The major thread of the Income-tax portal, the Income-tax utility and the portal are not giving the benefit of Rebate U/S 87A.

Reetu | Jul 15, 2024 |

Income Tax Portal not giving benefits of Rebate U/S 87A: Know the Whole Story

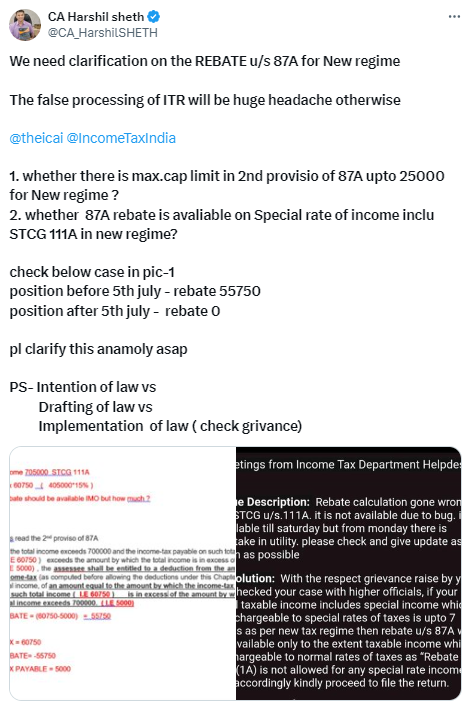

Currently, a major issue is going on the Income tax portal, as the Income-tax utility and portal are not giving the benefit of Rebate u/s 87A for Short Term Capital Gain (STCG) STCG u/s 111A and Special Incomes under the New Tax Regime.

On 5th July, ITR online utility was updated, and after the update the utility stopped giving benefit of Section 87A rebate for STCG u/s 111A and other special rate income. Before 5th July, IT Utility and Calculator were allowing 87A rebate against STCG u/s 111A and other special rate incomes other than Long Term Capital Gain (LTCG) u/s 112A where such rebate is specifically barred by Section 112A itself.

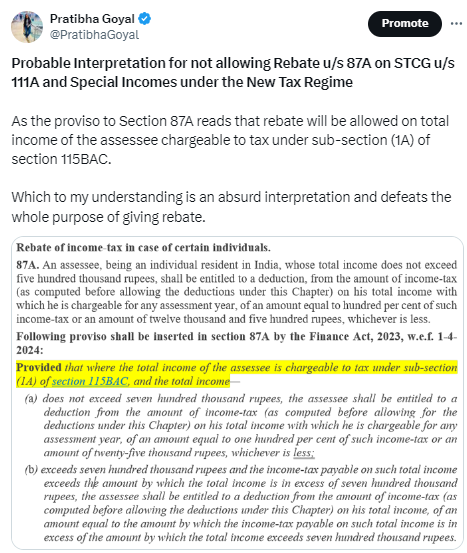

CA Pratibha Goyal, wrote on her Twitter handle that “The proviso to Section 87A reads that rebate will be allowed on total income of the assessee chargeable to tax under sub-section (1A) of section 115BAC. May be that’s the Probable Interpretation of Department for not allowing Rebate u/s 87A on STCG u/s 111A and Special Incomes under the New Tax Regime. As per her it is an absurd interpretation and defeats the whole purpose of giving rebate.”

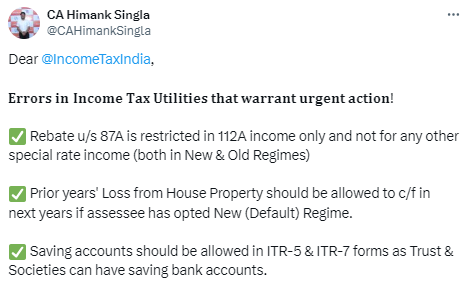

There are other Errors in Income Tax Utilities as well. CA Himank Singla wrote “𝐄𝐫𝐫𝐨𝐫𝐬 𝐢𝐧 𝐈𝐧𝐜𝐨𝐦𝐞 𝐓𝐚𝐱 𝐔𝐭𝐢𝐥𝐢𝐭𝐢𝐞𝐬 𝐭𝐡𝐚𝐭 𝐰𝐚𝐫𝐫𝐚𝐧𝐭 𝐮𝐫𝐠𝐞𝐧𝐭 𝐚𝐜𝐭𝐢𝐨𝐧! Rebate u/s 87A is restricted in 112A income only and not for any other special rate income (both in New & Old Regimes) Prior years’ Loss from House Property should be allowed to c/f in next years if assessee has opted New (Default) Regime. Saving accounts should be allowed in ITR-5 & ITR-7 forms as Trust & Societies can have saving bank accounts.”

CA Abhas Halakhandi has written a Mega Thread Ongoing major issue in Income tax Utility & Portal regarding Rebate u/s 87A. Here is the link to access the Thread.

CA Harshil Seth wrote: We need clarification on the REBATE u/s 87A for the New regime. The false processing of ITR will be a huge headache otherwise.

What is your opinion? Should Rebate U/S 87A be allowed in this case or not?

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"