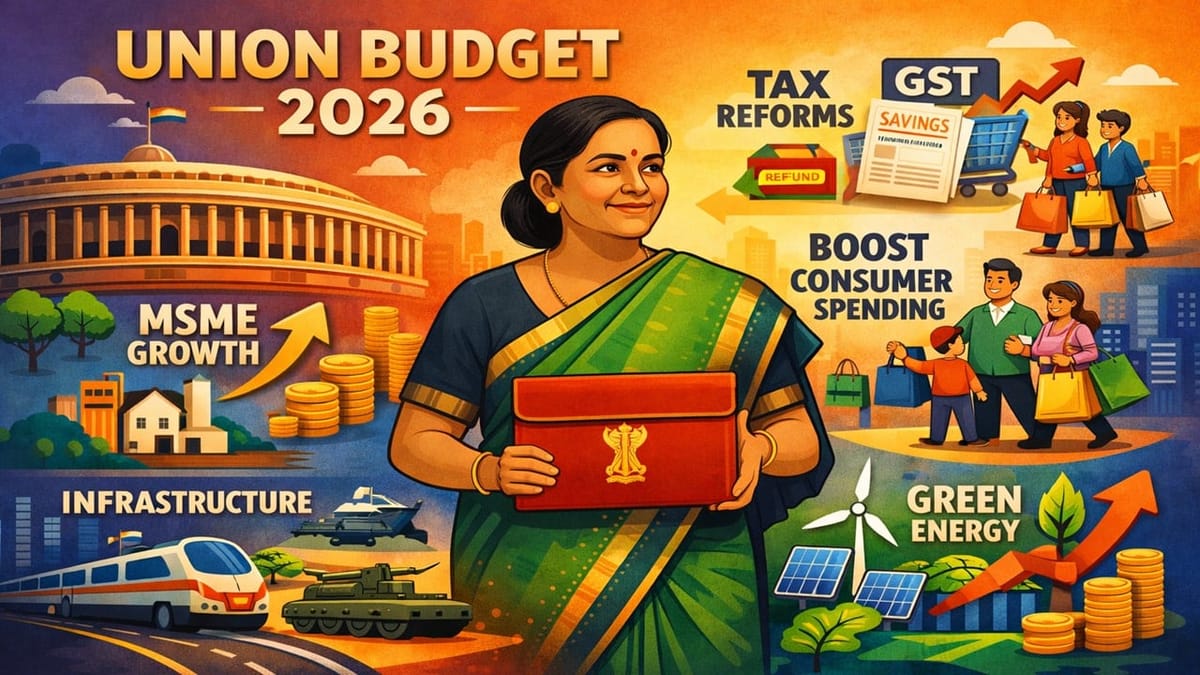

Union Budget 2026, to be presented by Finance Minister on Feb 1, will focus on boosting spending, infrastructure, MSME growth, defense & green energy reforms.

Vanshika verma | Jan 7, 2026 |

Union Budget 2026: Nirmala Sitharaman to Focus on Boosting Consumer Spending and MSME Growth

This year’s budget is expected to speed up refunds and make tax filing simpler. Last year, the government cut income tax so people could keep more of their earnings and simplified GST, which made some goods and services cheaper. Budget 2026 will likely continue these steps to encourage people to spend more, which in turn can help businesses grow and the economy become stronger. This will be Finance Minister Nirmala Sitharaman’s 9th time presenting the budget in Parliament.

The budget 2026 will focus on the following areas:

1. Fiscal and policy support

2. The defense sector increased.

3. Green transition and energy reforms, among others

4. MSME growth

5. Railway and infrastructure sector development

ASSOCHAM said that small and medium businesses (MSMEs) require urgent support from the government to create more employment and boost exports. It stressed that big companies should pay MSMEs on time, tax refunds should be processed faster, and special support should be given to industries like textiles, gems and jewelry, and seafood that are suffering due to sudden changes in tariffs.

Major Highlights of Budget 2025

In Budget 2025, the government introduced a new Income Tax Bill to make tax laws simpler and to reduce disputes and court cases. Under the new tax regime, an individual does not have to pay any income tax if their total income is up to Rs 12 lakh. For salaried people, this limit is slightly higher, up to Rs 12.75 lakh, because of standard deduction.

Union Budget 2026

The Union Budget 2026-27 is India’s annual financial statement and a blueprint for economic policy. This budget outlines the government’s estimated receipts and expenditures and introduces major reforms aimed at achieving the vision of a “Viksit Bharat.” It is expected that this year’s budget will be presented on February 1.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"