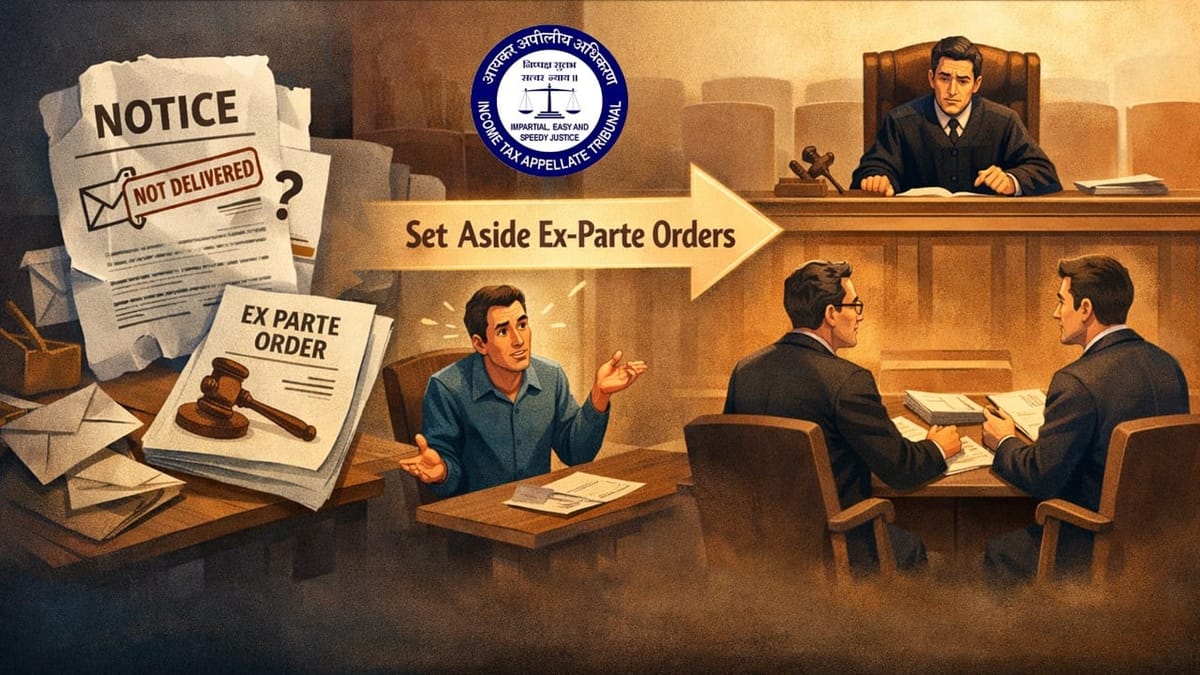

ITAT held that notices were not properly served and no effective hearing was given by CIT(A), set aside ex-parte orders and remanded all appeals for fresh adjudication.

Saloni Kumari | Jan 22, 2026 |

ITAT Grants Relief to NRI Senior Citizen by Quashing Ex-Parte Orders; Remands Case for Fresh Adjudication

ITAT Delhi condoned 125 days delay, held that notices were not properly served, and found a lack of hearing by CIT(A). Ex-parte orders for AYs 2014-15 to 2018-19 were set aside, and matters remanded for fresh adjudication. All appeals are allowed for statistical purposes.

Sushma Shrestha filed five appeals in the ITAT Delhi, all challenging a common order dated March 15, 2025, passed by the CIT(A) Delhi under Section 250 of the Income Tax Act, 1961. These appeals relate to the assessment years 2014-15 to 2018-19. The assessee claimed that she is a senior citizen; a permanent resident of the United States for the last several years, and does not reside in India, hence does not access the income tax portal regularly. The tax authorities uploaded the notices merely on the tax portal; no physical copy of the notice was served at her local address.

The assessee filed the current appeals late by 125 days. She explained that she could not respond promptly because notices sent by email were received by an employee of a family concern, and she was not aware of the same. The tribunal, after analysing the reason, found it genuine and condoned the delay.

The case arose when a search action was initiated in the cases of Shri Mukund Raj Shrestha & Ors. on October 31, 2018; the assessee was also included. In conclusion, a notice dated December 09, 2020, was issued to the assessee under Section 153A. Resulting in which, the assessee filed its income tax return (ITR) declaring ‘NIL’ income for A.Y. 2014-15. The assessee had selected non-resident status in her return; however, the Assessing Officer (AO) rejected her claim and completed the assessment at NIL income.

The aggrieved assessee filed an appeal before the CIT(A). However, the CIT(A) dismissed her appeals without giving her a proper opportunity for a hearing. Thereafter, the assessee filed the current appeal before the ITAT Delhi. When the tribunal analysed the facts of the case, it noted that the assessee was not given the opportunity of a hearing.

Following similar decisions in other group cases, the Tribunal set aside the ex parte orders and sent all five appeals back to the CIT(A) for fresh adjudication after giving a reasonable opportunity for hearing. The assessee was also directed to be more careful in future proceedings. As a result, all five appeals were allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"