CA Pratibha Goyal | Dec 27, 2022 |

CBIC notifies Manner of dealing with difference in liability reported in GSTR-1 and GSTR-3B

CBIC has notified new rule, 88C wherein the board has notified the manner of dealing with difference in liability reported in the statement of outward supplies (Form GSTR-1) and that reported in return (Form GSTR-3B).

Further, the person who has received intimation under rule 88C will not be allowed to furnish the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1 or using the invoice furnishing facility for a subsequent tax period, unless he has either deposited the amount specified in the said intimation or has furnished a reply explaining the reasons for any amount remaining unpaid, as required under the provisions of sub-rule (2) of rule 88C.

88C. Manner of dealing with difference in liability reported in statement of outward supplies and that reported in return.

(1) Where the tax payable by a registered person, in accordance with the statement of outward supplies furnished by him in FORM GSTR-1 or using the Invoice Furnishing Facility in respect of a tax period, exceeds the amount of tax payable by such person in accordance with the return for that period furnished by him in FORM GSTR-3B, by such amount and such percentage, as may be recommended by the Council, the said registered person shall be intimated of such difference in Part A of FORM GST DRC-01B, electronically on the common portal, and a copy of such intimation shall also be sent to his e-mail address provided at the time of registration or as amended from time to time, highlighting the said difference and directing him to—

(a) pay the differential tax liability, along with interest under section 50, through FORM GST DRC- 03; or

(b) explain the aforesaid difference in tax payable on the common portal, within a period of seven days.

(2) The registered person referred to sub-rule (1) shall, upon receipt of the intimation referred to in that sub- rule, either,-

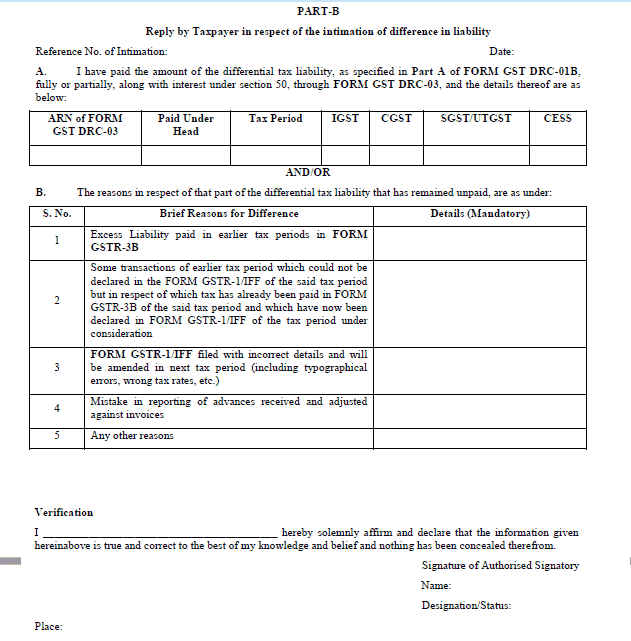

(a) pay the amount of the differential tax liability, as specified in Part A of FORM GST DRC-01B, fully or partially, along with interest under section 50, through FORM GST DRC-03 and furnish the details thereof in Part B of FORM GST DRC-01B electronically on the common portal; or

(b) furnish a reply electronically on the common portal, incorporating reasons in respect of that part of the differential tax liability that has remained unpaid, if any, in Part B of FORM GST DRC-01B, within the period specified in the said sub-rule.

(3) Where any amount specified in the intimation referred to in sub-rule (1) remains unpaid within the period specified in that sub-rule and where no explanation or reason is furnished by the registered person in default or where the explanation or reason furnished by such person is not found to be acceptable by the proper officer, the said amount shall be recoverable in accordance with the provisions of section 79.

CBIC has also notified new form GST DRC-01B for sending the intimation:

Part-B for sending a reply by Taxpayer in respect of the intimation of difference in liability:

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"