ROC Coimbatore penalizes company for omission of CIN in annual reports under Companies Act, 2013.

Vanshika verma | Jan 15, 2026 |

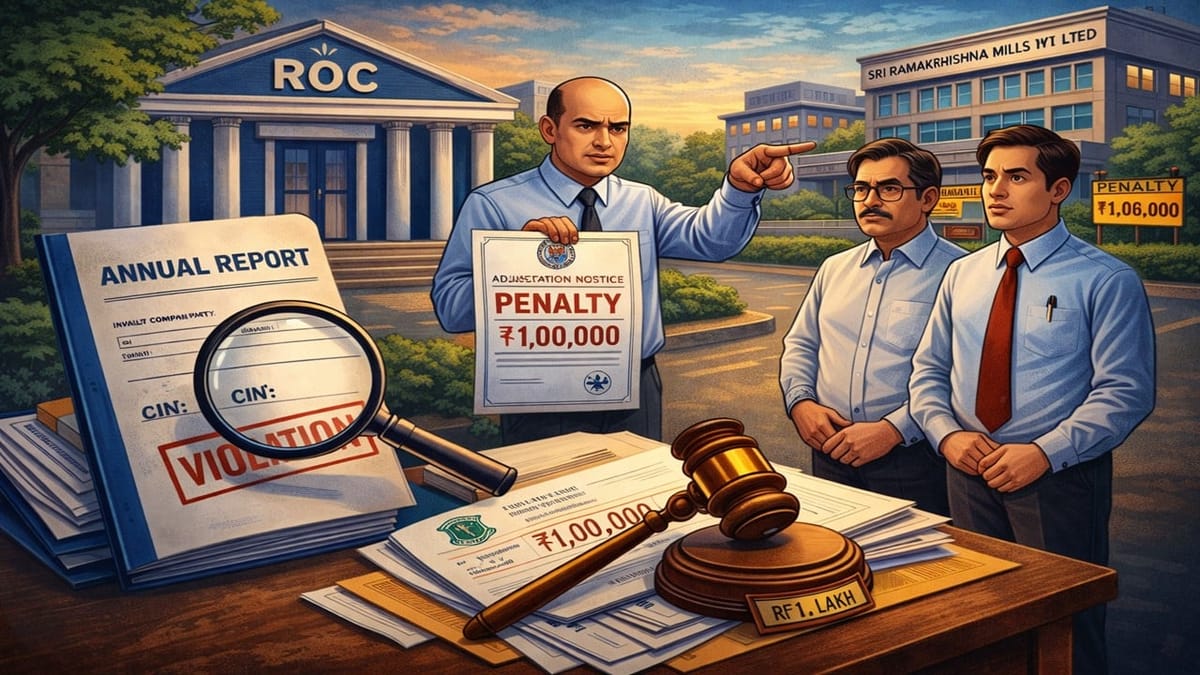

ROC Coimbatore Imposes Rs 1 Lakh Penalty for CIN Disclosure Violation

The Registrar of Companies (ROC) Coimbatore imposed a penalty of Rs 1.0 lakh on Sri Ramakrishna Mills Limited and all the officers for violating section 12 (8) of the Companies Act, 2013.

As per the law, a company must mention its Corporate Identification Number (CIN) on all official documents such as letterheads, notices, and publications. However, ROC noticed that the company’s annual reports for the financial years 2013-14 to 2022-23, which are circulated to shareholders, do not mention the CIN anywhere on the pages where the company’s address or details are shown.

ROC also issued an adjudication notice to the company asking for its explanation. In reply, the company and the officers in default stated that there is confusion about what qualifies as an “official publication” and claimed that, in their genuine belief, the company’s Annual Report does not fall under this category.

However, as per ROC, the explanation is not acceptable because an annual report is an official and authentic document that is circulated to thousands of shareholders and also shared with authorities such as stock exchanges. An e-hearing was scheduled. Later, at the company’s request, a physical hearing was conducted on January 12, 2026, after which the order was passed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"