New Vs Old Tax Regime: Benefits For Senior Citizens and Super Senior Citizens Under IT Act 1961

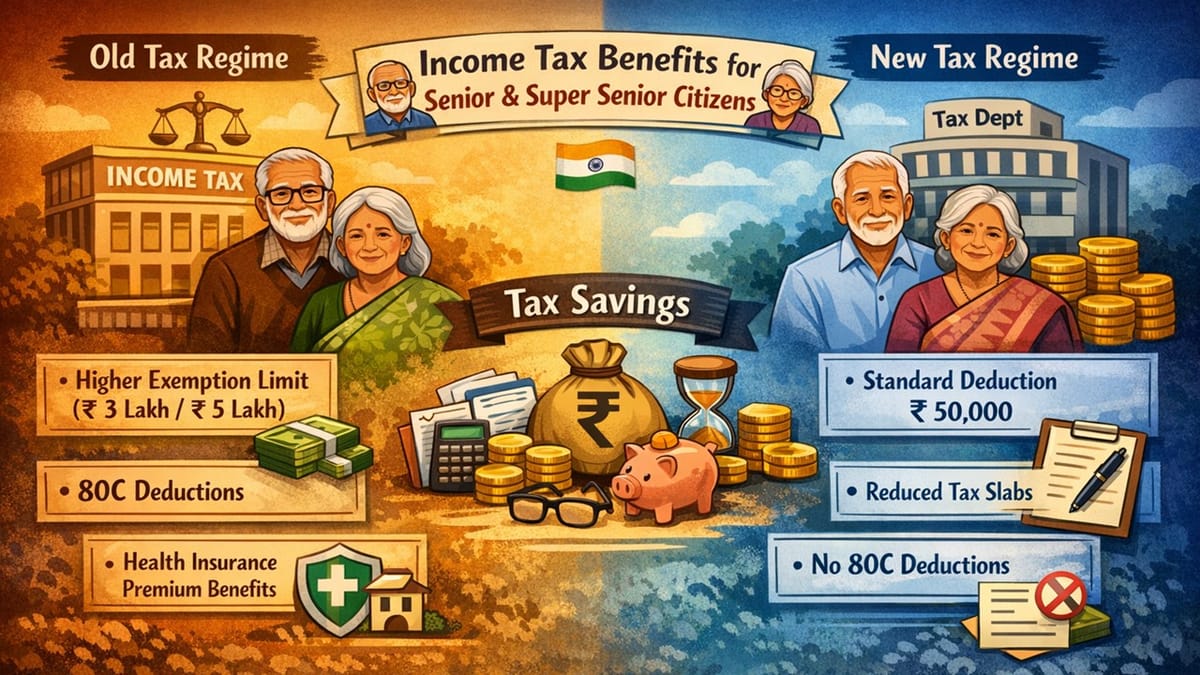

In India, several special tax benefits or reliefs are offered to senior citizens (aged 60 years or above but below 80 years) and super senior citizens (aged 80 years or above) under the Income Tax Act 1961. These reliefs or benefits are only available to resident senior citizens. Non-resident senior citizens are taxed according to the normal provisions applicable to non-residents. Here is the comprehensive guide on different tax slabs and reliefs available for senior and super senior citizens under the old and new tax regimes:

Income Tax Slabs for Senior Citizens Under the Old Tax Regime

- Under the Old Tax Regime, senior citizens aged between 60 and 80 years enjoy a basic tax exemption limit of upto Rs. 3 lakh. Meaning, they are not required to pay any tax on income upto Rs. 3 lakh. However, if their income is between Rs. 3 lakh and Rs. 5 lakh, they are required to 5% of their income as tax, if their income between Rs. 5 lakh and Rs. 10 lakh, they will required to pay tax at 20%, and if their income is above Rs. 10 lakh, 30% tax rate will be imposed. If total income exceeds Rs. 50 lakh, surcharge is applicable at prescribed rates, and Health and Education Cess at 4% is charged on income tax, in addition to surcharge. A resident individual with a total income below Rs. 5 lakh is eligible to avail a rebate of 100% of income or Rs. 12,500, whichever is less, under Section 87A.

Income Tax Slabs for Super Senior Citizens Under the Old Tax Regime

- Super senior citizens aged 80 years and above enjoy a basic tax exemption limit of upto Rs. 5 lakh under the Old Tax Regime. Meaning, they are not required to pay any tax on income upto Rs. 5 lakh. However, if their income is between Rs. 5 lakh and Rs. 10 lakh, then they are required to pay tax at 20% rate and income above Rs. 10 lakh is taxed at 30% rate. Surcharge and Health and Education Cess are applicable to the super senior citizens, the same as to senior citizens.

Income Tax Slabs Under the New Tax Regime (AY 2026-27)

- The New Tax Regime offers a single slab structure for all types of taxpayers, also including senior and super senior citizens. Under the new tax regime, the basic exemption limit is the same for all categories of taxpayers, i.e., Rs. 4 lakh. Income between Rs. 4 lakh and Rs. 8 lakh is taxed at 5%, between Rs. 8 lakh and Rs. 12 lakh at 10%, between Rs. 12 lakh and Rs. 16 lakh at 15%, between Rs. 16 lakh and Rs. 20 lakh at 20%, between Rs. 20 lakh and Rs. 24 lakh at 25%, and those earning income above Rs. 24 lakh are required to pay tax at 30% rate. Surcharge applies if income exceeds Rs. 50 lakh, and Health and Education Cess at 4% is charged on tax plus surcharge.

