Vanshika verma | Nov 11, 2025 |

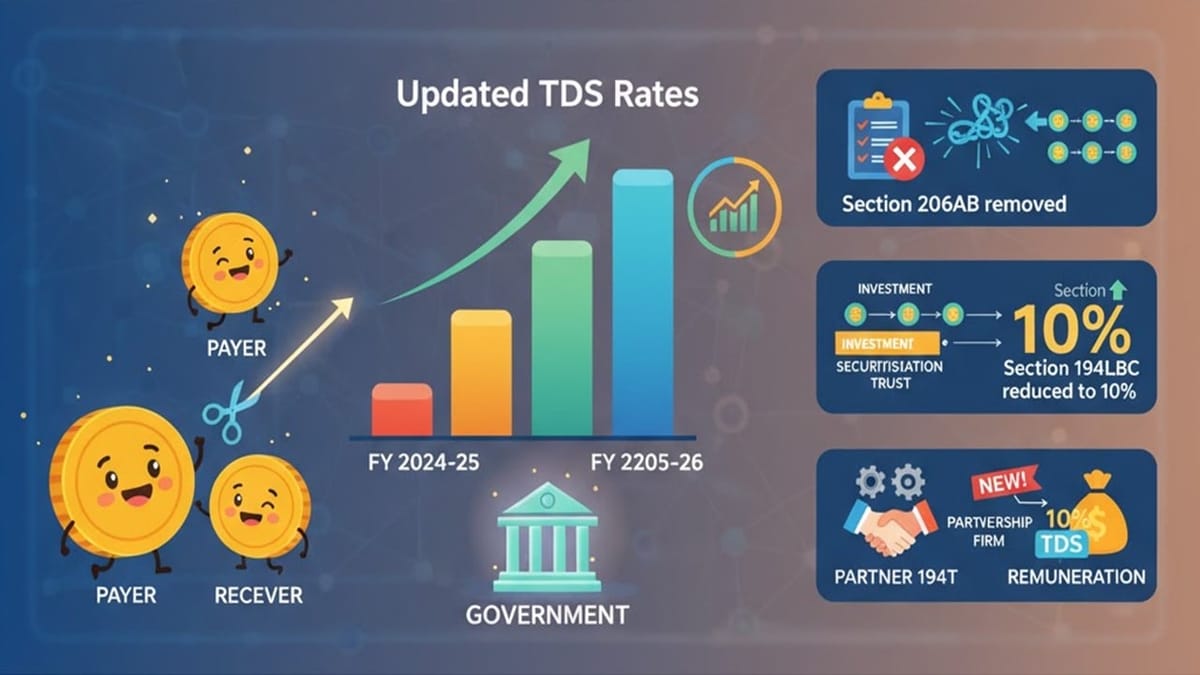

Updated TDS Rates and Provisions for FY 2025-26: Everything You Need to Know

TDS (Tax Deducted at Source) means tax that’s cut by the person making a payment, such as salary, rent, interest, or professional fees, before giving the money to the receiver. The TDS rate chart for FY 2025-26 (AY 2026-27) shows how much tax should be deducted for different types of payments. Knowing these rates helps you pay the right amount of tax on time and avoid any penalties or legal trouble.

What Do You Mean By TDS Rate Chart?

TDS stands for Tax Deducted at Source. It is an indirect method of collecting income tax in India, where a certain percentage of income is deducted by the payer (deductor) at the time of making a specified payment and is then remitted to the government on behalf of the recipient (deductee).

