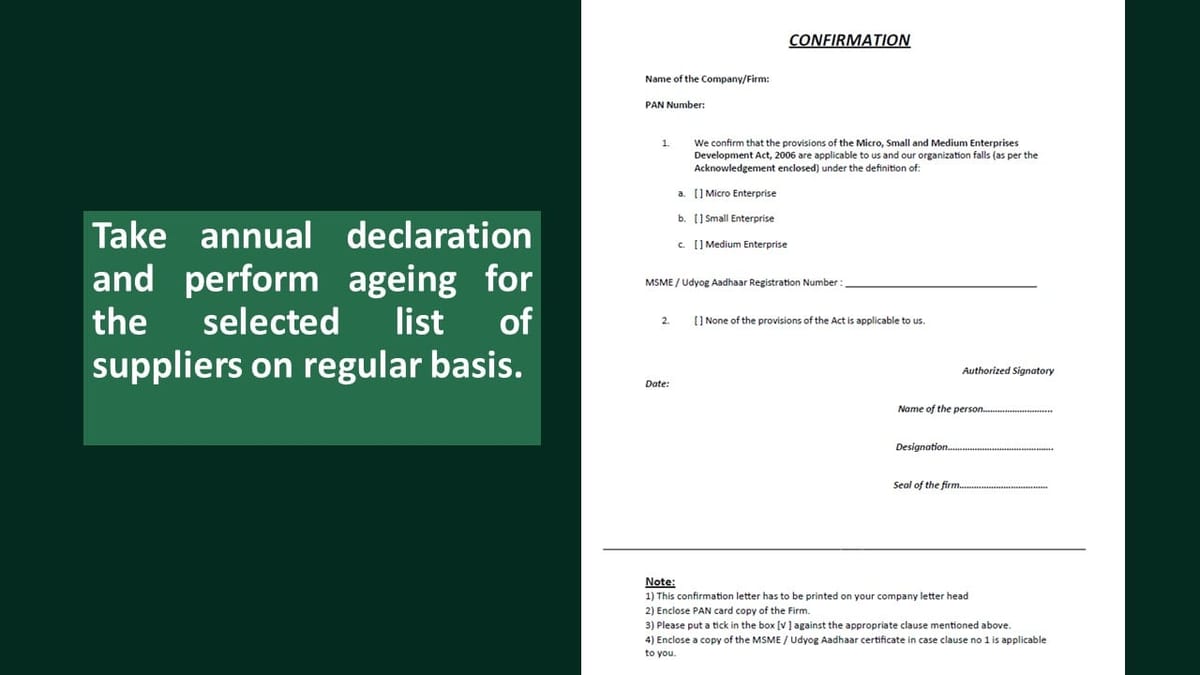

Format for Seeking confirmation of MSME Registration for applicability of Section 43B(h)

Hello friends, as we all know that with effect from 1st April 2024 Section 43B(h) would come into Ambit. Click here to know more about Applicability of Section 43B(h).

Here is Format for Seeking confirmation of SME Registration for applicability of Income Tax Section 43B(h). Hope you find the same helpful.

CONFIRMATION (Letter Head of SME)

Name of the Company/Firm:

PAN Number:

1. We confirm that the provisions of the Micro, Small and Medium Enterprises Development Act, 2006 (MSME) are applicable to us and our organization falls (as per the Acknowledgement enclosed) under the definition of:

a. [ ] Micro Enterprise

b. [ ] Small Enterprise

c. [ ] Medium Enterprise

MSME / Udyog Aadhaar Registration Number : _____________________________________

2. [ ] None of the provisions of the Act is applicable to us.

Authorized Signatory

Date:

Name of the person……………………….

Designation…………………………………….

Seal of the firm………………………………

Note:

1) This confirmation letter has to be printed on your company letter head

2) Enclose PAN card copy of the Firm.

3) Please put a Tick in the box [√ ] against the appropriate clause mentioned above.

4) Enclose a copy of the MSME / Udyog Aadhaar certificate in case clause no 1 is applicable to you.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"