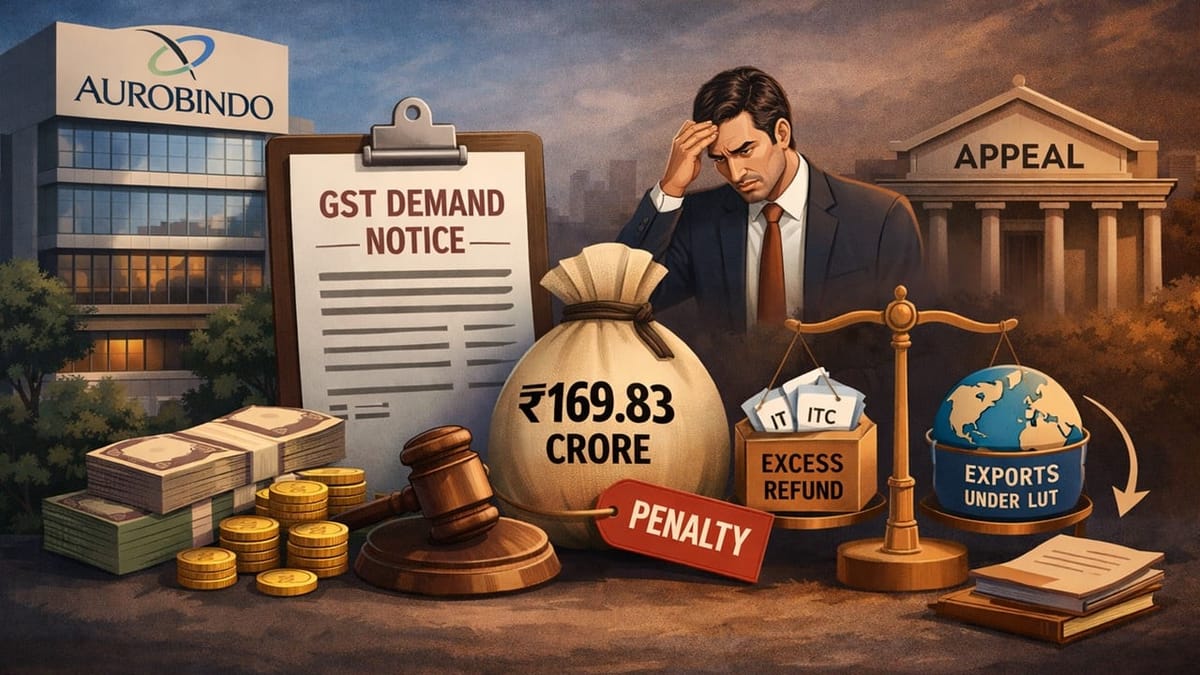

Aurobindo Pharma has received a Rs.169.83 crore GST demand, including penalty, over an alleged excess refund of accumulated ITC for exports made under LUT.

Saloni Kumari | Feb 20, 2026 |

Aurobindo Pharma Faces Rs.169.83 Crore GST Demand Over Alleged Excess ITC Refund; Plans to Challenge

Aurobindo Pharma has recently disclosed in its regulatory filing dated February 19, 2026, addressed to the stock exchange, that it has received a huge tax demand amounting to Rs. 169.83 crore imposed by the Goods and Services Tax (GST) Department on the accounts of alleged false refunds of accumulated input tax credit (ITC) under Rule 89 of the CGST Rules for the period September 2022 to December 2022.

The total tax demand of Rs. 169.83 crore includes Rs. 84.91 crore towards GST and an equivalent penalty of Rs. 84.91 crore. As per the company, it had received the order on February 18, 2026. The Additional Commissioner of Central Tax, Ranga Reddy GST Commissionerate, Hyderabad, Telangana, has passed the disputed tax demand order under relevant provisions of the Central Goods and Services Tax (CGST) Act, 2017.

As per the disclosure, the issue is regarding refund claims made by the company’s EOU Unit 3. This unit had built up Input Tax Credit (ITC) because it exported goods without paying tax, using a Letter of Undertaking (LUT). Now, the company is asking the government to refund the accumulated ITC amount.

Earlier, the department approved the refund to the company after verifying the documents and relying on the company’s statement that the unit had not sold the exported goods in India. Later, the department itself challenged the refund-approved orders before the Additional Commissioner (Appeals) in Hyderabad, arguing that similar products were being sold in the Indian market and that, while calculating the refund amount, the officer did not consider the value of such goods sold domestically.

In 2023, the appellate authority ruled in favour of the GST department. Thereafter, the company filed writ petitions before the Telangana High Court, objecting to the same appellate order. The matter has not been decided yet and is currently pending. To support its claims, the company has cited an earlier ruling of the Karnataka High Court in the case of Tonbo Imaging India Pvt. Ltd. (Writ Petition No. 13185 of 2020, decided on February 16, 2023).

The company now plans to appeal before the Commissioner of Central Tax (Appeals), Hyderabad, since the department has confirmed the aforesaid demand along with interest. The company further said that the present action has no impact on its financial operations.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"