Electronic filing of GSTAT appeals under Sections 107 and 108 will be processed on the NIC portal, with stepwise submissions recommended to manage system load.

Vanshika verma | Sep 25, 2025 |

Big GST Update! GSTAT Introduces Staggered Appeal Filing Window to Avoid Website Crash

Goods and Services Tax Appellate Tribunal (GSTAT), Department of Revenue, arising out of the orders or decisions of the appellate and revisional authorities under sections 107 and 108, respectively, of the Central Goods and Services Tax Act, 2017, are in accordance with the provisions of rule 115 of the Goods and Services Tax Appellate (Procedure) Rules, 2025, to be filed and processed electronically on the portal developed by NIC for this purpose, and all these appeals will be heard and recorded on the said portal.

The GSTAT Principal Bench received information from the GSTN about appeals filed with the first appellate authorities under Section 107 of the Act. These authorities have filed and resolved a significant number of appeals. Any orders made by the first appellate authorities, as well as decisions of the revisional authorities under Section 108 of the Act, can be challenged by filing an appeal with the GSTAT.

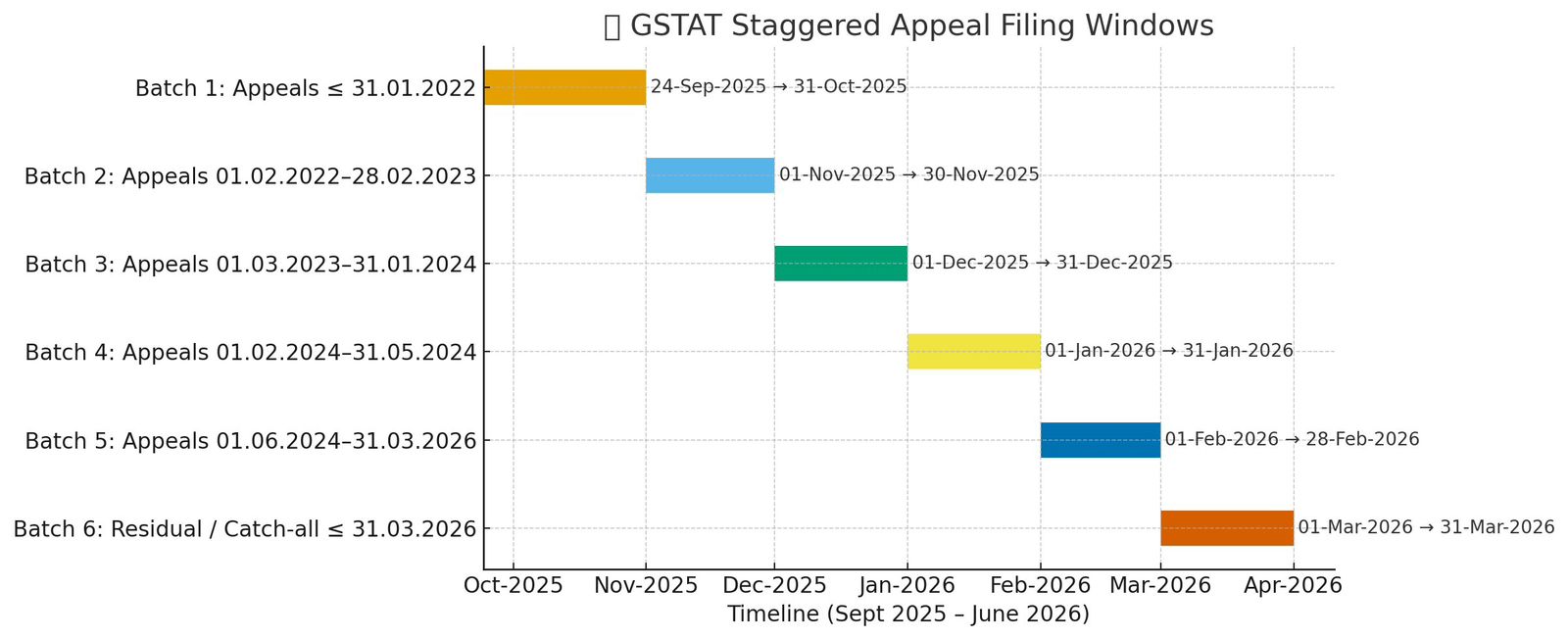

GSTAT Staggered Appeal Filing Windows (Sept 2025 – June 2026)

NIC has said that since the portal is new, there is a chance it may slow down or face problems if too many people try to use it at the same time. This could make it difficult for users to file their appeals. Therefore, it has been suggested that appeals should be filed in stages over time to reduce the load on the system. Because many appeals are expected to be filed with the GSTAT, and considering the limited system resources, the president has decided to make it easier for both the appellants and the system.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"