CA Pratibha Goyal | Dec 15, 2023 |

GST Portal Glitch of non-population of ITC in GSTR-3B now resolved

GST return fillers were facing a technical issue with the filing of Form GSTR-3B. The input tax credit (ITC) related data was not getting auto-populated in Form GSTR 3B.

GST Glitch: ITC data not getting auto-populated in GSTR 3B

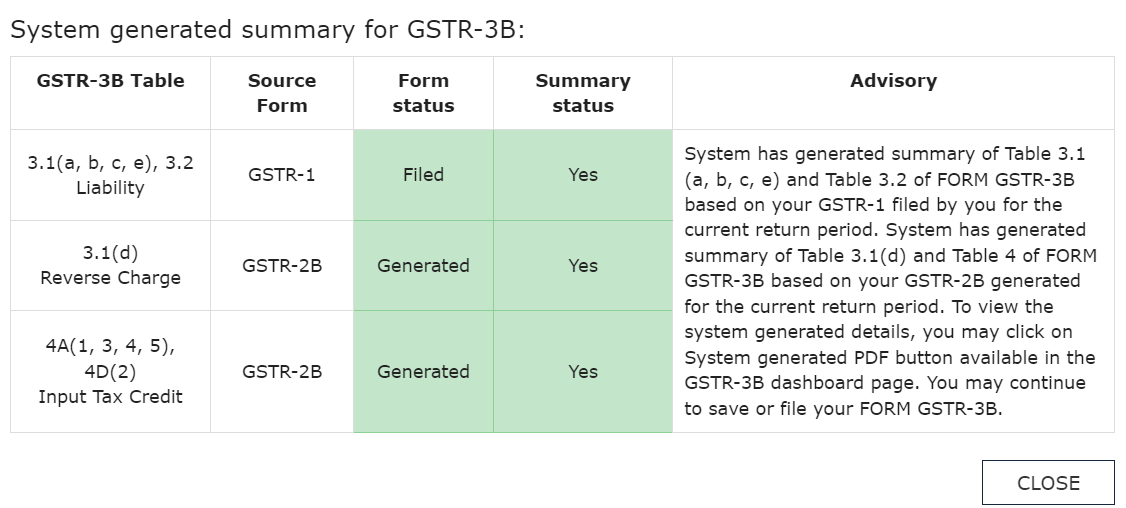

For November, Form GSTR-2B has been generated, but the same is not getting auto-populated in Form GSTR 3B.

We are happy to inform the GST fillers that this issue is now resolved from the GST portal‘s end. The Due Date for filing Form GSTR-3B for the month of November 2023 is 20th December 2023.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"