A state-wise inspection revealed that Karnataka had the most deleted transactions, worth Rs 2,000 crore, followed by Telangana with Rs 1,500 crore.

Nidhi | Feb 20, 2026 |

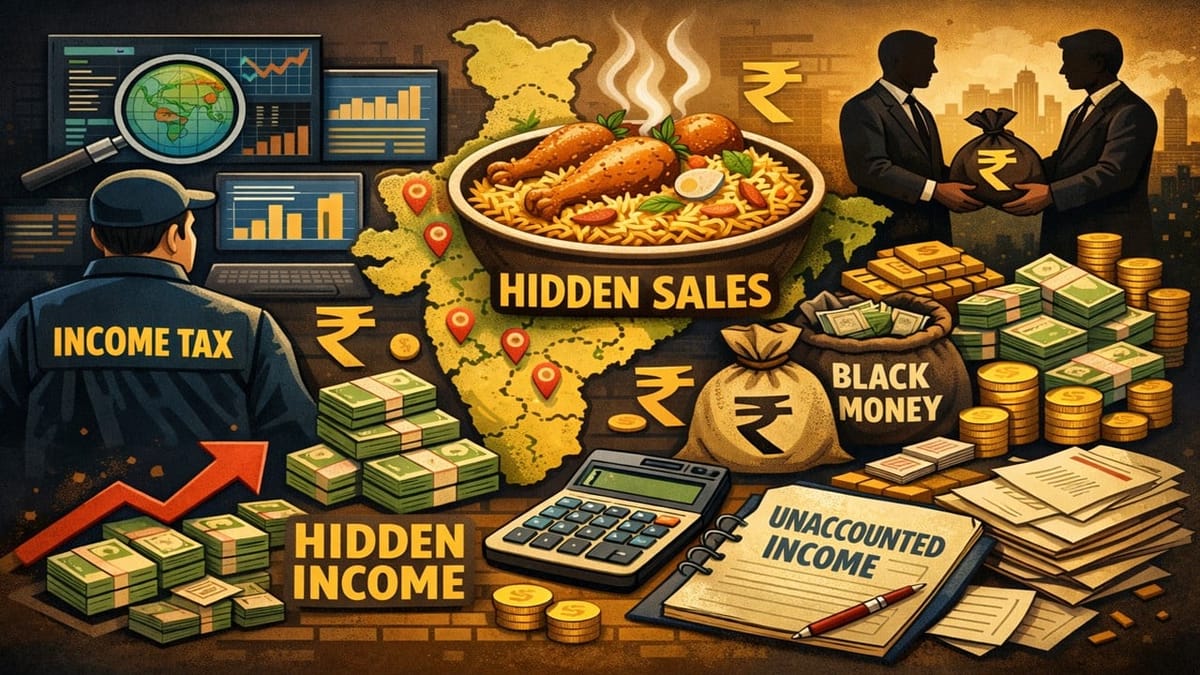

Biryani Billing Scam: I-T Dept Detects Rs 70,000 Crore Hidden Sales Across India

A normal inspection by the Income Tax Department of a few biryani restaurants in Hyderabad led to the discovery of Rs 70,000 crore in hidden sales across India.

The investigation uncovered widespread manipulation of restaurant billing software that helped them under-report their income and evade taxes.

Initially, the investigators did not find anything suspicious during the inspection of biryani restaurants. However, later, it was noticed that the diners inside the restaurants were far higher than the figures mentioned on the billing software. They further noted that all these restaurants had the same billing software. Now this seemed suspicious to the I-T officials.

The officials started tracing the deletion pattern back to the software provider’s backend in Ahmedabad. Surprisingly, they accessed around 60 terabytes of billing information from over one lakh restaurants across the country.

The specialist at the tax department’s digital lab in Hyderabad started rebuilding the deleted invoices. They discovered that even if a bill was removed from the system, every transaction still left small digital traces behind. With the help of Artificial Intelligence (AI) tools, the specialist read these traces and rebuilt the missing pieces. They found bills worth around Rs 2.43 lakh crore were generated by the restaurants during 6 years.

Even though the restaurants deleted the bills, the system still left some marks for the investigators to examine.

The team uncovered that out of Rs 70,000 crore, the post-billing deletions totalled Rs 13,317 crore. This is one of India’s biggest restaurant billing scams.

The investigation also found that there were mismatches between raw material purchases and the sales figures reported on the delivery platform and GST filings. The number of plates sold by the outlets was far higher than the reported sales in the returns.

Since Biryani is a high-selling food item in Hyderabad, Bengaluru, and Chennai, even a small suppression per bill can turn into a large-scale tax evasion.

A state-wise inspection revealed that Karnataka had the most deleted transactions worth Rs 2,000 crore, followed by Telangana with Rs 1,500 crore. The CBDT has expanded the investigations to other states as well.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"