Rebate Under Section 87A in the New Tax Regime

- Under the New Tax Regime, the tax authorities have introduced a new rebate under Section 87A, effective from Assessment Year 2024-25. This rebate has made income upto Rs. 12 lakh exempt from income tax for the AY 2026-27. Meaning, individuals earning income upto Rs. 12 lakh are now not required to pay any tax on it.

Choice Between Old and New Tax Regime

- Senior citizens and super senior citizens have a choice between old and new tax regimes. The New Tax Regime has been set as a default; to continue under the old tax regime, they must exercise the option under Section 115BAC(6). If not selected, then the new tax regime will automatically apply by default.

Basic Exemption Limit for Senior and Super Senior Citizens Under Old and New Tax Regime

- Under the New Tax Regime, the basic exemption limit for both senior and super senior citizens in AY 2026-27 is the same, i.e., Rs. 4 lakh. While under the Old Tax Regime, the basic exemption limit for senior and super senior citizens in AY 2026-27 is Rs. 3 lakh and Rs. 5 lakh, respectively. For individuals other than these, the basic exemption limit under the old tax regime and the new tax regime is Rs. 2.5 lakh and Rs. 4 lakh respectively.

Exemption from Payment of Advance Tax

- If a resident senior or super senior citizen does not possess any income from business or profession, then he/she is not required to pay any advance tax. This relief is not applicable if their total tax liability is above Rs. 10,000, which is otherwise the limit for advance tax payment.

Standard Deduction for Pension Income

- Senior and super senior citizens receiving pension income from their former employer are entitled to enjoy a standard deduction. A deduction of up to Rs. 75,000 is allowed from AY 2025-26 onwards under the New Tax Regime. On the other hand, deduction upto Rs. 50,000 is allowed under the Old Tax Regime. However, if the pension received is less than these limits, the deduction is restricted to the actual amount of pension.

Deduction for Medical Insurance and Medical Expenses (Section 80D)

- Under the old tax regime, senior and super senior citizens are eligible for a higher deduction under Section 80D. A deduction of up to Rs. 50,000 is allowed for health insurance premiums paid for themselves or for medical expenses incurred if no insurance policy is taken. This benefit can also be claimed for senior or super senior citizen parents. Payment must be made through non-cash modes. For non-senior individuals, the maximum deduction under this section is Rs. 25,000.

Deduction for Maintenance of Dependent with Disability (Section 80DD)

- Under the old tax regime, a deduction under Section 80DD is available for expenses incurred on maintenance and medical treatment of a dependent with disability. A fixed deduction of Rs. 75,000 is allowed, which increases to Rs. 1,25,000 in case of severe disability.

Deduction for Medical Treatment of Specified Diseases (Section 80DDB)

- Senior and super senior citizens can claim a deduction of up to Rs. 1,00,000 under Section 80DDB for medical treatment of specified diseases for themselves or for a dependent senior or super senior citizen. For non-senior taxpayers, this deduction is limited to Rs. 40,000 under the old tax regime.

Deduction on Interest Income (Section 80TTB)

- Senior and super senior citizens can claim a deduction of up to Rs. 50,000 under Section 80TTB for interest income earned from savings accounts, fixed deposits, post office deposits, or cooperative banks under the old tax regime. If the total interest income does not exceed Rs. 50,000, banks or post offices generally do not deduct TDS. Non-senior individuals are allowed a deduction of only Rs. 10,000 under Section 80TTA.

Facility to File Income Tax Return in Paper Form

- A super senior citizen aged 80 years or above can file the income tax return in paper mode using ITR-1 or ITR-4 if the total income exceeds Rs. 5 lakh or if a refund is claimed. E-filing is optional for such taxpayers.

Submission of Form 15H for Non-Deduction of TDS

- Senior and super senior citizens can submit Form 15H to banks or other deductors declaring that their estimated tax liability for the year is NIL. On submission of this form, no tax will be deducted at source from their income.

Tax Exemption on Reverse Mortgage

- Any amount received by a senior or super senior citizen under the Reverse Mortgage Scheme notified by the Central Government is not taxable. The transfer of the residential house under this scheme does not attract capital gains tax, and the loan amount received is also not taxable under any head of income.

Exemption from Filing Income Tax Return for Certain Senior Citizens

- Resident senior citizens aged 75 years or more are not required to file an income tax return if they have only pension income and interest income from the same bank where the pension is received. Such individuals must submit Form 12BBA to the bank, and the bank is responsible for computing total income, allowing deductions and rebates, and deducting the applicable tax.

Applicable Income Tax Return Forms for Senior Citizens

- Senior citizens whose income includes a pension, interest, and income from one house property with a total income up to Rs. 50 lakh can file ITR-1 (Sahaj). Those having capital gains income must file ITR-2. Senior citizens having income from business or profession are required to file ITR-3 or ITR-4 (Sugam), depending on the nature of business income.

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"