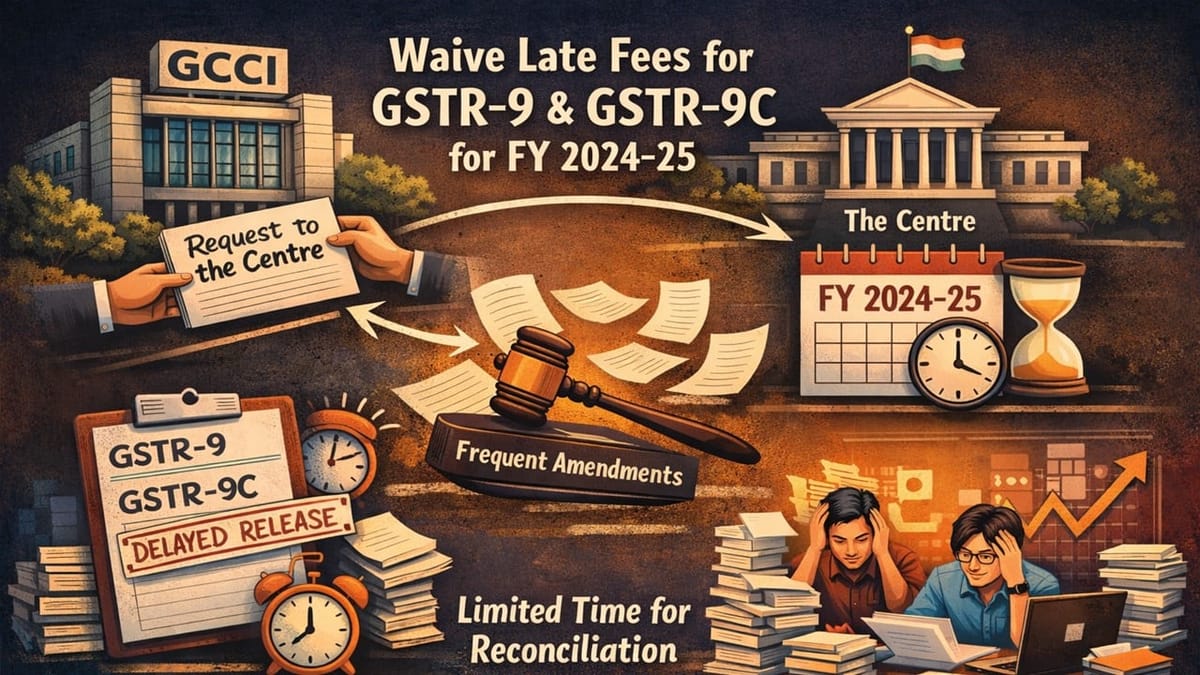

GCCI requests the Centre to waive late fees for GSTR-9 and GSTR-9C for FY 2024-25 due to the delayed release of forms, frequent amendments, and limited time for reconciliation.

Saloni Kumari | Dec 30, 2025 |

GCCI Urges Finance Minister to Waive Late Fees for GSTR-9 and 9C Filing for FY 2024-25 until Jan 31

The Goa Chamber of Commerce and Industry (GCCI) has urged the Union Finance Minister of India, Nirmala Sitharaman, to remove the late fee for filing the GST annual return (GSTR-9) and the reconciliation statement (GSTR-9C) for the Financial Year 2024-25 (Assessment Year 2025-26) till January 31, 2026, highlighting the fact that this FY, annual forms were released late with key amendments in them.

The Director General of GCCI, in a formal representation to the Finance Minister, said, “The forms were made available on the GST portal only on Oct 15. These structural changes, particularly in input tax credit (ITC) reporting and multiple disclosure requirements, have significantly reduced the time available for taxpayers to complete the comprehensive reconciliations.”

Form GSTR-9 is filed by taxpayers having a turnover exceeding Rs. 2 crore to ensure the details mentioned in annual GST returns align with those listed in the audited books of accounts. Each day succeeding the due date is imposed with a late fee of Rs. 200 per day.

In the representation, the GCCI also emphasised that until November 30, 2025, the Central Board of Indirect Taxes and Customs (CBIC) had introduced continuous amendments in the auto-populated ITC data because of late invoice reporting by vendors, and this was the due date for reporting invoices for the Financial Year 2024-25.

The authority further highlighted that the GST reforms made effective from September 22, 2025, introduced key amendments to the tax rates and compliance process, which further raised the need for revisions, ultimately affecting the due dates.

The GCCI stated, “Accurate preparation of GSTR-9 and GSTR-9C requires reconciliation with audited financial statements and tax audit reports. With audits and related compliances extending into Nov and Dec for many taxpayers, the effective window for finalising GST filings has been shortened.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"