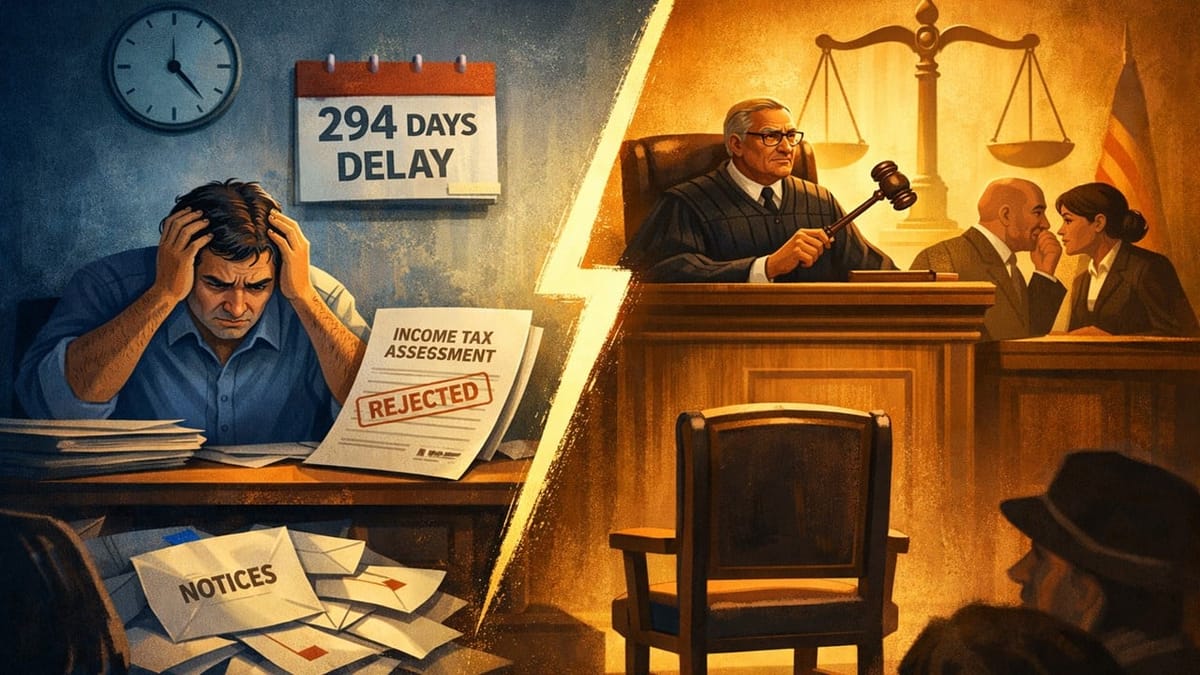

The ITAT condoned a 294-day delay, finding that the assessee was not given a proper hearing due to the non-service of notices, a violation of the principles of natural justice.

Saloni Kumari | Dec 30, 2025 |

ITAT Condones 294-Day Delay, Sets Aside CIT(A) Order for Violation of Natural Justice

The present appeal has been filed by a taxpayer named Shri Kiran Kumar Soma in the ITAT Hyderabad, challenging an order dated December 29, 2023, passed by the CIT(A)/NFAC. The case is related to the Assessment Year 2014-15.

The current appeal in the Tribunal was delayed by 294 days. The assessee explained that while furnishing Form No. 35 before the CIT(A), the assessee clearly refused to receive notices through emails and provided his physical address for delivery notices. However, the CIT(A) sent all the notices via email and did not serve even a single notice at the given address. As a result, the assessee was not aware of the appellate proceedings and the final order. He only came to notice when the authority directly contacted him for the recovery of tax dues in November 2024. Thereafter, he immediately filed an appeal before the ITAT Hyderabad.

The tribunal found the reason explained by the assessee as genuine and not intentional after verifying each detail in depth, hence condoned the 294-day delay and accepted the appeal.

The assessee claimed that CIT(A) had erroneously decided the appeal without properly giving him the opportunity of a hearing. Additionally, he challenged the addition made by the AO, who assessed his total income at Rs. 7.05 crore. He further argued that the actual price of the property purchased by him was just Rs. 2 crore due to defects in the title, and that even this amount was properly disclosed, so no additional amount should have been added.

The tribunal noted that since the notices were never received by the assessee, the CIT(A)’s final order was issued without hearing the assessee. Hence, it is a contravention of the principles of natural justice. Therefore, the tribunal set aside the impugned order and remanded the case to CIT(A) for fresh consideration. Directed the CIT(A) to give the assessee a proper opportunity of hearing and allow the assessee to furnish all necessary documents or evidence. Finally, the appeal was allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"