Vanshika verma | Oct 21, 2025 |

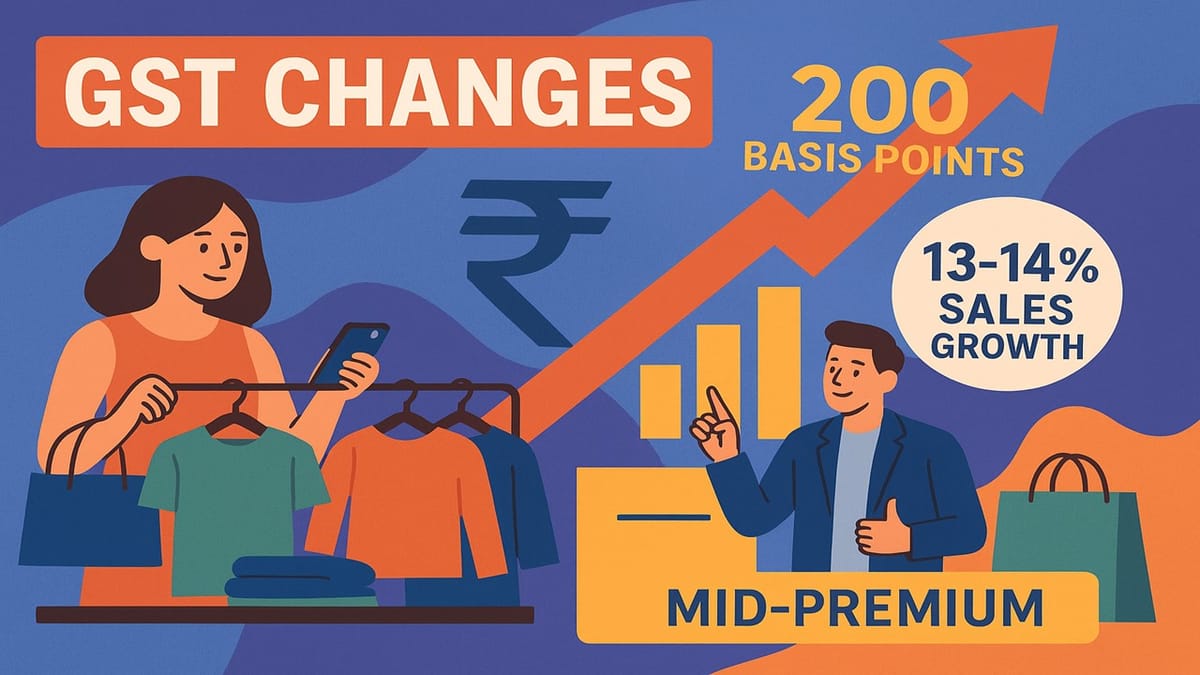

GST Shift Fuels 13-14% Growth in Organised Apparel Retail

The latest GST changes are expected to boost revenue growth for organised apparel retailers by around 200 basis points this financial year. This will help keep overall sales growth steady at 13-14% for the second year in a row, as per the reports.

The report explains that the GST cut on clothes priced below Rs. 2,500 is likely to increase demand, especially in the mid-premium category. Meanwhile, the fast fashion and value segments are expected to keep driving strong sales.

While the GST relief is limited, it comes at the right time to support ongoing growth. The shift to a flat 5% GST rate replacing the earlier two-tier system of 5% for clothes under Rs. 1,000 and 12% for those between Rs. 1,000 and Rs. 2,500 has also helped expand the consumer base.

The increase in GST on apparel priced above Rs. 2,500 from 12% to 18% has impacted sales in the premium segment, a report noted. This includes categories like wedding wear, woollens, handlooms, and embroidered clothing, which are now seeing slower demand due to the higher tax burden.

One of the senior directors of a company added that “Extending the 5 per cent GST slab to apparel priced up to Rs 2,500 boosts price competitiveness across the fast-fashion or value and mid-premium segments, whose customers are price-sensitive. With the timing of the GST rate cut coinciding with the festive season, demand should increase as middle-class spending picks up.” and the director further said, “Apparel retailers with a higher share of premium sales may choose to absorb part of the GST hike to sustain demand during the ongoing festive and wedding season, when buying activity is buoyant. However, lower cotton prices and the reduction of GST on synthetic fibres and yarn, from 18 per cent and 12 per cent to a uniform 5 per cent, will ease input costs.”

Overall, the GST changes show that the government wants to support formal retail and boost overall consumer spending. In the short term, this move is likely to help brands that focus on price–sensitive buyers. Over time, it could also shape how retailers plan their product ranges and set prices in the apparel industry.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"