Nidhi | Dec 11, 2025 |

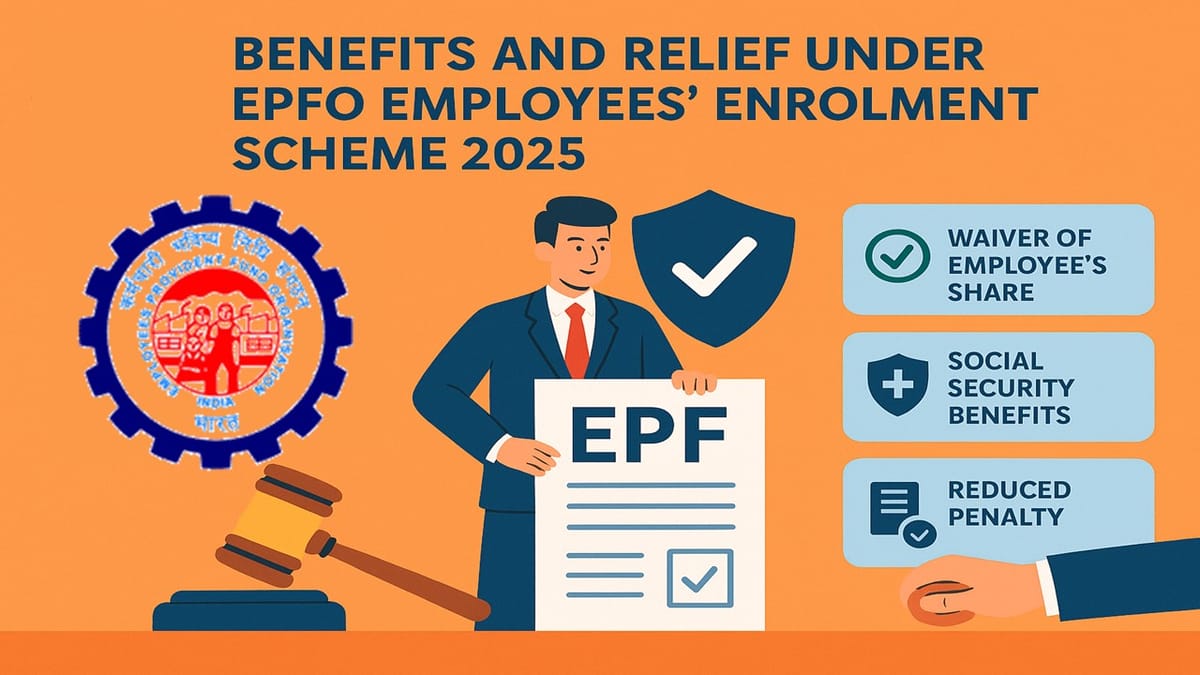

Benefits and Relief Under EPFO Employees’ Enrolment Scheme 2025

In an aim to provide significant relief and social security benefits, the Employee Provident Fund Organisation (EPFO) had earlier introduced the Employees’ Enrolment Scheme 2025, which is a one-time compliance window to voluntarily enrol the eligible employees who were not covered under the EPF between July 1 2017 and October 31, 2025. The scheme is an initiative to encourage voluntary contributions and expand the social security coverage to all eligible employees under the EPF Act, 1952.

The Scheme was launched by the Ministry of Labour and Employment on the 73rd Foundation Day of EPFO on November 1, 2025. The Scheme will remain open for six months, starting from November 1, 2025, to April 30, 2026. Let us know the key features of the Employees’ Enrolment Scheme 2025.

Waiver of Employee’s Share Contribution.

If an employer did not deduct their employee’s share of provident fund contributions from their wages for the period from July 1, 2017, to October 31, 2025, those employees will not have to pay it now. This will help many workers who have missed their contributions during this period.

Social Security Benefits

The scheme ensures that the eligible employees get their social security benefits right from their date of joining under the Employees’ Provident Fund (EPF) Scheme, Employees’ Pension Scheme (EPS), and Employee Deposit Linked Insurance (EDLI) Scheme.

Reduced Penalty

The scheme offers a major reduction in the penalties levied on the employers. The employers only need to pay a lump-sum damage of Rs 100 for each defaulting establishment. This reduced the compliance cost burden on the employers.

Benefits under Pradhan Mantri Viksit Bharat Yojana

The Scheme also offers benefits under the Pradhan Mantri Viksit Bharat Yojana for the eligible establishments for the net additional employment generated.

No Suo Moto Action

Under this scheme, EPFO will not take suo moto action against the employees for the past omissions if voluntary compliance is made.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"