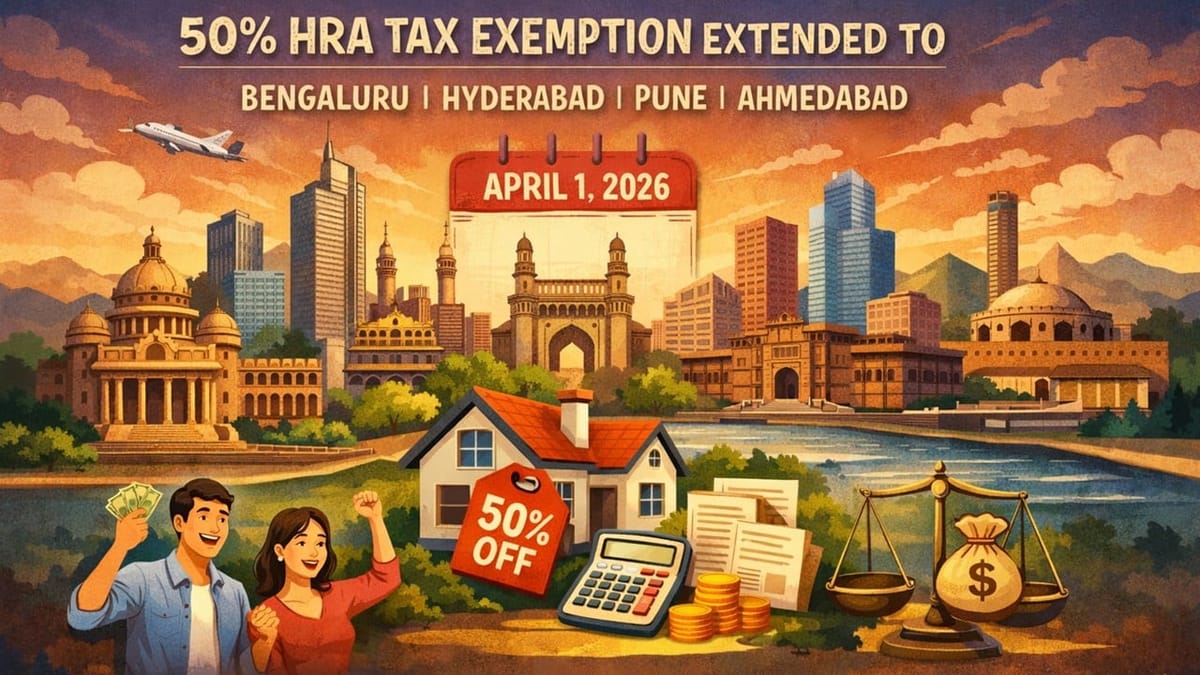

The government proposes extending the 50% HRA tax exemption to Bengaluru, Hyderabad, Pune, and Ahmedabad from April 1, 2026, under the new income tax rules 2026.

Saloni Kumari | Feb 19, 2026 |

Major Relief to Salaried Employees: HRA Exemption Set to Rise to 50% for Four More Cities; Effective April 1, 2026

According to the draft Income Tax Rules 2026, scheduled to take effect from April 01, 2026, the government is planning to extend the ambit of higher HRA tax exemption under the old income-tax regime by adding two more cities to the existing list. If the change takes effect, it will bring significant relief to the salaried employees.

Presently, a higher 50% HRA exemption limit is only allowed to the salaried employees working in four cities: Mumbai, Delhi, Kolkata, and Chennai. While those in cities other than these are permitted for the 40% HRA exemption limit. Now, the government has proposed to extend this list by adding four more cities to it, including Bengaluru, Hyderabad, Pune, and Ahmedabad.

The proposal forms part of a broader effort to modernise tax provisions and align them with current urban demographics, where several fast-growing cities now face residential costs comparable to traditional metros. By recognising these economic shifts, the government aims to provide more realistic tax relief to salaried individuals dealing with increasing rental expenses.

The change is expected to be implemented on April 01, 2026.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"