Saloni Kumari | Sep 10, 2025 |

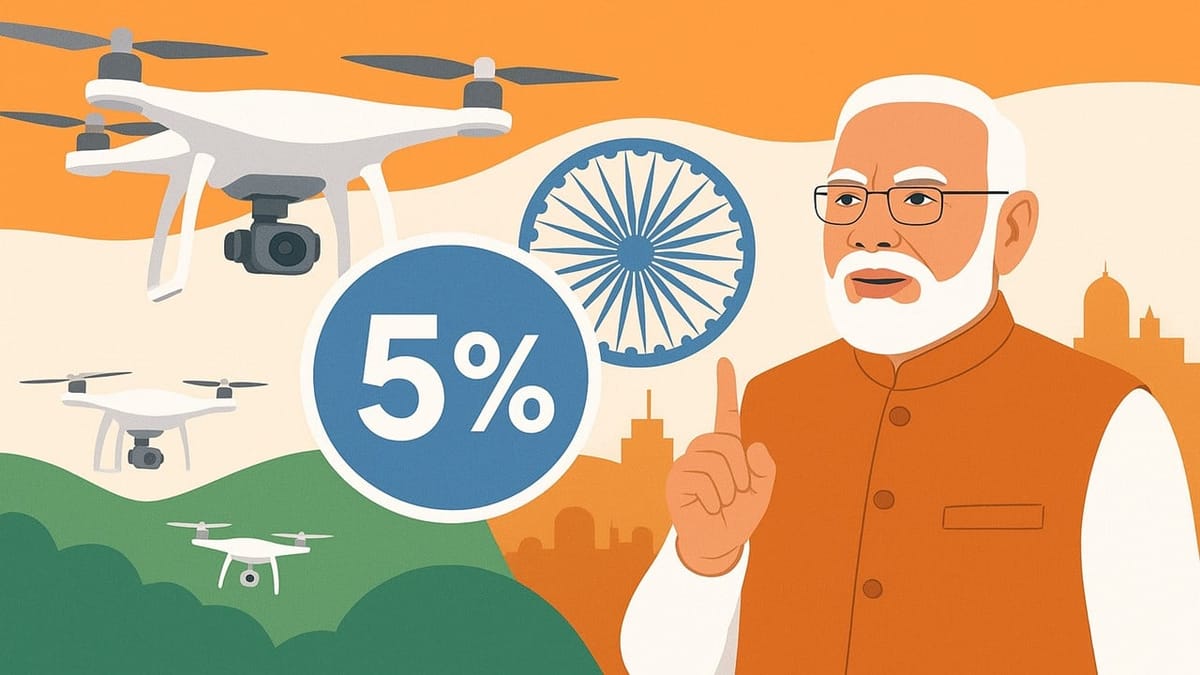

GST 2025: Govt Imposes Uniform 5% Tax on Drones to Power Make in India

In the speech of the 79th Independence Day (August 15, 2025), Prime Minister Shri Narendra Modi spoke about bringing Next-generation GST reforms across the nation. These reforms represent a strategic, principled and citizen-centric evolution of India’s landmark tax framework. These GST reforms, recently approved by the 56th GST Council Meeting, will help many industries grow, including India’s fast-growing drone industry.

Previously, on drones with integrated cameras, a GST rate of 18% was applicable, and on drones classified for personal use, a 28% GST was applicable. Now, under the new GST reforms of 2025, a uniform GST of 5% has been imposed on all types of drones; it does not matter if the drone includes integrated cameras or is manufactured for commercial or personal use. This change supports the government’s plan to build a strong, safe, and globally competitive drone industry in India.

Minister for Civil Aviation Shri Ram Mohan Naidu admired the GST reforms and said the GST rationalisation from a four-slab structure to a simplified two-slab structure of 5% and 18% is the biggest change ever made in India’s taxation. The country is slowly growing to achieve the goal of a Viksit Bharat 2047 with Atmanirbhar Bharat as its foundation under the leadership of Prime Minister Shri Narendra Modi. She says the wide-ranging GST rate reductions in the different sectors of the country will strengthen ease of living, ease of compliance and ease of doing business in the country. This move will greatly benefit consumers and give a strong push to Indian manufacturers. It will also help India become a leader in new technologies like drones. With a uniform 5% GST on all drones, there is now a clear policy and no confusion about classifications. In addition, flight simulators and motion simulators, which are important for training pilots, are now free from GST. This will support the training sector in India and help airlines and training institutes save money on equipment.

Reducing confusion in the minds of manufacturers and lowering the end cost of drones for users will increase drone adoption, especially in sectors like agriculture (crop monitoring, pesticide spraying), petroleum and mining (pipeline and asset inspection), infrastructure (surveying and mapping), logistics (last-mile delivery) and defence/security (surveillance and rapid response).

Drone availability at cheaper prices will contribute to the country’s goal of Make in India and Atmanirbhar Bharat. Additionally, it will improve the efficiency of multiple industries and public services. The action of GST rationalisation is also aimed at generating more employment opportunities for Indian citizens in the drone industry (like in manufacturing, assembling, software development, data analytics and field operations).

With the new GST rates and exemptions, the tax system is now more supportive of growth in aviation and new technologies like drones. This major step shows that drones are seen as both a business opportunity and an important need for India. The fast-growing drone sector will gain a lot from this simpler tax system.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"