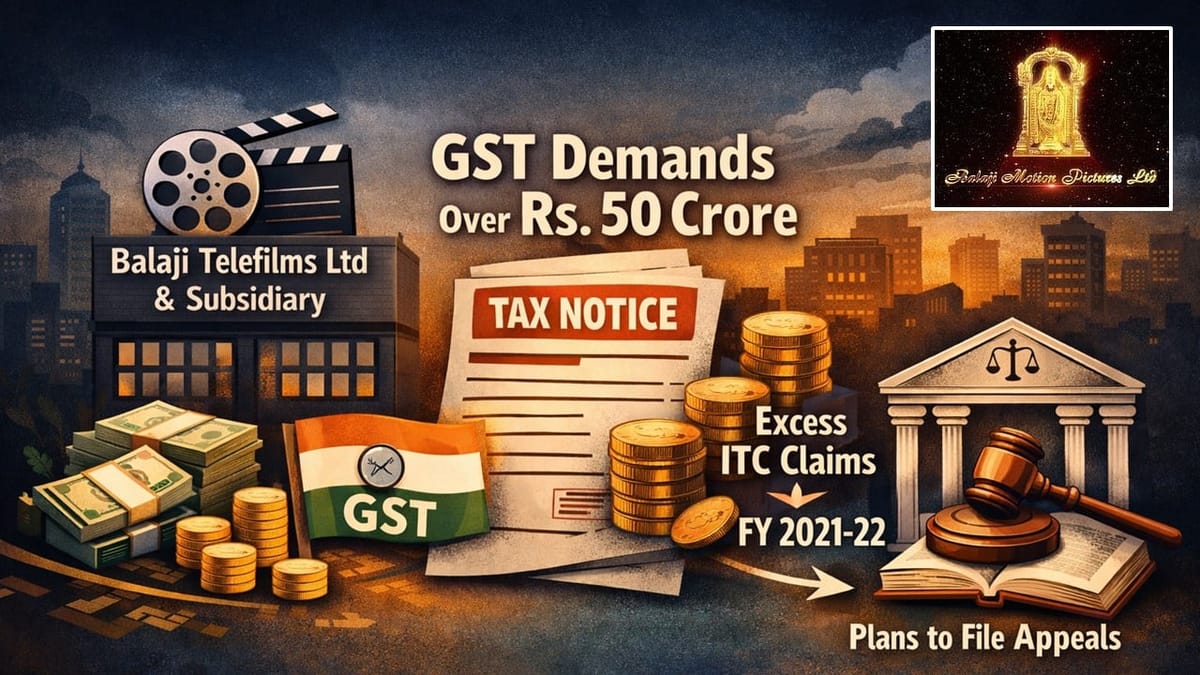

Balaji Telefilms Limited and its subsidiary disclosed GST demands exceeding Rs. 50 crore on alleged excess ITC claims for FY 2021-22, and plans to file appeals.

Saloni Kumari | Feb 14, 2026 |

Balaji Telefilms and Its Subsidiary Faces Rs. 50.62 Crores GST Demand; Plan to Appeal Before Appellate Authority

Balaji Telefilms Limited has filed a regulatory filing dated February 13, 2026, addressed to the BSE Limited and National Stock Exchange of India Limited, disclosing that it had received an order dated December 17, 2025, in Form GST DRC-07 issued by the Deputy Commissioner of State Tax, Malad West, Mumbai, under Section 73(9) of the CGST/MGST Act, 2017. The order pertained to the financial year 2021-22.

The said order had raised a demand amounting to Rs. 32.58 Crores (comprising a tax of Rs. 16.93 Crores, interest of Rs. 13.96 Crores, and a penalty of Rs. 1.69 Crores) on the company on the grounds of alleged ineligible/excess Input Tax Credit (ITC).

The erstwhile subsidiary of the disputed company, M/s. ALT Digital Media Entertainment Limited, which was merged with the company on June 20, 2025, also received a similar order dated December 09, 2025, from the Deputy Commissioner of State Tax, Vile Parle East, Mumbai, raising demand amounting to Rs. 18.04 Crores (comprising tax of Rs. 9.54 Crores, interest of Rs. 7.22 Crores, and penalty of Rs. 1.28 Crores) for the Financial Year 2021-22.

The company has claimed that the aforesaid demands are not justified as per the law, in respect to the retrospective amendment to Section 16(2)(c) of the CGST Act by the Finance Act, 2024, and because it has properly met all conditions required to claim Input Tax Credit (ITC).

The company further disclosed that a large part of the demand belongs to last year’s ITC, which the company says was claimed correctly within the statutory time limit. Presently, the company is in the process of filing appeals before the Appellate Authority within the allowed time limit under Section 107 of the CGST/MGST Act, 2017.

The required pre-deposit amount will be paid using the company’s available ITC balance, so no cash payment will be needed. The company also states that these orders do not have any material impact on its financial, operational, or other activities.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"