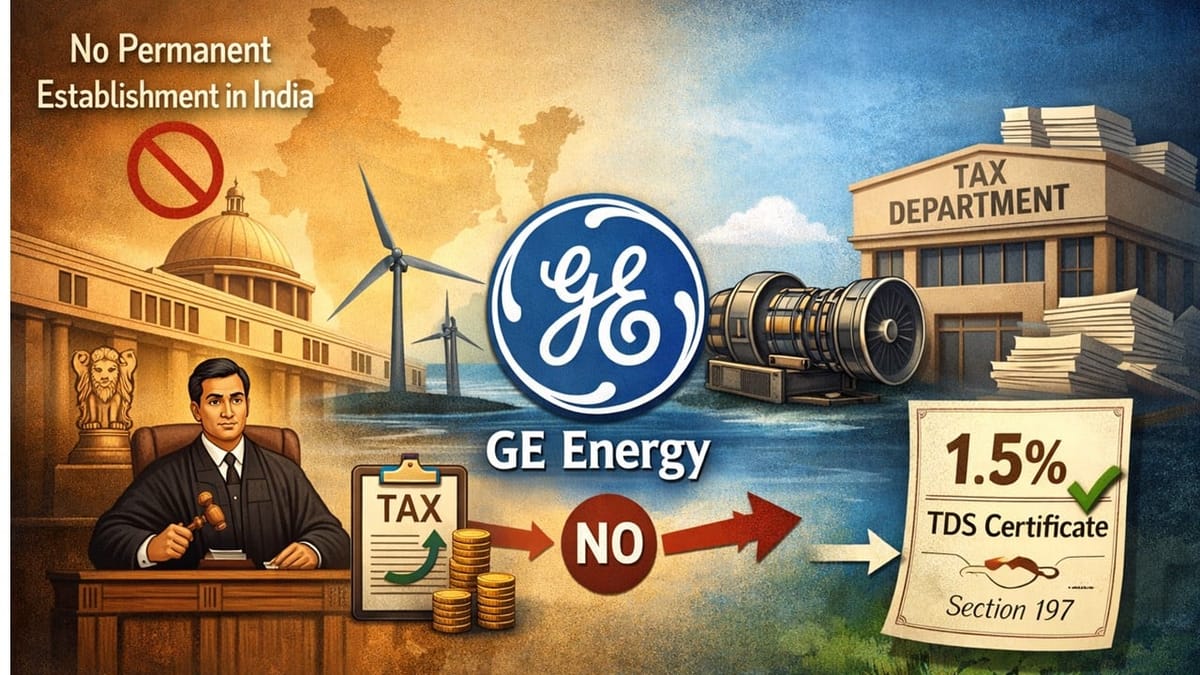

HC ruled that in the absence of a PE in India, taxpayers cannot be subjected to higher TDS and directed the tax department to issue a 1.5% TDS certificate under Section 197.

Saloni Kumari | Jan 9, 2026 |

HC Holds Certificate Imposing Higher TDS Rate at 3.5% Unjustified Without Permanent Establishment

Delhi High Court held that companies had no PE in India as the ITAT quashed earlier findings. Hence, higher 3.5% TDS was unjustified. Court ordered fresh Section 197 certificate at 1.5%, with higher TDS only if new PE evidence arises.

GE Energy Parts Inc. and GE Global Parts and Products GMBH have filed the writ petitions in the Delhi High Court; both revolve around similar issues. Both the petitioners are foreign companies engaged in the business of supplying gas turbines and spare parts.

The petitioner company claimed that it does not possess any Permanent Establishment (PE) in India. As the petitioner does not earn any income in India, no tax at source can be deducted from the payments made to it, and they sought a certificate under Section 197 of the Income Tax Act, 1961, to allow TDS at a lower rate.

Previously, the Income Tax Department had issued certificates allowing TDS at 1.5%; however, for the year in consideration, i.e., AY 2025-26, a certificate was issued requiring 3.5% TDS payable. The petitioner challenged the claim of the Income Tax Department that they have a PE in India. However, the tax department argued that PE was indeed found during the year AY 2022-23, which is liable for a higher rate of TDS.

When the court analysed the arguments of both sides, it noted that ITAT had already quashed the tax department’s findings that the petitioner had PE in AY 2022-23. Therefore, the only reason claimed by the Income Tax Department for a higher TDS rate of 3.5% no longer existed. Hence, the court quashed the certification dated May 16, 2025, and directed the tax department to issue a fresh certification permitting a TDS rate of 1.5% and gave a time period of 15 days for the same.

The Court also clarified that for future years, certificates should continue to be issued at 1.5% unless there is new evidence proving the existence of a PE. If the department finds a PE in the future, it must issue a notice to the company, and only if the company cannot prove otherwise can a higher TDS rate be applied. The petitioners’ right to challenge any such future order is reserved. Both writ petitions were allowed, and all pending applications were disposed of.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"