Vanshika verma | Oct 24, 2025 |

New Banking Nomination Rules to Take Effect from November 1, 2025

The Ministry of Finance has announced new guidelines under the Banking Laws (Amendment) Act, 2025. These new rules aim to give depositors more flexibility and control when it comes to nominating beneficiaries for their bank deposit accounts, lockers, and assets kept in safe custody. The updated provisions will come into effect from November 1, 2025.

Starting November 1, 2025, new rules will come into effect about how people can nominate someone for their bank accounts, safe custody items, and locker contents. These updated regulations explain what happens to these assets if the account holder or locker owner passes away.

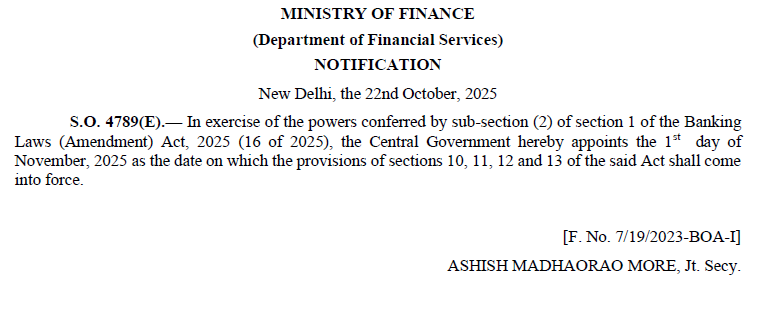

The Ministry of Finance said, “The Central Government has notified that the provisions contained in Sections 10, 11, 12 and 13 of the Banking Laws (Amendment) Act, 2025 will come into force with effect from 1st November 2025.” Finmin further stated, “The Banking Laws (Amendment) Act, 2025 was notified on 15th April 2025. It contains a total of 19 amendments across five legislations: the Reserve Bank of India Act, 1934; the Banking Regulation Act, 1949; the State Bank of India Act, 1955 and the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 and 1980.”

“The Banking Laws (Amendment) Act, 2025 aims, inter alia, to strengthen governance standards in the banking sector, ensure uniformity in reporting by banks to the Reserve Bank of India, enhance depositor and investor protection, improve audit quality in public sector banks, and promote customer convenience through improved nomination facilities. The Act also provides for rationalisation of the tenure of directors, other than the Chairman and whole-time directors, in co-operative banks,” the Ministry of Finance added.

Following are the key nomination related amendments that will come into effect from November 1, 2025:

Multiple nominations

In case of unforeseen events, customers can now nominate four people for their deposits either at once (simultaneous) or one after another (successive).

Nomination for deposit accounts

Depositors can select for either simultaneous or successive nomination as per their choice.

Nomination for articles in safe custody and safety lockers

For such facilities, only successive nominations are allowed.

Simultaneous nomination

Depositors can nominate up to four persons and specify the share or the percentage of entitlement for every nominee, ensuring that the total equals 100% and enabling transparent distribution amongst all nominees.

Successive nomination

Individuals maintaining deposits, articles in safe custody, or lockers may specify up to four nominees, where the next nominee becomes operative only upon the death of the nominee placed higher, ensuring continuity in settlement and the clarity of succession.

These new measures will let depositors choose their nominees as they prefer, while making the process the same, transparent, and efficient for everyone across all banks, the statement said.

To make sure all banks follow the same rules, the Banking Companies (Nomination) Rules, 2025 which will explain how to make, cancel, or change a nomination and what documents are needed, will be issued later.

Nomination in a deposit account is the facility where the account holder designates a person to receive the account’s funds upon their death. It simplifies the transfer of assets, saving the nominee from legal complications and lengthy procedures. The nominee acts as a trustee for the funds, distributing them to the rightful heirs, according to the account holder’s will or the law.

Designating a nominee: When opening an account, or at any time afterward, the account holder can name one or more individuals to be the beneficiary.

Receiving the funds: In the unfortunate event of the account holder’s death, the nominee can claim the funds by providing the bank with a valid death certificate and their identity proof.

Smooth asset transfer: This process bypasses the lengthy and complex legal procedures typically required to settle an estate, such as probate or getting a succession certificate.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"