Vanshika verma | Nov 15, 2025 |

Annual GST Compliance: Applicability of GSTR-9 and GSTR-9C

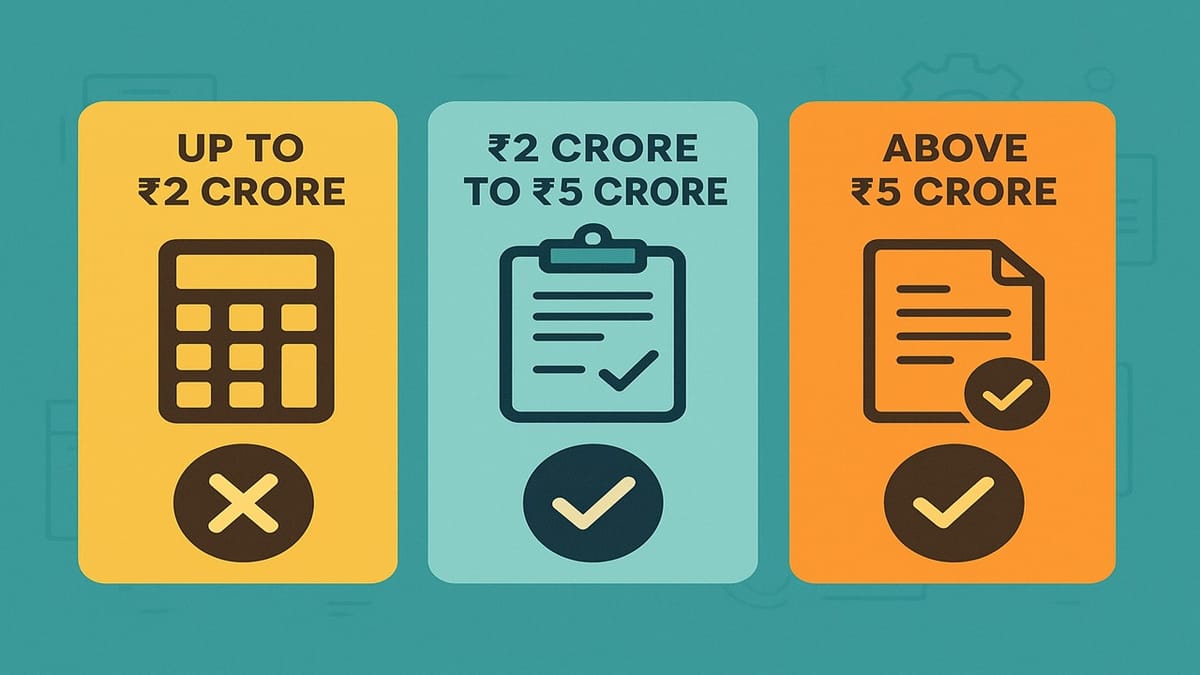

GSTR-9 is an annual return to be filed by all regular GST–registered taxpayers, while GSTR-9C is a reconciliation statement that must be filed by registered taxpayers whose aggregate annual turnover exceeds a specified limit in a financial year.

The deadline for filing GSTR-9 and GSTR-9C for F.Y. 2024-25 is December 31, 2025. Failure to file GSTR-9 and GSTR-9C attracts specific late fees for GSTR-9 and a general penalty for GSTR-9C, along with other potential consequences like interest and scrutiny.

Aggregate Annual Turnover Limit

Following are the aggregate annual turnover limits:

According to Section 2(6) of the CGST Act, 2017, Aggregate Turnover includes:

However, it excludes the value of CGST, SGST, UTGST, IGST, and Cess.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"