Vanshika verma | Dec 24, 2025 |

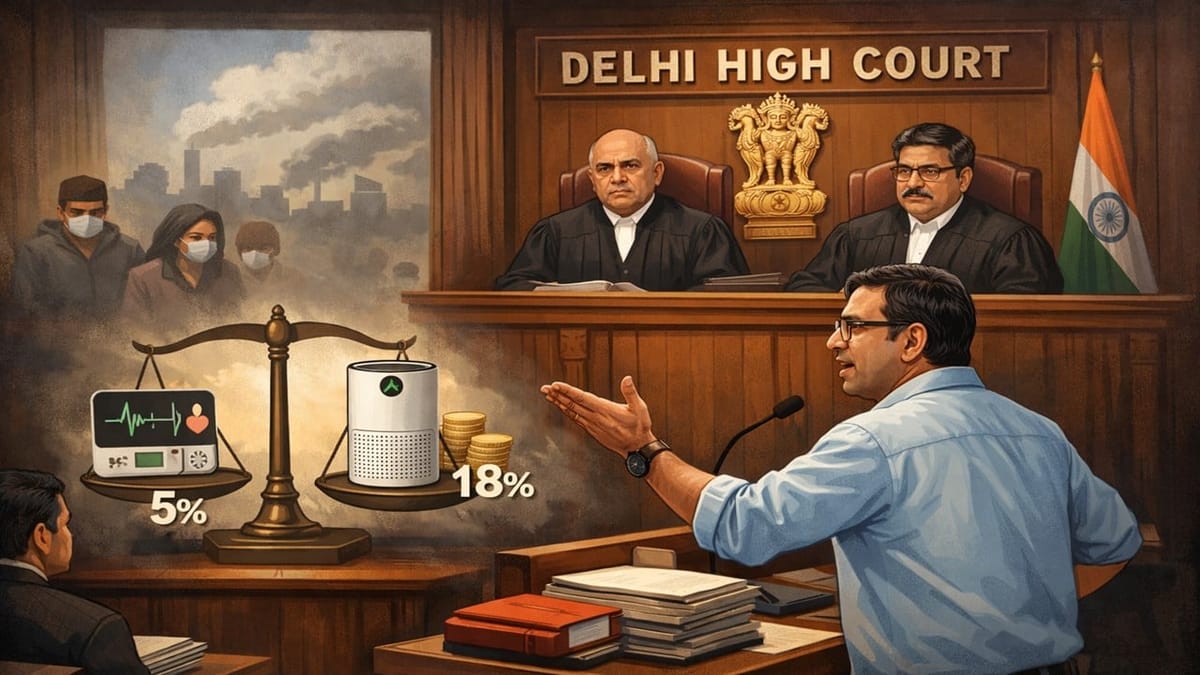

GST: PIL filed with Delhi High Court to Treat Air Purifiers As Essential Items, Not Luxury Goods

The Delhi High Court declared that air pollution in Delhi has become so serious that it should be treated like an emergency. Because of this, the court felt that the government should remove GST on air purifiers, as people need them to breathe clean air.

A PIL was filed in court asking the government to treat air purifiers like medical equipment, not luxury items. The argument is that air purifiers help protect people’s health especially in cities with severe air pollution so they should not attract a high tax of 18% GST. A two-judge bench, headed by Chief Justice DK Upadhyaya and Justice Tushar Rao Gedela, was listening to this case.

During the hearing, the court showed its displeasure, saying that the authorities have not taken enough action to deal with the pollution problem.

Justice Tushar Rao Gedela added that “Let the purifiers be provided. That’s the minimum you can do. When will you come back?….Even if it is for temporary, give exemption for next one week or one month… consider this an emergency situation, only for temporarily. Take instructions. Tell us now, when is the (GST) Council going to sit and when will you come back with instructions? We will place it before the vacation bench only for compliance. As we speak, we all breathe. You know how many times we breathe in a day, at least 21,000 times a day. Just calculate the harm you are doing to your lungs just by breathing 21,000 times a day, and that’s involuntary”.

The plea has been filed by Kapil Madan. He added that air purifiers should not be seen as luxury items, because in today’s conditions of severe air pollution, they have become a basic necessity for people to protect their health.

He explained that air purifiers help prevent health problems by cleaning the air we breathe. Because of this preventive health role, Kapil Madan argued that air purifiers should be treated like medical devices, as defined under a notification issued under Section 3(b)(iv) of the Drugs and Cosmetics Act, and not as optional or luxury products.

The plea states, “Therefore air-purifiers squarely fall within the statutory sweep of a medical device, as their intended and primary purpose is the prevention and alleviation of disease-causing exposures and the safeguarding of respiratory health”.

He added that, There is no logical or scientific reason why medical devices are taxed at a low GST rate of 5%, while air purifiers are taxed much higher at 18%, even though air purifiers help prevent health problems, especially when air pollution is very bad.

He says, “Accordingly, the continued imposition of 18% GST on air-purifiers, despite their medically recognised role in crisis situations and their functional equivalence to devices taxed at 5%, constitutes an arbitrary and unreasonable fiscal classification. Such differential treatment fails the constitutional test of intelligible differentia and bears no rational nexus to public-health objectives, thereby warranting judicial intervention”.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"