Income Tax Department Alerts Taxpayers to Phishing Scams, Fraudulent Refund Emails, and Fake Websites; Advises Caution and Reporting Steps.

Vanshika verma | Oct 14, 2025 |

IT Dept Warns Taxpayers About Phishing, Fake Refund Emails, and Fraudulent Websites

The Income Tax Department has issued an guidelines on its official portal, warning taxpayers about phishing attempts, fraudulent refund email scams, and fake income tax websites. The guidelines also provides guidance on how to identify and report such scams.

The Income Tax Department has clarified that it does not request detailed personal information through e-mail. It also does not send email asking for PIN numbers, passwords, or similar access information related to credit cards, banks, or other financial accounts.

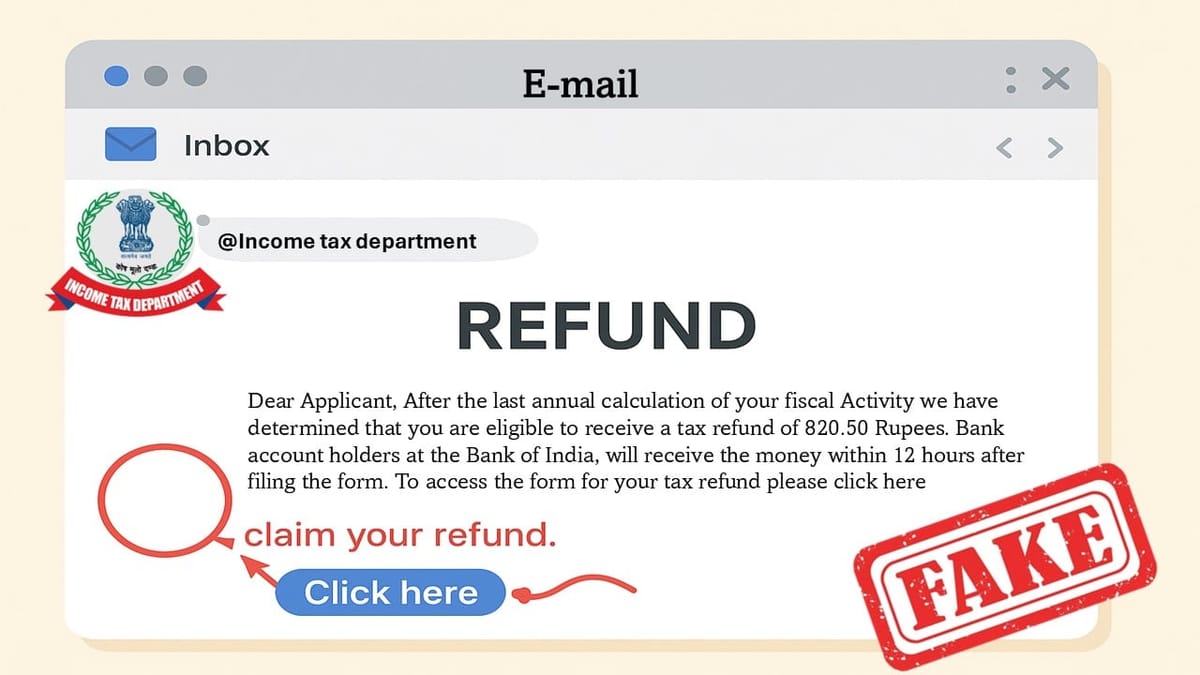

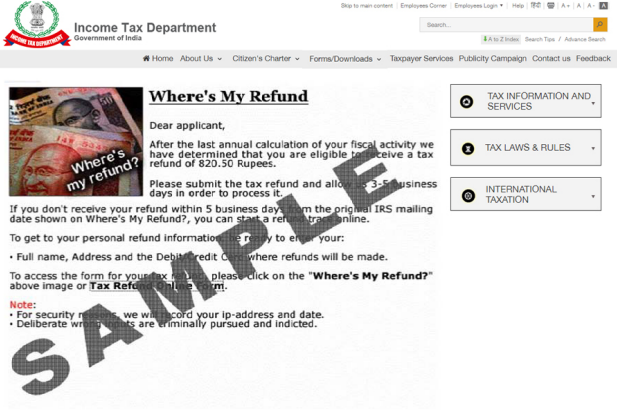

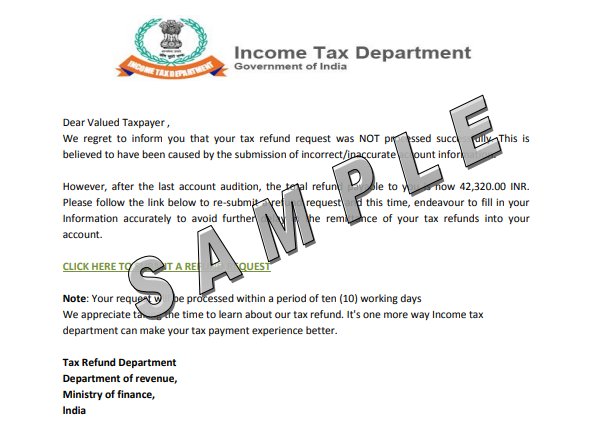

Below are some screenshots of fake refund e-mails that have been circulated on various social media platforms, which everyone should be cautioned of:

Following are some precautions that the income tax department shared, which everyone must consider:

If an individual receives an email from someone claiming to represent or be authorized by the Income Tax Department, or one that directs them to an alleged Income Tax website, the following precautions should be observed:

Know how to report if you receive a fake email:

In case an individual receives an e-mail or encounters a website that appears to impersonate the Income Tax Department, they are advised to forward the email or website URL to [email protected]. A copy may also be sent to [email protected].

Recipients may forward the message as received or include the internet header of the e-mail, which contains additional technical details useful in identifying the sender. After forwarding, the suspicious message should be deleted immediately.

If the phishing mail is unrelated to the Income Tax Department, it should still be forwarded to i[email protected]. for appropriate action.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"