TDS Rate Chart FY 2025-26

The following are the TDS rates applicable with effect from FY 2025-26:

| Section | Nature of Transaction | Threshold Limit (Rs) | TDS Rate (%) |

| 192 | Salary | Basic exemption limit of employee | Slab rates |

| 192A | Premature withdrawal from EPF | Rs. 50,000 | 10% |

| 193 | Interest on Securities | Rs. 10,000 | 10% |

| 194 | Dividends | Rs. 10,000 | 10% |

| 194A | on bank/post office deposits | Rs. 50,000 | 10% |

| Interest on bank/post office deposits (Senior Citizen) | Rs. 1,00,000 | 10% | |

| Interest (Others) | Rs. 10,000 | 10% | |

| 194K | Payment of dividend by mutual Funds | Rs. 10,000 | 10% |

| 194B | Lottery, game shows, gambling winnings | Rs. 10,000 | 30% |

| 194BA | Online gaming winnings | – | 30% |

| 194BB | Winnings from horse races | Rs. 10,000 (Aggregate winnings during a financial year not single transaction) | 30% |

| 194C | Payment to contractors or sub-contractors | Rs. 30,000 (Single Transaction) or Rs. 1 lakh (In a FY) | 1% for individuals and HUF, 2% for others |

| 194D | Insurance Commission | Rs. 20,000 | 2% for individuals and HUF, 10% for others |

| 194DA | Payment received – Life insurance Policy | Rs. 1 lakh | 2% |

| 194EE | Payment received – National Savings Scheme (NSS) | Rs. 2,500 | 10% |

| 194G | Lottery Commission | Rs. 20,000 | 2% |

| 194H | Commission/Brokerage | Rs. 20,000 | 2% |

| 194J(a) | Fees – Technical Services, Call Centre, Royalty, Distribution / Exhibition of Cinematography Films, etc. | Rs. 50,000 | 2% |

| 194J(b) | Fees – All other Professional Services | Rs. 50,000 | 10% |

| 194I(a) | Rent for Plant & Machinery | Rs. 50,000 | 2% |

| 194I(b) | Rent of Land Building & Furniture | Rs. 50,000 | 10% |

| 194IA | Transfer of certain immovable property other than agricultural land | Rs. 50 lakh | 1% |

| 194IB | Rent payment by individual / HUF not covered u/s 194I | Rs. 50,000 pm | 2% |

| 194IC | Payment under specified Joint Development Agreement | – | 10% |

| 194LA | Compensation on transfer of certain immovable property other than agricultural land | Rs. 5 lakh | 10% |

| 194LB | Income by way of interest from infrastructure debt fund (non-resident) | – | 5% |

| 194LBA | Certain income from units of a business trust | – | 10% |

| 194LBB | Income in respect of investment of investment fund | – | 10% for residents, 30% for non-residents, 40% for foreign companies |

| 194LBC | Income in respect of investment in securitization trust | – | 10% for residents, 40% for non-residents, 10% for individual & HUF |

| 194M | Payment made for Contracts, Brokerage or Professional Fees etc. by Individual and HUF | Rs. 50 lakh | 2% |

| 194N | Cash withdrawal in excess of 1 crore during the previous year from 1 or more account with a bank or co-operative society | 1 Crore (Rs. 3 Crores, if withdrawal is by co-operative society) | 2% |

| 20 Lakh (if ITR not filed for previous 3 years) | 2% (Rs. 20 Lakh – 1 Crore) | ||

| 5% (Rs. 1 Crore and above) | |||

| 194O | TDS on e-commerce participants | Rs. 5 lakh | 0.10% |

| 194P | TDS in case of Specified Senior Citizen (above 75 years) having Salary & Interest (ITR not required) | – | Slab Rates |

| 194Q | TDS on Purchase of Goods exceeding Rs. 50 Lakh | Rs. 50 lakh | 0.10% |

| 194R | Benefits or perquisites of business or profession | Rs. 20,000 | 10% |

| 194S | Payment of consideration for transfer of virtual digital asset by persons other than specified person | Rs. 10,000 | 1% |

| Payment of consideration for transfer of virtual digital asset by specified person | Rs. 50,000 | 1% | |

| 194T | Payments by Partnership Firms to Partners | Rs. 20,000 | 10% |

| 194B | Income by way of lottery winnings, card games, crossword puzzles, and other games of any type (Up to Rs.10,000 per transaction- No TDS needs to be deducted) | Nil | 30% |

