The representation outlines several reasons that have caused disruptions in completing the filing of GSTR-9 and GSTR-9C on time.

Nidhi | Dec 24, 2025 |

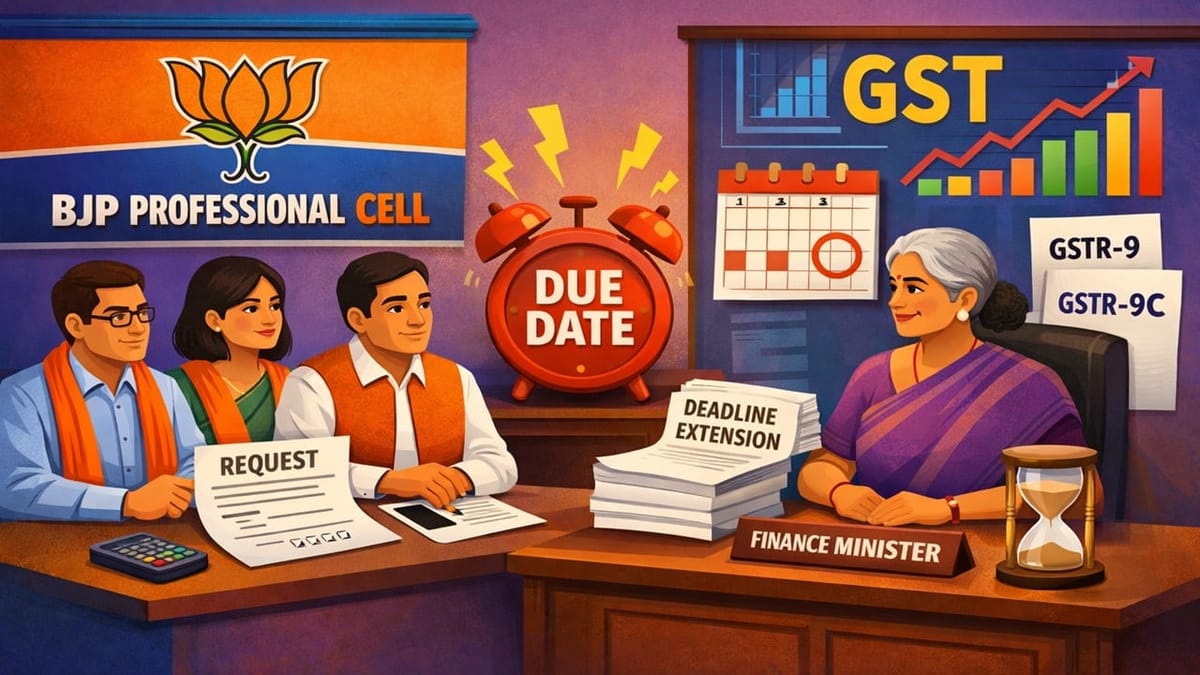

BJP Professional Cell Requests Finance Minister to Extend GSTR-9 and 9C Filing Deadline

The President of the Bharatiya Janata Party (BJP) Professional Cell, CA Shailesh R. Ghedia, has submitted a formal representation to the Finance Minister, Smt Nirmala Sitharaman, requesting an extension of the annual return and statement of reconciliation under the GST law for the year 2024-25. The current due date for filing GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for FY 2024-25 is December 31, 2025. The representation outlines several reasons that have caused disruptions in completing the filing of GSTR-9 and GSTR-9C on time.

One of the main issues highlighted by the BJP professional cell is the extension of the audit under the Income Tax Act to 10.12.2025, which is handled by the same professional who handles GST filings. Additionally, the utility forms were released late in October, and the form changes and major changes were made in the forms in November 2025, with their FAQs released in November and December, causing confusion among the taxpayers and professionals.

Another concern was the update of the auto-populated amount in Table 8A, which is important for the ITC reconciliation. This update was made available in the first week of December 2025, leaving very little time for the professionals.

Due to these difficulties, the cell has requested the government to extend the GSTR-9 and GSTR-9C filing due Date until 28/02/2026 to give more time to the professionals and taxpayers, ensuring correct filing.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"