| 194E | Payment to non-resident sportsman (including an athlete) or an entertainer (not a citizen of India) or non-resident sports association. | Nil | 20% |

| 194LBA(3) | Interest income received or receivable to a business trust from SPV and distribution to its unitholders. | Nil | 5% |

| Dividend income received from SPV by a business trust, in which it holds the entire share capital other than required to be held by the government or government body, and distribution to its unitholders. | Nil | 10% | |

| Payment in the nature of income in the nature of rental income, out of real estate assets owned directly by such business trust, to unitholders. | Nil | 40% | |

| 194LC | Payment in the nature of interest for the loan borrowed in foreign currency by an Indian company or business trust against loan agreement or against the issue of long-term bonds*. | Nil | 5% |

| If interest is payable against long term bonds listed in recognized stock exchange in IFSC | Nil | 4% | |

| 194LD | Payment of interest on the bond (rupee-denominated) to Foreign Institutional Investors or a Qualified Foreign Investor | Nil | 5% |

| 195 | Payment of any other sum, such as-Income by way of LTCG under section 112(1)(c)(iii); | Nil | 12.50% |

| Income by way of LTCG under section 112A; | Nil | 12.50% | |

| Income by way of STCG under section 111A; | Nil | 20% | |

| Any other income by way of LTCG; | Nil | 12.50% | |

| Interest payable on money borrowed by the government or Indian concern in foreign currency; | Nil | 20% | |

| Income by way of royalty | Nil | 20% | |

| Income from technical fees to the Indian concern by government or Indian concern in pursuance of an agreement on matters related to industrial policy. | Nil | 20% | |

| Any other income. | Nil | 35% | |

| 196B | Income from units of an offshore fund. | Nil | 10% |

| Long-term Capital Gain on transfer of units an offshore fund. | Nil | 12.50% | |

| 196C | Income from foreign currency bonds or GDR of an Indian company | Nil | 10% |

| LTCG foreign currency bonds or GDR of an Indian company | Nil | 12.50% | |

| 196D | Income (excluding dividend and capital gain) from Foreign Institutional Investors. | Nil | 20% |

TDS Rate Changes FY 2025-26

The government has updated the threshold limit for TDS deduction for various sections. The following are the changes made in TDS provisions with effect from April 1, 2025.

| Section | Previous Threshold Limits | Modified Threshold Limits |

| 193 – Interest on securities | NIL | 10000 |

| 194A – Interest other than Interest on securities | (i) 50,000/- for senior citizen; (ii) 40,000/- in case of others when payer is bank, cooperative society and post office (iii) 5,000/- in other cases | (i) 1,00,000/- for senior citizen (ii) 50,000/- in case of others when payer is bank, cooperative society and post office (iii) 10,000/- in other cases |

| 194 – Dividend, for an individual shareholder | 5000 | 10000 |

| 194K – Income in respect of units of a mutual fund | 5000 | 10000 |

| 194B – Winnings from lottery, crossword puzzle Etc. & 194BB – Winnings from horse race | Aggregate of amounts exceeding 10,000/- during the financial year | 10,000/- in respect of a single transaction |

| 194D – Insurance commission | 15000 | 20000 |

| 194G – Income by way of commission, prize etc. on lottery tickets | 15000 | 20000 |

| 194H – Commission or brokerage | 15000 | 20000 |

| 194-I – Rent | 2,40,000 (in a financial year) | 6,00,000 (in a financial year) |

| 194J – Fee for professional or technical services | 30000 | 50000 |

| 194LA – Income by way of enhanced compensation | 250000 | 500000 |

| 206C(1G) – Remittance under LRS and overseas tour program package | 700000 | 1000000 |

From April 1, 2025, a few important changes have been made in TDS rules:

Section 206AB, which earlier made tax deduction more complicated for people paying TDS, has now been removed, making compliance easier.

The TDS rate under Section 194LBC (for income from investments in securitisation trusts) has been reduced to 10% for residents.

A new Section 194T has been added from now on, 10% TDS will be deducted on partners’ remuneration paid by a partnership firm.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"